California-based regulator launches Crypto Scam Tracker

Crypto fraud can cause a significant loss to investors (both retail and institutional). Ergo, regulators are taking steps to compensate for fraud losses. In this case, the California regulator released a tracker to help investors fight bad actors.

Bad actors have taken various measures to steal funds. The rise of scams that use a combination of spoofing and phishing to offer initial coin offerings (ICOs) or newly issued tokens/coins at prices that are too good to be true is a growing concern in the cryptocurrency industry.

These scams often target people who are new to the industry and lack knowledge of the underlying technology. Thus making them vulnerable to fraudulent schemes. Spoofing and phishing tactics are used by fraudsters to disguise them as legitimate messages or websites. Spoofing involves falsifying the identity of the sender, while phishing involves tricking the recipient into revealing sensitive information, such as passwords or financial data. The combination of both tactics is often used to create convincing scams.

With ICOs or newly issued tokens/coins, scammers often create fake websites or social media accounts that mimic legitimate offerings. They may offer tokens/coins at prices that are seductively below market value or promise a high return on investment. Unsuspecting investors who fall for these scams can lose their investment or personal information.

Maintain caution against bad actors

To avoid falling victim to these scams, it is crucial to conduct thorough research and due diligence before investing in an ICO or newly issued token/coin. This includes researching the project team and their background. Review the project’s whitepaper and technical documentation, and look for red flags or warning signs. Promises of guaranteed returns or pressure to invest quickly are red flags.

In addition, investors should be wary of unsolicited emails or messages. They should always verify the legitimacy of a website or social media account before sharing personal information or making an investment. This may include checking for SSL certificates and verifying the official domain name. Self-review of the website’s privacy policy and terms of use.

Finally, it’s important to remember that if an investment opportunity seems too good to be true, it probably is. Risks are always involved in any investment, so “do your own research” (DYOR) is essential. Investors should be cautious and take steps to protect themselves from fraudulent schemes.

Regulators are taking steps to stop bad actors

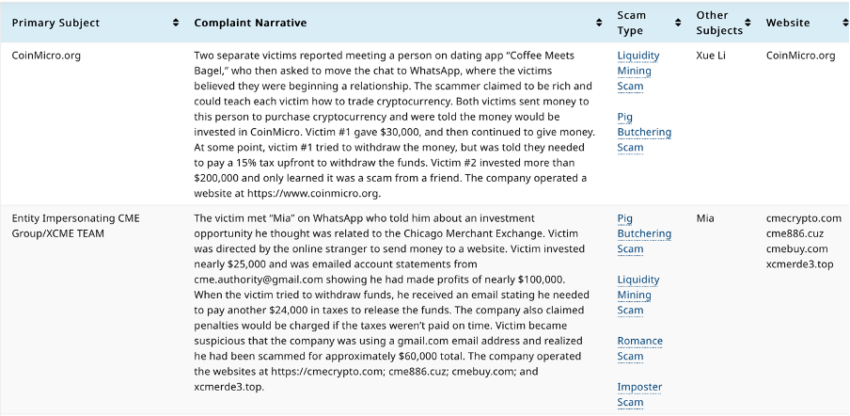

To combat the growing crypto scams, the California Department of Financial Protection and Innovation (DFPI) released a tracker to help traders and investors spot potential industry threats.

Crypto Scam Tracker is an online tool that allows investors to report suspected cryptocurrency-related illegal activities. Designed to assist the California Department of Financial Protection and Innovation (DFPI) in identifying and tracking fraudulent activities in the cryptocurrency market. Users can provide details about the scam, such as the name of the company or person behind it, and the money lost.

DFPI will use the information provided by the Crypto Scam Tracker to investigate suspected scams and take action against the perpetrators. The tool also provides users with information about common cryptocurrency scams and tips on how to avoid them.

How does the tool work?

The tool aims to help Californians “detect and avoid crypto scams.” Thereby functions as a database that can be searched by company name, fraud type or keyword – for investors/customers. The tracker describes apparent crypto scams identified through a review of complaints submitted by the public.

It allows California consumers and investors to do their research and prevent harm to themselves and others.

Furthermore, the team shared a screenshot with BeInCrypto quoting DFPI Commissioner Clothilde Hewlett over mail.

This initiative by the California regulator is an important step to protect investors from fraud in the cryptocurrency space. Cryptocurrency scams are becoming more sophisticated, and many investors are falling victim to fraudulent schemes.

Elizabeth Smith, a spokesperson for the DFPI, told BeInCrypto:

“Our hope is that this tool will be a resource for Californians to use before they are targeted or make financial decisions and help Californians from falling prey to prevent future fraud. We also want to encourage people to report fraud – it helps us to keep all Californians safe.”

Such steps mark a positive development in raising awareness of the risks of investing in cryptocurrencies. Even giving investors the tools they need to protect themselves.

Scams to watch out for

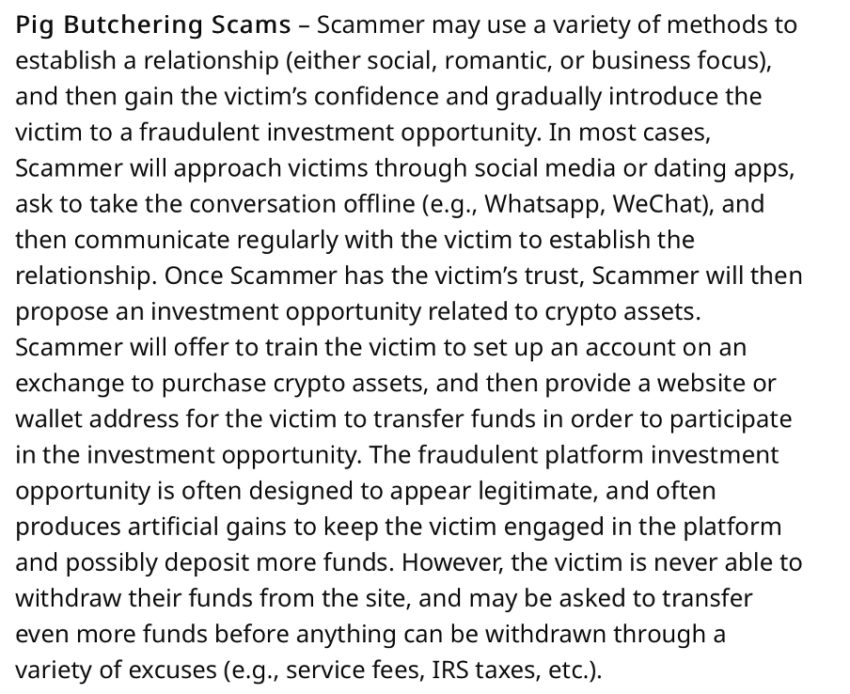

Worryingly, most of the reported scams started on social media. Sophisticated social engineering tricks victims into shopping on Facebook, Instagram, TikTok and dating apps. Meanwhile, the DFPI referred to one of the most recurring illegal activities as “pig slaughter fraud”.

In addition, WhatsApp (and WhatsApp Groups) seems to be the tool of choice for crypto scammers to spread uncertainty. Perpetrators use WhatsApp as a communication tool to find victims due to its ease of use, wide reach and end-to-end encryption. While WhatsApp has addressed this issue, more needs to be done to prevent misuse of the platform.

Fighting fraud on WhatsApp

One step WhatsApp has taken to combat abuse is to create a feature that allows users to report suspicious or inappropriate behavior. This feature allows users to report users they find concerning. Reports are then reviewed by WhatsApp’s security team.

WhatsApp has also taken steps by limiting the number of people who can be added to a group. This is designed to prevent large groups that are often difficult to monitor and moderate. Limiting the size of groups encourages smaller, more manageable groups. However, there is still more that WhatsApp can do. For example, they can develop more sophisticated algorithms to detect and flag inappropriate behavior. Plus, more robust tools for moderators to manage and moderate group chats.

WhatsApp may work with law enforcement agencies to provide training and support to identify and respond to cases of abuse or exploitation reported through the platform.

And while WhatsApp has taken steps to address misuse of its platform to lure victims, there is still more work to be done. By developing more sophisticated tools and working with law enforcement agencies, WhatsApp can help make its platform safer and more secure for everyone.

Other US regulators are taking responsibility

Other US states have initiatives to raise awareness of fraud and protect consumers from fraud. Examples include:

- New York: The New York State Attorney General has a “Consumer Frauds and Protection Bureau” that investigates and prosecutes fraud. The agency also provides resources and tips to help consumers avoid fraud.

- Texas: The Texas Attorney General’s Office has a “Consumer Protection Division” that helps consumers who have been defrauded. The division also provides information on how to avoid fraud.

- Florida: The Florida Department of Agriculture and Consumer Services has a “Consumer Protection” webpage that provides information on common scams and how to avoid them. The website also allows consumers to file a complaint if they have been defrauded.

Regarding a federal fraud search site or policy, the Federal Trade Commission (FTC) is the primary federal agency responsible for protecting consumers from fraud. The website, www.ftc.gov, provides information about fraud and allows consumers to report fraud. The FTC also has a national do not call registry that will allow consumers to opt out of phone calls. In addition, there have been discussions about the possibility of creating a centralized fraud reporting system. Even so, an official federal fraud detection site or policy has yet to be in place.

Cryptocurrency Space Needs Work

Such narratives mentioned above raise questions regarding cryptocurrencies. Despite crypto’s growth, there is room for development. More protections are lacking in crypto compared to traditional finance (TradFi) available to Main Street (retail) investors.

Here are some examples:

Investor protection: In the traditional financial system, several regulatory agencies provide investor protection, such as the Securities and Exchange Commission (SEC) in the United States. These regulators oversee the securities markets, ensure that companies are transparent, disclose material information and protect investors from fraud. However, centralized regulatory bodies must provide such protections in the crypto space. The decentralized and global nature of cryptocurrencies makes regulation and enforcement of investor protection challenging.

Insurance: Traditional financial institutions such as banks and brokerage firms often offer insurance coverage to protect customers’ funds. However, many crypto exchanges and wallets do not provide insurance coverage, leaving investors vulnerable to hacking and other cyber attacks.

Clearing and settlement: Clearing and settlement systems in TradFi ensure that trades are processed accurately and quickly, which reduces the risk of counterparty default. In contrast, the settlement process for crypto transactions can be slow and uncertain. This increases the risk of fraud and losses for investors.

Market manipulation: Traditional financial markets are subject to laws and regulations that prevent market manipulation. Insider trading and price fixing are punishable by heavy fines and imprisonment. However, the unregulated nature of the crypto market makes it more susceptible to this type of illegal activity.

Transparency and disclosure: Traditional financial markets have strict requirements for transparency and disclosure, such as financial reporting and auditor reviews.

Some final thoughts

Many crypto projects and companies need precise reporting requirements, making it difficult for investors to assess the value and risk of their investments. Overall, the need for more regulatory oversight and investor protection is in the crypto space, especially due to its decentralized nature. This makes it challenging to regulate and enforce rules across multiple jurisdictions.

In addition, the fast-paced and rapidly evolving nature of the crypto industry makes it challenging for regulators to keep up with the latest developments and ensure adequate investor protection.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.