Can Bitcoin be converted to cash?

Bitcoin, a cryptocurrency developed in 2009 by Satoshi Nakamoto, was proposed to be a full-fledged form of money. It was called “electronic cash” in its whitepaper. The idea was to have an arrangement where electronic transfer of money could be done ‘without relying on’ trust or a financial intermediary. In a sense, Bitcoin was conceived to be a fully valid and easily accepted digital currency.

Almost 13 years after its launch, the cryptocurrency has neither become legal tender in any large and developed economy, nor is it easily accepted by merchants or the general public. Bitcoin’s market value is in the hundreds of billions of dollars, but experts are divided over its utility as money in digital transactions. Today, let’s explore why the need for Bitcoin’s conversion to cash arises and whether this is possible in Australia and elsewhere.

Why Bitcoin’s Conversion to Cash?

Bitcoin is not a physical currency that can be quickly handed over to other parties. It exists in virtual form alone, which means that only online transactions are possible. There are intermediaries such as cryptocurrency exchanges that allow transfers between two parties. But the problem arises when one party refuses to accept Bitcoin. Unlike fiat currency, backed by governments and central banks and easily accepted in the market, Bitcoin lacks universal acceptance.

In Australia, the most preferred form of money is the Australian dollar. Likewise, virtually every country has its fiat currency. People have confidence in fiat currency because of the presence of an intermediary such as a central bank. In Bitcoin, there is no such intermediary. Currently, the cryptocurrency has not been adopted as a fiat currency by any major economy such as Australia. This is why there is a need to convert Bitcoin to cash.

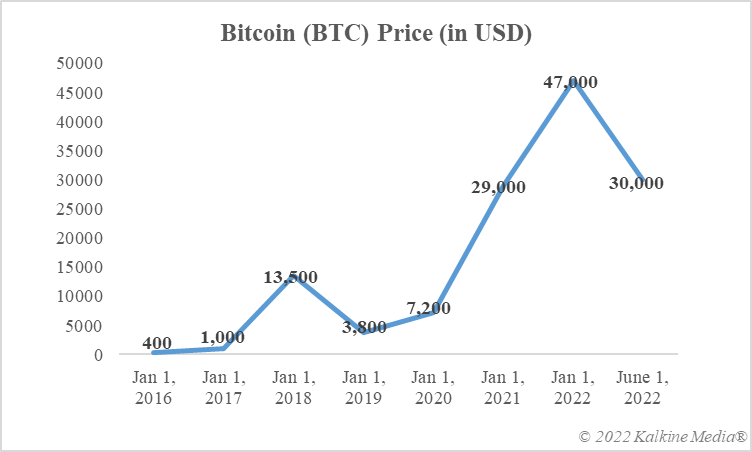

Stated data of CoinMarketCap.com

Is the conversion possible?

Intermediaries such as cryptocurrency exchanges allow the conversion of fiat currency to Bitcoin and vice versa. These exchanges can list Bitcoin and many other cryptocurrencies such as Dogecoin for trading purposes. To start trading, one must first purchase Bitcoin using fiat money in their bank account. After a while, the person might want to liquidate the Bitcoin holding, which can be done by converting it back to fiat currency.

Separately, a person can also hold Bitcoin outside of an exchange, such as in a digital cryptocurrency wallet. One of the ways to convert such Bitcoin holdings into cash is by using Bitcoin ATMs. In Australia, for example, such ATMs are available in a few major cities, including Sydney and Adelaide. Some countries may not have any Bitcoin ATMs at all.

The bottom line

Converting Bitcoin to cash may also be completely prohibited in some countries, such as China. In other countries, where owning Bitcoin and trading it are not considered illegal activities, the cryptocurrency can be converted into cash through an intermediary such as a cryptocurrency exchange or by using a Bitcoin ATM.

Risk Disclosure: Trading cryptocurrencies involves high risks, including the risk of losing part or all of your investment amount, and may not be suitable for all investors. The prices of cryptocurrencies are extremely volatile and may be affected by external factors such as economic, regulatory or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) are subject to change. Before deciding to trade in financial instruments or cryptocurrencies, you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience and risk appetite, and seek professional advice where necessary. Kalkine Media does not and cannot represent or warrant that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept responsibility for any loss or damage resulting from your trading or your reliance on the information shared on this website.