Can Bitcoins [BTC] sell exhaustion giving way to bullish pressure

Bitcoin [BTC] Traders paying close attention to price action, especially in recent days, may have noticed a reduction in selling pressure. Could this be a sign that it may be about to resume the upside, or is this another pause before the bulls regain control?

Here is AMBCrypto’s Bitcoin (BTC) price forecast for 2022-23

Here’s a quick look at some analysis to help give you an idea of what to expect this weekend.

Glassnode recently reported that Bitcoin’s seller fatigue constant has retested its 2018 lows. According to the post, the metric retests its lower range when unrealized losses rise while volatility falls.

The #Bitcoin the seller fatigue constant has recorded its lowest value since November 2018.

This calculation reaches such levels when volatility is low, but the losses realized on the chain are high.

6-of-7 recent similar levels preceded volatility to the upside pic.twitter.com/YFta3DTrkV

— glassnode (@glassnode) 3 November 2022

Will Bitcoin Bulls Benefit From This?

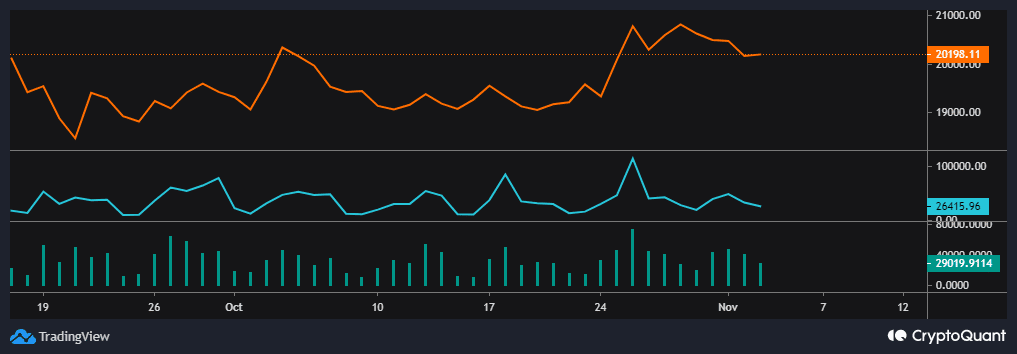

Seller exhaustion may indicate that Bitcoin may be about to shift gears in favor of the bulls. But does this result agree with the ongoing characteristics of the chain? Well, BTC exchange supply has leveled off considerably since Wednesday after earlier drops during the last 3 days of October.

Source: CryptoQuant

The pace of BTC exchange has also seen a drop, especially since the beginning of November. This confirms the relative lull in the market as volatility declines. This observation emphasizes the reduced incoming selling pressure, as well as the buying pressure.

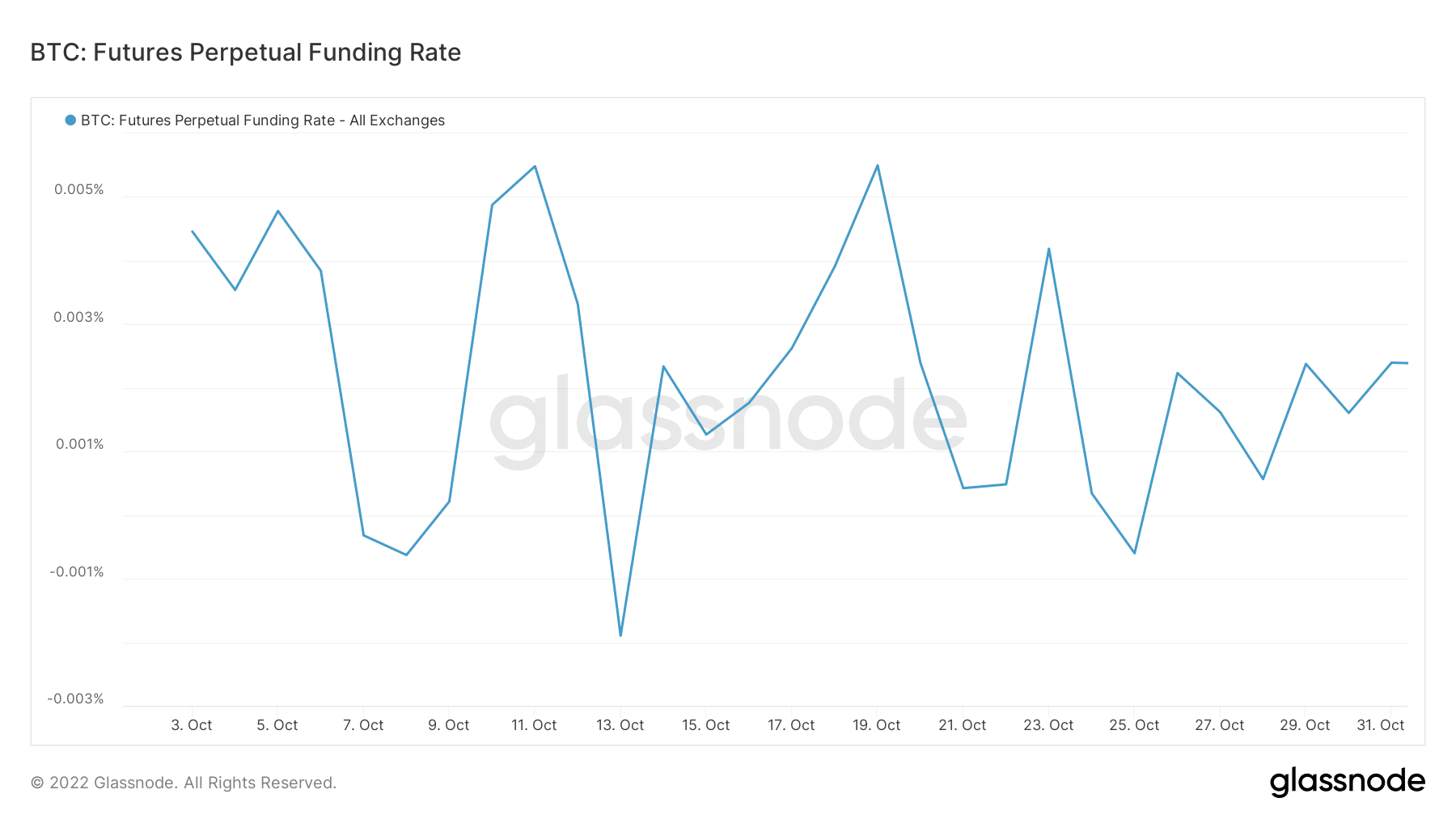

A similar result was seen in the derivatives market. Bitcoin Futures perpetual funding rate has fluctuated within a tighter range, with less movement. This seemed to confirm a drop in demand within the derivatives market.

Source: Glassnode

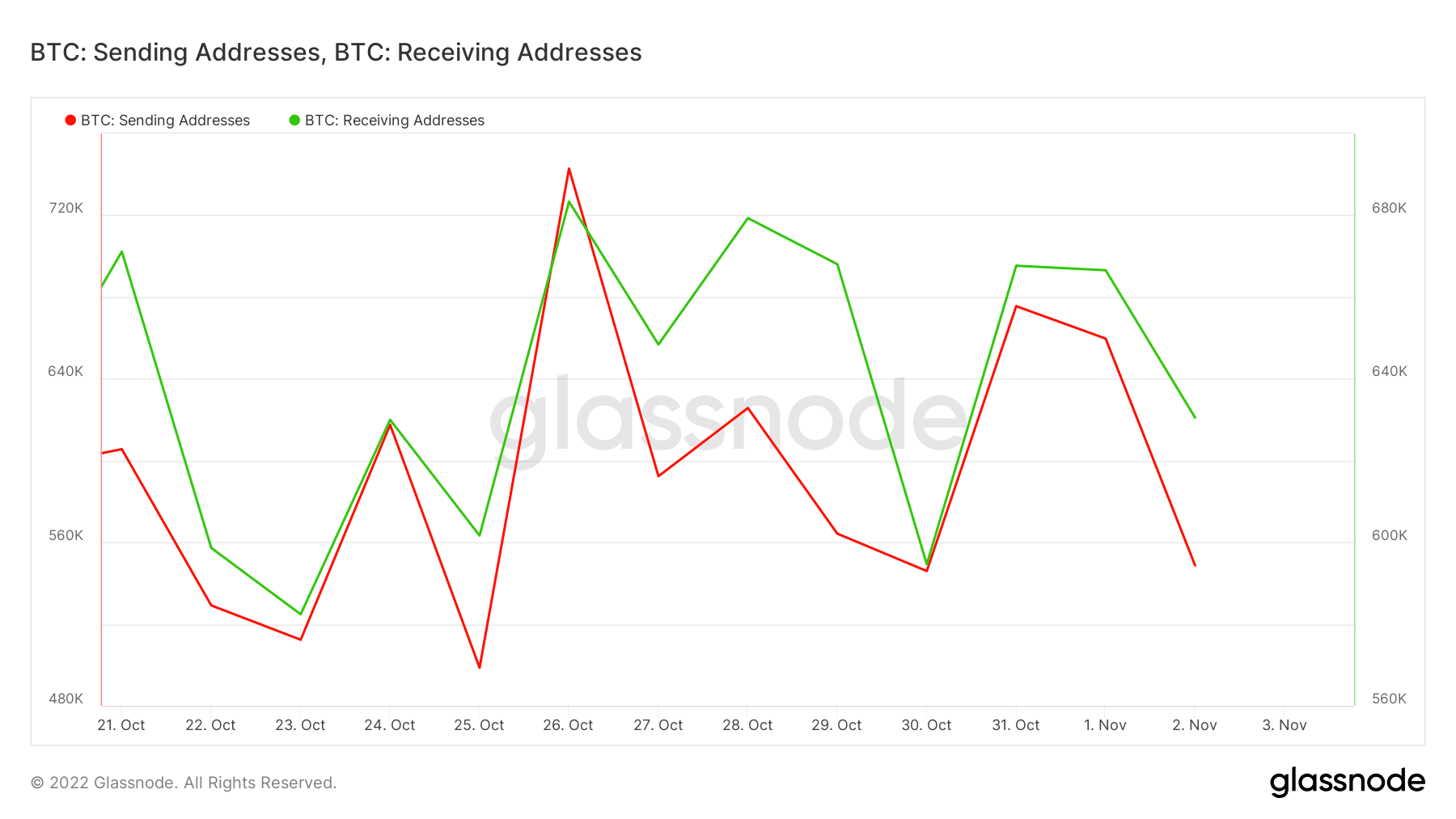

Bitcoin [BTC] has managed to maintain a significant level of trading activity over the past 3 days, despite an observed lull. Nevertheless, trading activity took a hit, and this is evident from the decline in both sending and receiving addresses.

Source: Glassnode

Receiving addresses exceeded sending addresses, which resulted in net address entry in the middle of the week. This may explain why the bears let the bulls dominate the last 24 hours, at the time of writing.

How is the price actually?

BTC managed to stay above the $20,000 level, despite its bearish retracement in recent days. In fact, its price tag of $20,247 represented a 0.49% upside in the last 24 hours.

Source: TradingView

What BTC Investors Should Prepare For

If the observation of seller exhaustion is accurate, healthy bulls could sustain price levels above $20,000, at least for a while. We could see some more upside if there is a notable bullish push as the weekend approaches.

On the other hand, Bitcoin investors should also watch out for another potential bearish wave. Investors should therefore be on the lookout for factors that can affect prices in either direction, given the uncertain position. If none of these occur, the prevailing performance could be the start of a new crab market.