BTC needs one more confirmation for a push to $22,000

- Bitcoin price is struggling with the 20-day EMA at $19,440 after a twelve-hour candlestick close to it.

- If BTC holds above $19,440, it is likely to target the $22,048 level.

- A daily candlestick approaching the $17,593 low indicates the start of a bearish outlook.

Bitcoin price produced a bullish candlestick over the weekend, enabling it to face a crucial hurdle. A breakout above this blockade could trigger a quick rally to key levels, indicating the start of a bullish week.

Bitcoin price continues to consolidate

Bitcoin price has been consolidating since the June 18 crash, which set a swing low of $17,593. Since then, market makers have been extremely busy sweeping important swing lows. The last swing low formed on October 13th at $17,935 created similar lows and collected the sell stop liquidity that rests below all swing lows formed after June 19th. This move was an excellent place to enter a long position and book a profit of $19,951, aka. the range high, but the 30-day exponential moving average (EMA) of $19,440 is in the way.

Although the Bitcoin price produced a twelve-hour candlestick close above it, investors will have to wait for another confirmation. A successful reversal and hold above this level could propel BTC to the next significant level of $22,048, provided it overcomes the $20,306 to $20,737 barrier.

In such a case, investors are looking at a 13% rise in the Bitcoin price from the current position.

BTCUSDT 12 Hour Chart

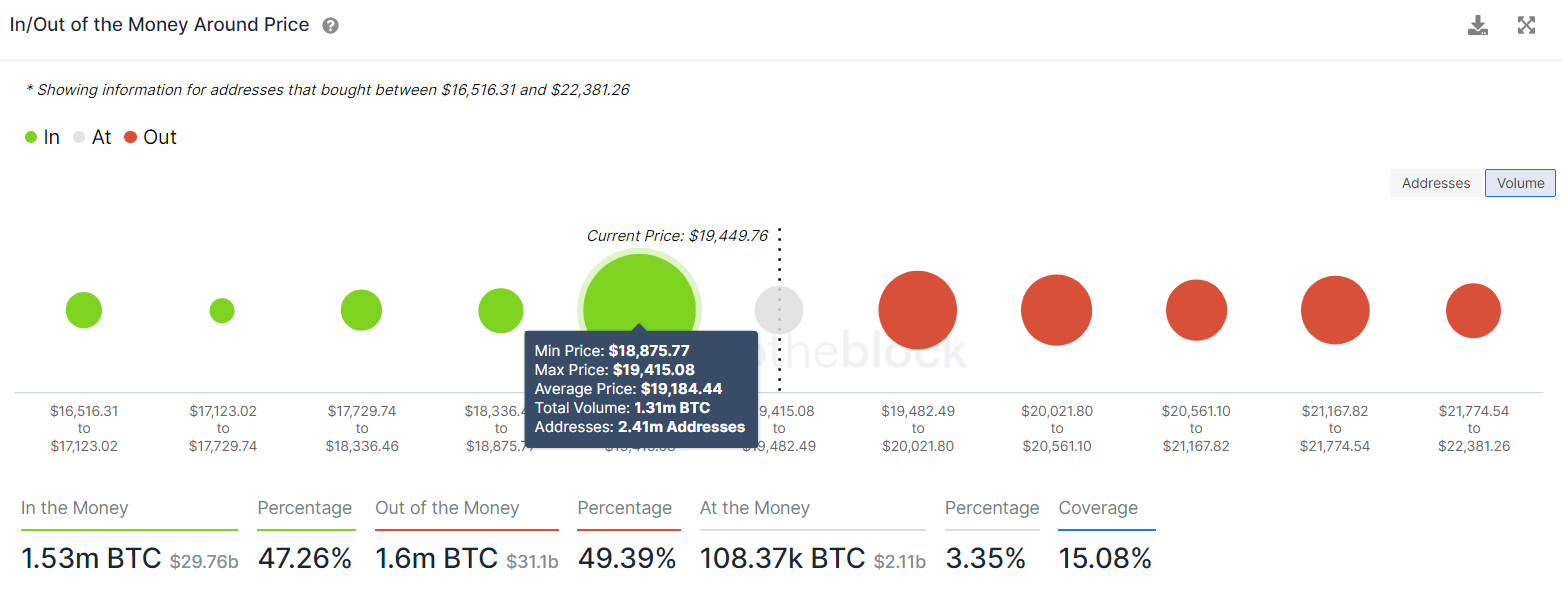

Adding credence to a potential reversal of the 30-day EMA and an uptrend is IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model. The transaction data indicates that approximately 2.41 million addresses purchased nearly 1.30 million BTC at an average price of $19,184.

These investors are likely to add more to their holdings if the Bitcoin price falls, thus acting as a support level by absorbing the selling pressure. Compared to the “In the Money” investors, the “Out of the Money” holders are fewer and likely to be outnumbered if there is an increase in buying pressure.

Since the technical and chain values are in line, there is a good chance that BTC will experience a bullish week.

BTC IOMAP

As things look up for the Bitcoin price, market participants need to keep a close eye on $18,934, which is the midpoint of the $17,917 to $19,951 range. A breakdown of this level would indicate a shift in the market structure favoring bears.

In this situation, investors should note that a weakness of the June 18 swing at $17,593 will be a manipulation by the market participants before it triggers a rally. Therefore, a daily candlestick near said level instead of a liquidity run would indicate that the sellers are in control.

Such a development would invalidate the bullish thesis and trigger a further correction to the $17,000 or $15,551 support levels. Here, buyers can step up and give the uptrend a second chance.