Bullish momentum builds as bulls target $27,500 resistance – Cryptopolitan

Bitcoin price analysis reveals that market sentiment is positive. The Relative Strength Index (RSI) suggests that the market is bullish. A decisive break above $27,000 could propel BTC towards its next resistance at $28,000.

Bitcoin price analysis shows that Bitcoin opened today’s trading session on a bullish note, trading at around $26,944.04. The 20-day exponential moving average (EMA) also supports the BTC/USD pair, staying above $26,000 for most of yesterday’s session. Bitcoin price is hovering near the $27,000 resistance level and bulls are looking for a breakout to propel BTC towards its next target of $28,000.

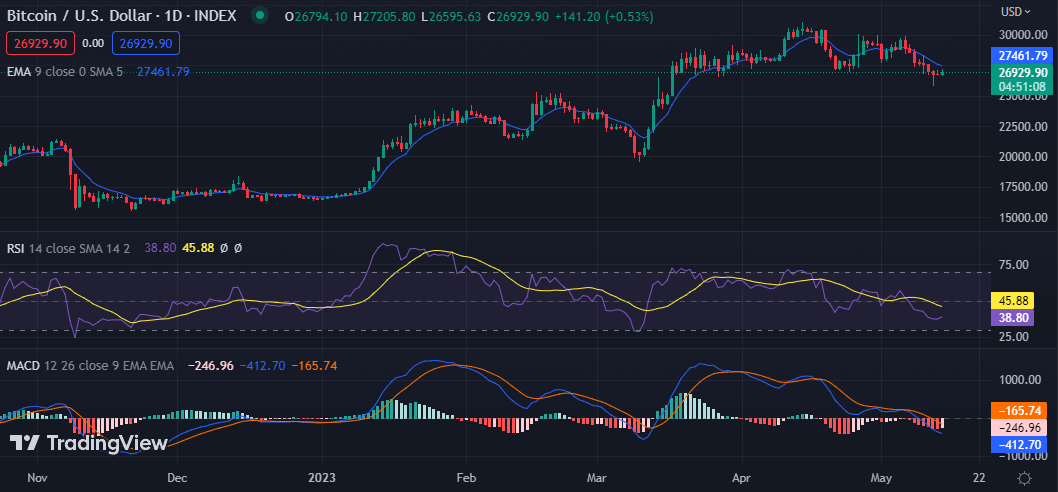

BTC/USD Daily Chart Analysis: BTC prices stall near $27,000

Bitcoin price analysis on the daily chart shows that Bitcoin’s price reached an intraday high of $27,150.98 but has lacked enough momentum to break past the $27,000 resistance level. The 50-day simple moving average (SMA) and 200-day The SMA line remains above the 20-day EMA line, suggesting that the Bitcoin price is in a strong uptrend.

The price appears to be stuck at the $26,900 level, with bulls and bears in a tug of war. The Relative Strength Index (RSI) also suggests that the market is in bullish territory, but it has remained below the 70 level since yesterday’s trading session.

If bulls can muster enough buying pressure to break past the $27,000 resistance level, BTC could see a rally towards its next resistance level of $28,000. On the other hand, failure to break the $27,000 resistance causes the Bitcoin price to fall back towards the $26,660 support level. A break below this level could cause BTC to fall towards its next support at $25,700.

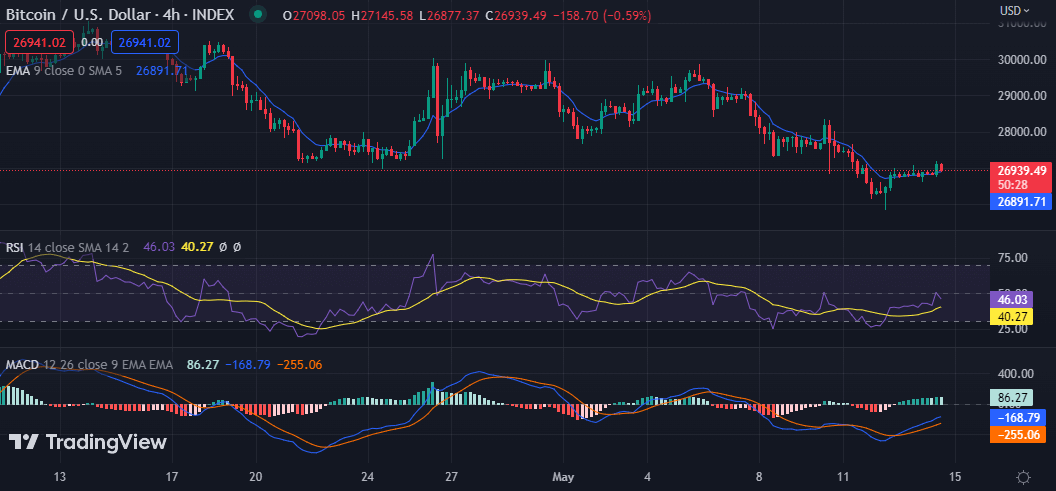

BTC/USD 4-Hour Chart Analysis: BTC Forms an Ascending Triangle Pattern

Bitcoin price analysis on the 4-hour chart shows that BTC is forming an ascending triangle pattern, a sign that buyers want to push prices higher. The formation of this pattern also suggests that Bitcoin may see an upswing soon.

The RSI recently dipped below the 50 level, but it remains in bullish territory, suggesting that bulls have the upper hand in the market. If buyers break past the $27,000 resistance level and further sustain gains above this level, Bitcoin could rise to the next target of $28,000 in the next few days. On the other hand, failure to break past the $27,000 resistance could cause BTC to fall back. The MACD line has moved above the red signal line, suggesting that a bullish breakout may be imminent. Bitcoin’s candle close above the $27,000 resistance level is necessary for a truly bullish rally.

Bitcoin price analysis conclusion

Bitcoin price analysis shows that BTC is consolidating near the key resistance level of $27,000 as bulls look to break past this barrier and drive prices towards their next target of $28,000. A strong rejection at this level could cause Bitcoin to fall back towards the $26,660 support. For now, buyers maintain the upper hand in the market and may soon be able to break the $27,000 resistance level.

While you wait for Bitcoin to move forward, check out our price estimates on XDC, Polkadot and Curve

Disclaimer. The information provided is not trading advice. Cryptopolitan.com has no responsibility for investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.