BTC Falls 2.5% – What’s Next for Bitcoin?

In recent trading sessions, Bitcoin has experienced a 2.5% drop, raising questions about the future path of the leading cryptocurrency. As market participants analyze various technical indicators and market trends, it becomes crucial to understand the factors that could influence Bitcoin’s next move.

In recent trading sessions, Bitcoin has experienced a 2.5% drop, raising questions about the future path of the leading cryptocurrency. As market participants analyze various technical indicators and market trends, it becomes crucial to understand the factors that could influence Bitcoin’s next move.

In this Bitcoin price analysis, we will discuss current market conditions, key support and resistance levels, and possible scenarios for the BTC price in the near future.

Fed interest rate hikes

The data from the US Personal Consumption Expenditures (PCE) index from last Friday, which was expected to be the big macro event of the week, did not live up to expectations. However, the dollar rose as data suggested the Federal Reserve will not delay raising interest rates. The dollar index (DXY) has gained 0.15% to 101.81.

Interest rates are likely to rise by 25 basis points at the Fed’s rate decision on May 3, from 5% to 5.25%. Furthermore, the probability of an increase in June increased to 27%.

If the Fed deviates from this strategy and proposes an increase of more than 25 basis points, it will be a hawkish hold indicating a stronger US dollar, resulting in a decline in the price of BTC/USD. Therefore, investors exercise caution because this macroeconomic event can cause volatility.

Tesla maintains consistent Bitcoin holdings in Q1 2023

Tesla’s Q1 results show that it maintained a consistent Bitcoin balance during the first three months of 2023. According to the company’s announcement, it had the same amount of digital assets in Q1 2023 as in Q4 2022: $184 million.

The revelation that the company neither bought nor sold any Bitcoin during the volatile quarter has created a buzz in the Bitcoin sector.

In addition, this decision may indicate a long-term investment strategy or a display of confidence in the future growth of cryptocurrencies. However, how the market will react to Tesla’s stance is still uncertain.

Going forward, many will closely monitor Tesla’s involvement in the industry as it could significantly affect the overall direction of the crypto market and the price of BTC/USD.

Bitcoin price

The BTC/USD pair is trading at $28,591, down 2.5% on the day. The price of Bitcoin fell after the US PCE data triggered expectations of another Fed rate hike in June. Bitcoin prices fell dramatically from the 29,600 level to the 28,640 level. On the four-hour time frame, Bitcoin has crossed below the 50-day exponential moving average, which was a support area around 29,000.

The formation of candles suggests that the bearish bias dominates the market, and at the same time, the RSI and MACD indicators are in the sell zone, supporting the chances of a downward trend in the Bitcoin price today.

On the downside, Bitcoin is likely to find immediate support around the 28,000 level, which is being extended by a trendline as you can see on the 4-hour time frame. A break below this particular 28,000 level has the potential to take the BTC price to the next support level of 27,195.

Buy BTC now

Top 15 Cryptocurrencies to Watch in 2023

Besides Bitcoin, the market presents a number of promising cryptocurrencies, covering upcoming altcoins and pre-sale tokens with the potential for significant returns.

As a result, the Cryptonews Industry Talk team has compiled a list of the top 15 cryptocurrencies for 2023, each showing robust prospects for both short-term and long-term growth.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

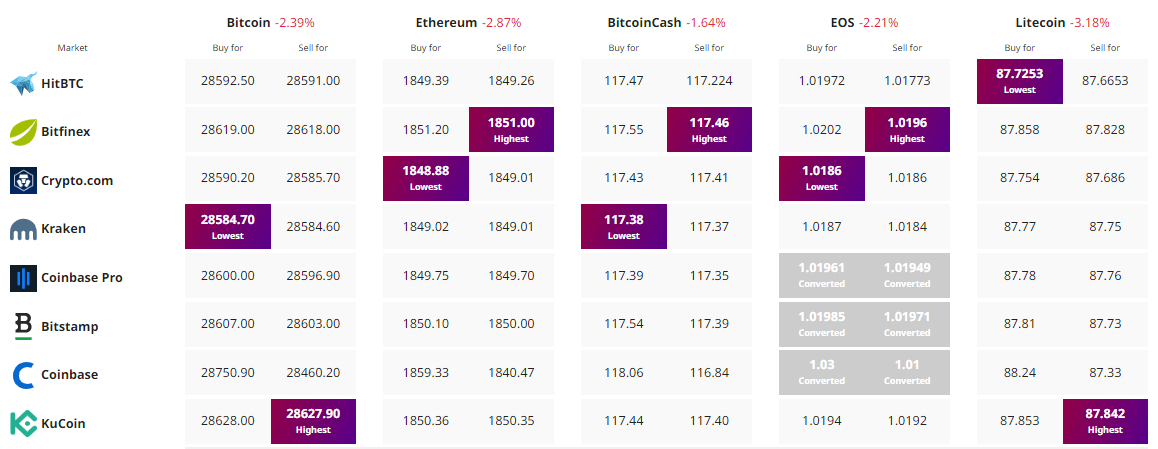

Find the best price to buy/sell cryptocurrency