BTC Whales ditch exchanges, but deposits keep growing

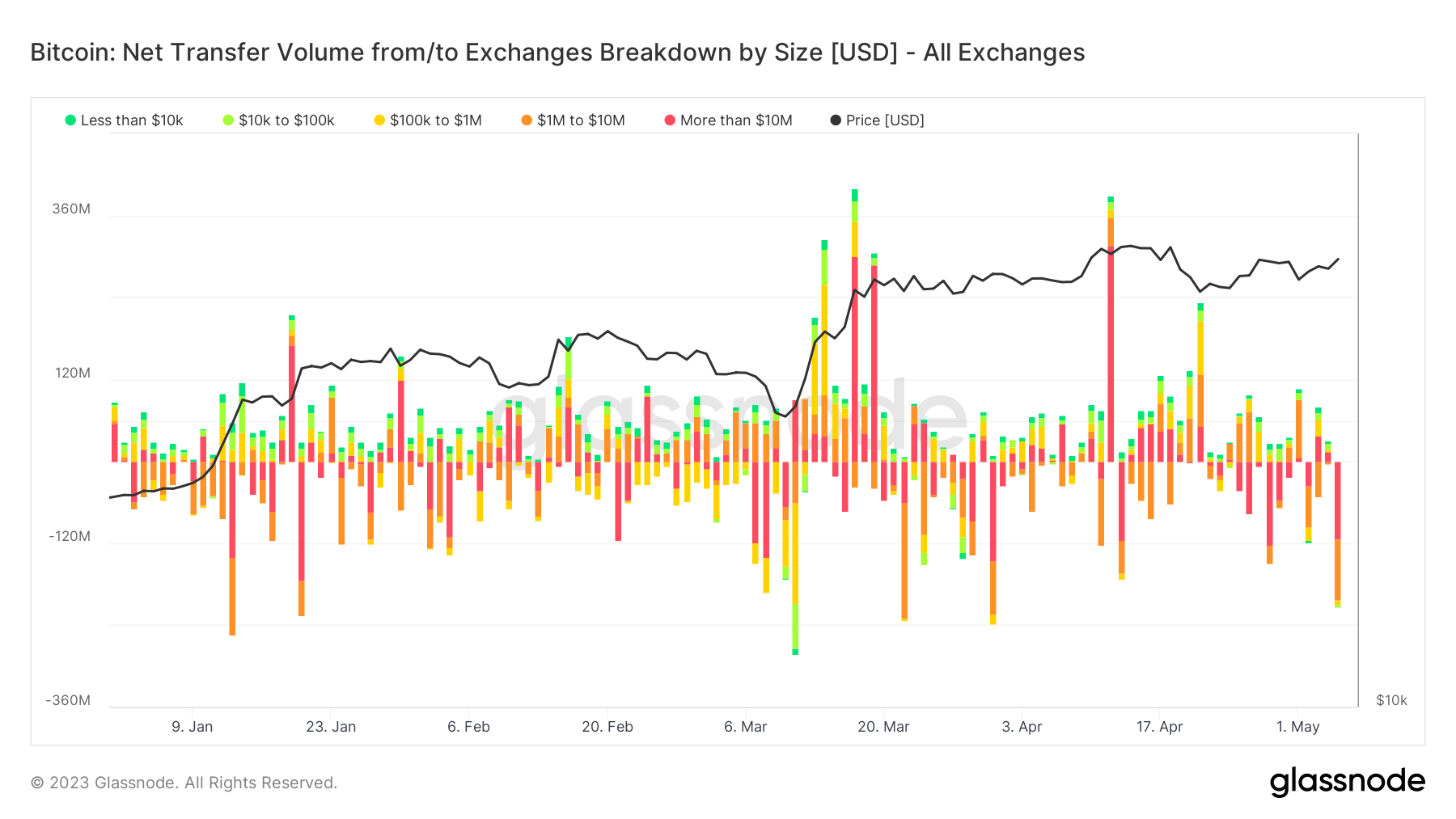

Bitcoin withdrawals from exchanges outweighed massive deposits on Friday thanks to the activity of a handful of whales.

Data from Glassnode reveals that BTC withdrawals reached almost USD 240 million in a single day. The outflow was the sixth largest seen this year. And transactions worth over USD 10 million accounted for around half of all withdrawals.

The same data show that total exchange activity, both deposits and withdrawals, has increased. For example, on a single day in April, over USD 360 million worth of Bitcoin was deposited into exchanges. So too, the increase in activity was driven by transactions in the $10 million+ range.

The Ethereum Foundation powers the ETH movement

And it’s not just Bitcoin that’s seeing greater movement on and off crypto exchanges.

On Saturday, the Ethereum Foundation transferred 15,000 ETH to a Kraken deposit address. Apparently signaling a sell-off worth around USD 30 million, based on past trends, observers have speculated that the price of ETH may be about to fall.

In the past, the foundation has timed its sales right when the market is peaking, taking advantage of peaks in the ETH price cycle to maximize gains. And while the price of ETH shows no signs of a major downtrend at the moment, it could be due for a negative adjustment if history repeats itself.

Exchanges still haven’t recovered from mass withdrawals after FTX

Overall, Glassnode data shows that the total balance of Bitcoin held on major exchanges has increased since mid-March and currently stands at just over 2.3 million BTC. There are also around 18.1 million ETH deposited with crypto exchanges.

However, total assets held on centralized exchanges have still not recovered from mass withdrawals between October and January.

In the past, it was common for there to be over 2.5 million BTC held by exchanges at any given time. And at the height of March 2020, over 3.2 million BTC were deposited with exchanges.

During this period, the fear that contagion from the collapse of FTX could destroy another cryptocurrency exchange led many investors to seek alternative custody solutions for their assets.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.