BTC/USD not out of the woods

Bitcoin, BTC/USD – Technical Outlook:

- Bitcoin has stabilized in recent weeks.

- Is BTC/USD rally about to run its course?

- What is the outlook for BTC/USD and key levels to watch?

Recommended by Manish Jaradi

Get your free introduction to cryptocurrency trading

BITCOIN SHORT TERM TECHNICAL OUTLOOK – NEUTRAL

While Bitcoin has stabilized in recent weeks, more work needs to be done before concluding that the worst for the cryptocurrency is over.

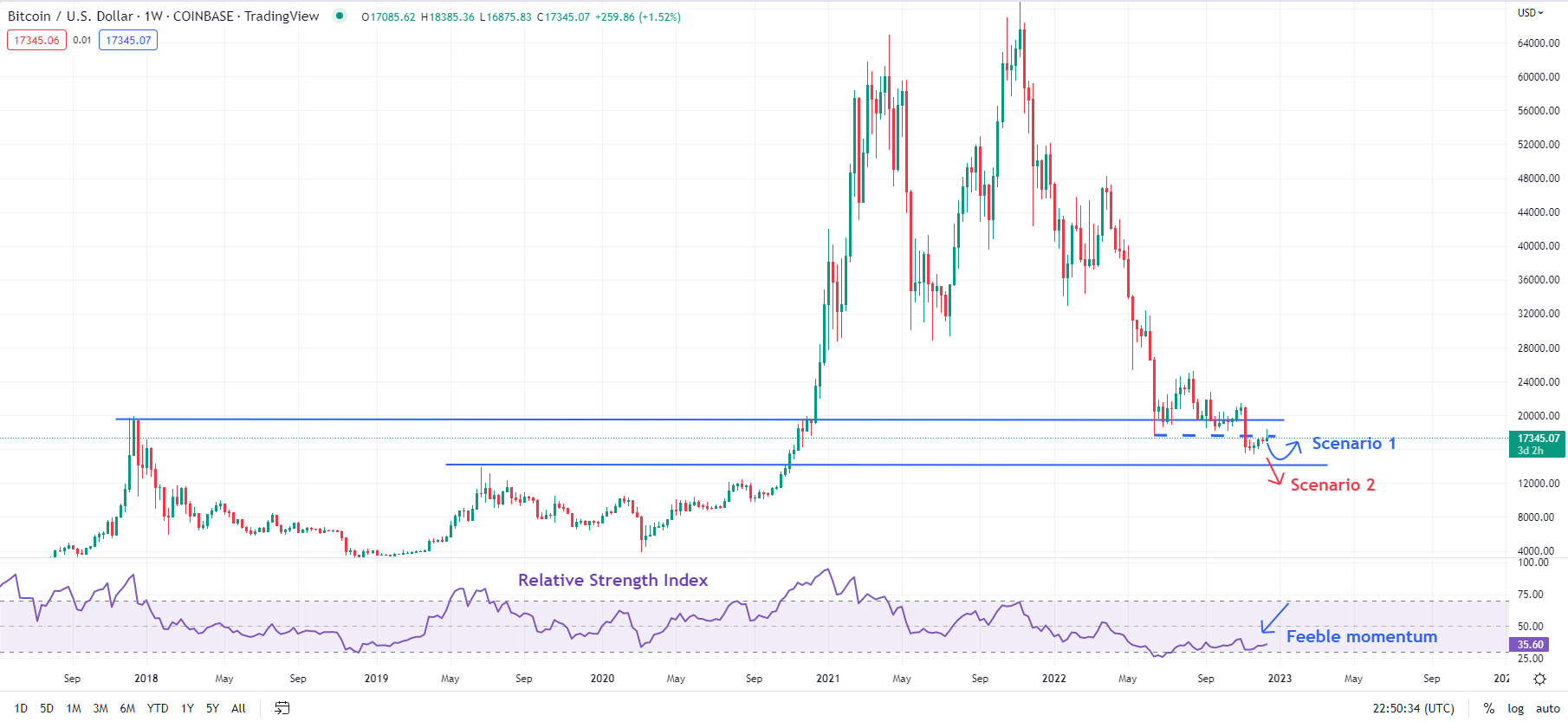

Since mid-November, this column has highlighted the possibility of some consolidation/minor pullback after the early November slide. So far, the highlighted scenario 1 seems to be playing out, but to be fair it is stabilization at best, rather than a reversal of the downtrend. In fact, the chance that scenario 1 may be nearing completion is increasing.

.

BTC/USD weekly chart

Chart created using TradingView

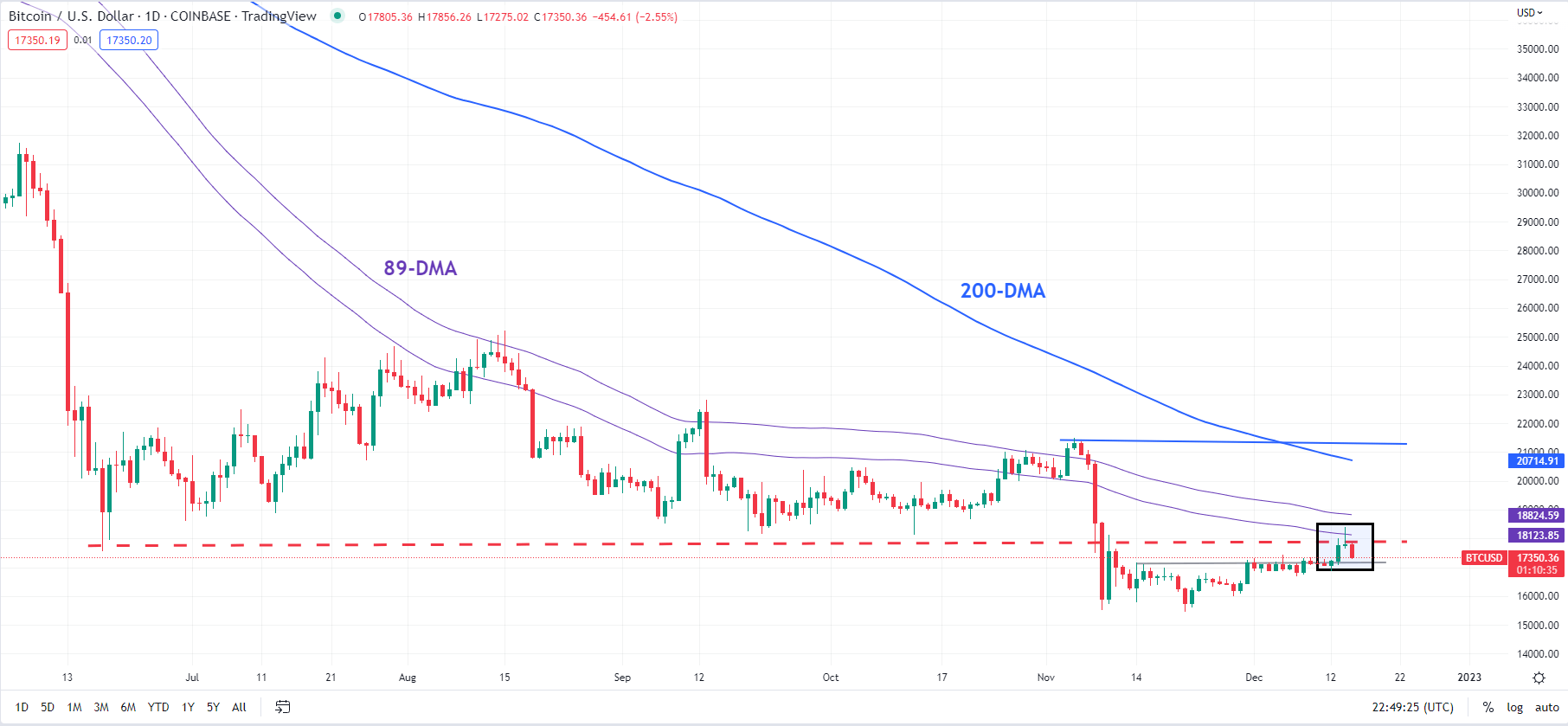

BTC/USD has risen above the immediate mid-November barrier at 17170, but it does not appear to be convincing given the bearish evening star candlestick pattern created on the daily chart on Thursday around stronger resistance on a horizontal trend line from June at about 18150 -18200 and 89-day moving average. Rally since mid-2022 has been limited to moving averages (see chart). In addition, the decline in recent weeks has been associated with weak momentum, which increases the risk of a pullback.

BTC/USD Daily Chart

Chart created using TradingView

If BTC/USD is unable to extend its gains in the coming days, it could be a warning sign that the one-month stabilization is over. One of the signs you should see to conclude that scenario 1 has run its course would be a drop below the December 7 low at 16690. Such a drop would confirm that the upward pressure had eased, increasing the odds of a broad range of 15500 -18500 is developing in the meantime. On the bearish side, a decisive break below the November low of 15480 could pave the way towards the 2019 high of 13895.

On the upside, if the current rally has legs, a break above the converged barrier around 18150 is needed, which could unfold towards the November 5 high of 21470, near the 200-day moving average.

Recommended by Manish Jaradi

Top Trading Lessons

— Posted by Manish Jaradi, Strategist for DailyFX.com