Buffett says don’t gamble with Bitcoin. 2 prefer to buy instead

Marko Horvat/iStock Editorial via Getty Images

Co-author of “Hidden Opportunities”

Las Vegas is a fun place. The city welcomes almost 42 million tourists annually and has a lot going on there, making it a must-visit destination; fine hotels, excellent food, vibrant nightlife, highly entertaining shows and most importantly, the casinos.

As a business, casinos handle these tokens or chips instead of cash because they are easier to stack, store and count. While these tokens can be exchanged for cash at the casino (and perhaps a few businesses in “gambling towns” may honor them informally), make no mistake – these tokens have no practical value. When the old casino closes and a new one moves in, the old chips are interesting art.

Similarly, the financial markets have a wide range of highly speculative instruments that tempt the average investor to “get in on it.” That’s understandable. After all, the urge to partake in what looks like easy money is a basic human instinct.

“A rising price creates more buyers and people think, ‘I’ve got to get into this,’ and it’s better if they don’t understand it. If you don’t understand it, you’ll be much more excited than if you understand it.” – Warren Buffett in 2018

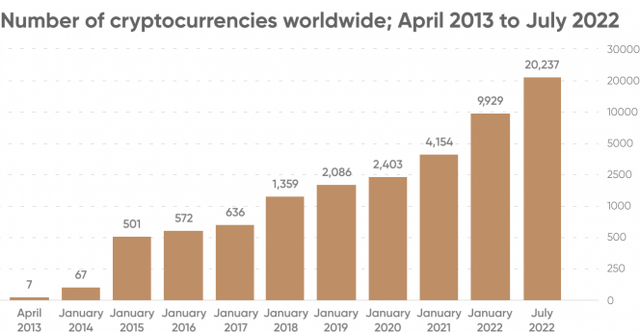

The funny thing about the crypto market is that the instruments are not perfect, even in theory of being the technology to support decentralized finance. Because Bitcoin is fundamentally flawed, we have Ethereum. And Ethereum has scalability issues, so we have Cardano. You often hear about the founder of one crypto starting another, claiming improvements in known challenges from the former. Today, there are almost 23,000 cryptocurrencies with a market capitalization of +1 trillion dollars. They are filled with “pie in the sky” potential described in ways beyond the comprehension of the average individual with a “shut up and take my money” attitude. Source

CoinMarketCap

The Oracle of Omaha, who also happens to be a notable disciple of Ben Graham, the father of value investing, sees no value in Bitcoin. Despite the rising price, the Berkshire Hathaway boss sympathizes with cryptocurrency speculators and does not shy away from calling it a “get-rich-quick” scheme.

While Mr. Buffett buys hidden value and allows time to unlock the true potential of his purchases, our goals differ slightly. We don’t invest in anything from the financial markets unless it pays us for our time (and money).

Preferred securities offer reliability in current markets

Benjamin Graham noted that due to the irrationality of investors (including factors such as the inability to predict the future and the fluctuations of the stock market), buying undervalued or unfavorable securities is guaranteed to provide a margin of safety for the investor. .

In a market where the prices of stocks and bonds have fallen simultaneously due to the so-called “interest rate risk”, preferred stock combines the best of both worlds for risk-averse investors.

Unlike bonds, most preferred shares have no maturity date at which the principal must be repaid. Companies issuing the preferred can redeem it at any time after the “call date” of the issue. Until this time, you can collect regular dividend payments.

Preferred securities are the opposite of speculative bets – they provide a reliable and predictable income stream and are redeemable at a set face value (typically $25). As long as the underlying company continues to execute on its business goals, we get paid for our patience. Finally, as the company improves its credit rating and can borrow at lower costs, convertible preferreds are redeemed at face value, and if we bought below par, we collect a capital upside.

As interest rates have risen, many preferreds are trading well below par, and we are increasing our holdings in this asset class. At High Dividend Opportunities we maintain an interest allocation of 40%. Our preferred portfolio has positions in 45+ individual preferences and baby bonds, aiming for an average return of 8-9%. As Wall Street runs away from interest rates in this rising interest rate environment, we buy with both hands for our long-term income needs.

Here are two deeply discounted high-yield preferreds we’re uploading in this sale.

Pick #1: SiriusPoint Preferreds – Yield 8.7%

SiriusPoint Ltd. (SPNT) is an insurance company licensed to write property and casualty insurance and casualty and health insurance and reinsurance globally. SPNT has $2.9 billion in total capital and its operating subsidiaries have a financial strength rating of A- from AM Best, S&P and Fitch.

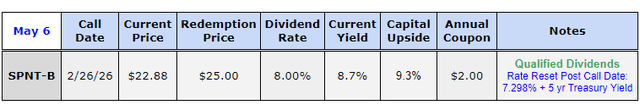

With discussions about SPNT being taken private by ~9% shareholder Dan Loeb who got airtime, holders of their 8% resettable preference shares with fixed interest (SPNT.PB) is concerned about the abandonment of the securities.

If not redeemed after the call date (February 2026), SPNT-B‘s coupon swaps to a floating rate of 5-year US Treasury plus 7.298%, resets every five years. Considering that the coupon is most likely going to be higher than current levels, (and that the subsequent call option will not be until 2031), there is a higher probability of redemption of the preferred in three years.

Author’s calculations

Since SPNT-B was issued to appease large institutional investors as part of a definitive agreement that led to the formation of SPNT, it carries a generous coupon of 8%; it has several structural protections and features that make it quite a unique investment. 8.7% qualified yield and 9% upside to par from this preferred with an interest reset clause that almost guarantees redemption on the purchase date.

Option #2: Essential Retail REIT Preferred – Yield up to 9.3%

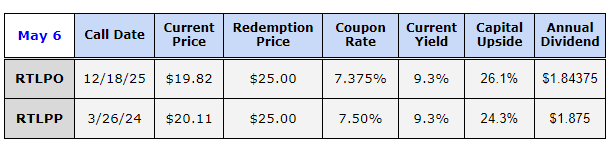

The Necessity Retail REIT (RTL) also calls itself the place “Where America Shops.” This REIT has a recession-proof portfolio of primarily convenience-based tenants such as discount retailers, auto repair shops, gas stations and convenience stores. RTL maintains high occupancy rates and a healthy balance sheet, providing adequate coverage to the preferred dividends.

RTL has two classes of preference with an attractive yield of 9.3% and offers up to 25% upside to face value. The growing common dividend is a boon to the investors of these cumulative preferences.

- 7.375% Series C Cumulative Redeemable Perpetual Preferred (RTLPO)

- 7.50% Series A Cumulative Redeemable Perpetual Preferred Stock (RTLPP)

Author’s calculations

As perpetual preferences, the Company has no obligation to redeem these securities after the date of purchase. Given RTL’s financial position and the interest rate climate, we do not expect the RTL preferreds to be called anytime soon, making them excellent buys for our long-term income needs.

Conclusion

As an observer of decades of investor sentiment, Mr. Buffett has for decades seen several financial instruments masquerading as “assets” with big promises, drawing anxious people to “get in” on the upside. With Bitcoin, The Oracle of Omaha simply compares them to the gambling he has seen throughout his life.

“Cryptocurrencies basically have no value and they don’t produce anything. They don’t reproduce, they can’t send you a check, they can’t do anything, and what you’re hoping for is that somebody else comes along and pays you more money for them later, but then that person has the problem. As for value: zero.” – Warren Buffett in 2020

Don’t gamble away your financial future with the promises of highly speculative investments. Your neighbor may have banked with Bitcoin or other cryptocurrencies, but you could lose everything when the bubble bursts into nothingness.

We love dividend stocks and these two picks are part of our preferred stock portfolio which makes up +45 different solid investments. Thanks to the Hawkish Fed, there are much safer asset classes at deeply discounted prices. We believe interest rates have peaked and dividend stocks in general are at their lowest today. As income investors, we stock up on preferred securities and will patiently wait for the upside as the interest rate cycle shifts. Retire in safety with up to 9.3% yield from two well-protected preferences. Now is the time to stock up on dividend stocks!