BTC, ETH, XRP, BNB, DOGE and ADA – Cryptopolitan

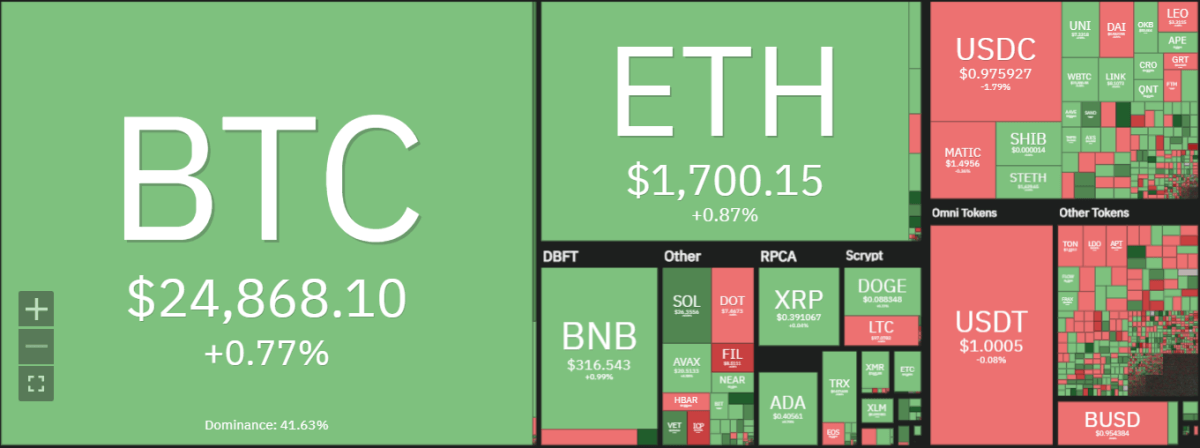

Our weekly crypto price analysis shows that most coins have been trading in a neutral trend with bulls and bears equally active in the market. Throughout the week, the top coins have remained bounded between their upper and lower limits. Bitcoin has traded between $21,000 and $24,000, while Ethereum has held its price between $1,400 and 1,600. Ripple’s XRP token was also trading in a similar range along with other top coins such as Binance Coin (BNB), Dogecoin (DOGE) and Cardano (ADA).

Overall market sentiment was positive this week, with Bitcoin and Ethereum both hitting all-time highs. The Altcoins market also saw a surge led by SOL reaching its highest levels in many years. Looking ahead, the weekly crypto price analysis suggests that BTC, ETH, ADA, DOGE and XRP have the potential to strengthen further if bulls manage to break past resistance levels. At the same time, it is important to note that any negative news or events can cause these coins to fall back down. It is therefore recommended that investors be vigilant and take account of any changes in market conditions.

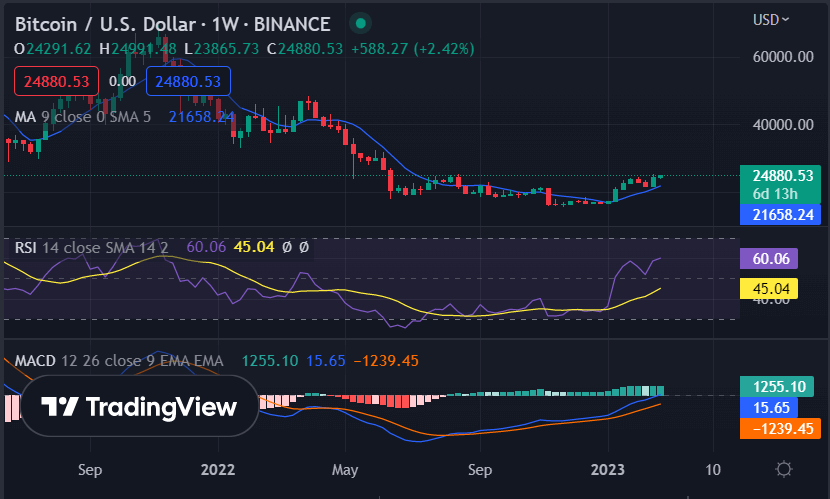

BTC/USD

Bitcoin price analysis shows that the digital asset has consolidated above 24,000 in recent days. Bulls were successful in buying on every dip as BTC defended and reclaimed its upper resistance at $25,000. The next target for Bitcoin is likely to be the psychological level of $25,500 which it may test soon if bulls remain in control.

Currently, BTC/USD is trading at $24,497.14 with a small loss of around 0.65 which will soon be recovered if the bulls remain in control. The coin currently has a market cap of over $472 billion and a daily volume of more than $28 billion.

BTC/USD has risen more than 12 percent in the past seven days and is expected to continue its bull run in the coming weeks. Looking at the technical indicators, the MACD is in bullish territory and the RSI has risen to near 60.06, indicating strong buying pressure. The moving average trend line is also trending upwards, indicating a continued uptrend.

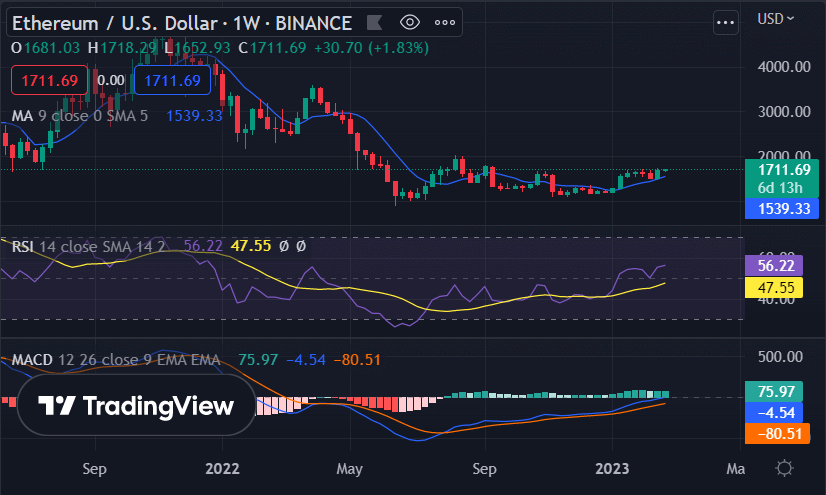

ETH/USD

Ethereum price analysis shows that the number two crypto asset has managed to break above 1600 in recent days. Bullish momentum has continued to push ETH/USD higher, with buyers successfully defending each dip and bringing it back up. The current price of Ethereum is $1,692 which is higher compared to the start of last week.

The support level for ETH/USD is at 1600 and if the bears manage to break this level, the price may drop further. On the upside, the bulls will look to break above the $1,800 resistance, which is likely to be tested soon. Looking at the technical indicators, a state of equilibrium is maintained with the MACD (Moving Average Convergence Divergence) marginally above the zero line and the RSI (Relative Strength Index) trading at 56.22, indicating a neutral trend. The moving average is currently around 1,539 and will act as an important support level for the bulls.

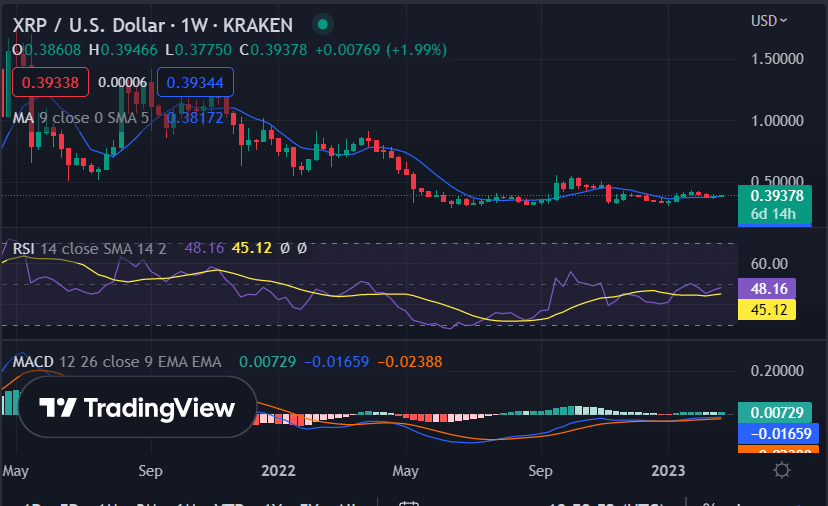

XRP/USD

According to our weekly crypto price analysis, Ripple has risen from $0.36 to over $0.39 since the beginning of last week. After crossing the $0.35 resistance level, XRP/USD has failed to break above the next resistance at $0.39 and is currently trading around $0.3906 with a minor loss of 0.31 percent in the last 24 hours.

RSI (Relative Strength Index) is near 48.16 levels. Furthermore, the bulls are trying to break through the resistance formed by the moving averages. If we succeed in that, we can expect a rise towards $0.39 or more. However, if the bears manage to push prices below $0.38, we could see a selloff that could take XRP/USD all the way down to $0.37 – its crucial support level.

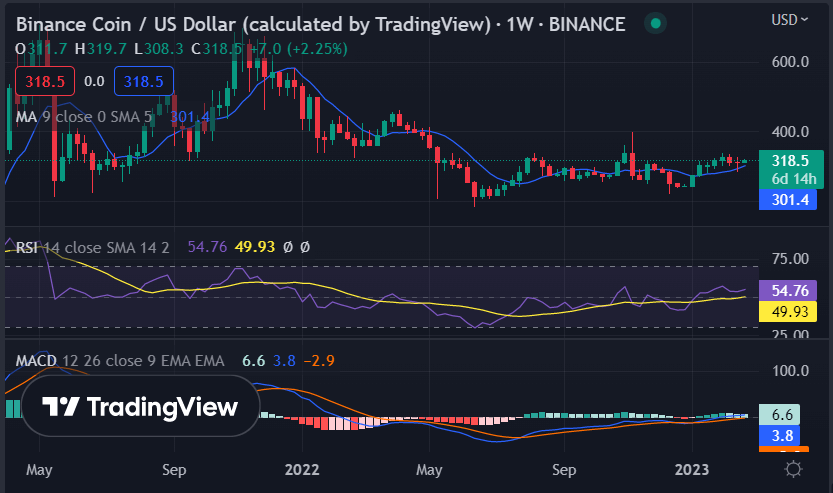

BNB/USD

According to our weekly crypto price analysis, Binance Coin has been trading in the neutral zone with bullish and bearish corrections at the same time. Today’s BNB/USD pair is trading at $316 with a minor gain of 0.41 percent in the last 24 hours. The coin has also increased by more than 9.12 percent in the last seven days, which is encouraging for buyers.

The 24-day trading volume for the BNB/USD pair is $578 million and the market capitalization is just over $49 billion. Looking at the technical indicators, we can see that MACD (Moving Average Convergence Divergence) has crossed the zero line, indicating a bullish trend while RSI (Relative Strength Index) is currently trading near 54.76 levels. On the upside, buyers will look to break through the $318 resistance level, while on the downside, they will aim to defend the support around $309. If the bulls manage to break through this resistance and maintain the momentum, we could see BNB/USD test its all-time high of $320.

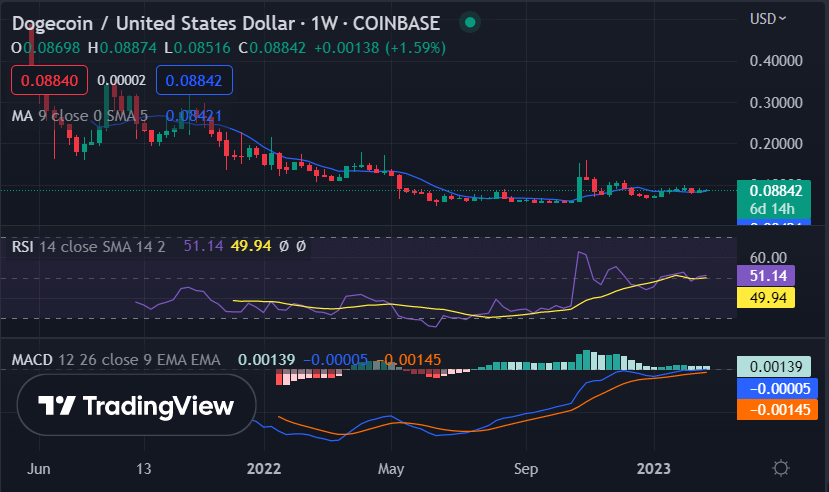

DOGE/USD

Dogecoin price analysis shows that the coin is currently trading at $0.08839 with a gain of 0.08% in the last 24 hours. In addition, the coin has increased by more than 9.56% in the last seven days and is expected to continue its bullish trend in the coming days. weeks. For the past week, the DOGE/USD coin has been trading in a range between $0.080 and $0.088 and is looking to break past the current resistance at 0.089 to continue its bullish momentum.

Looking at the technical indicators, we can see that the MACD indicator is currently in positive territory, with the histogram extended and the signal line pointing upwards. The RSI (Relative Strength Index) is currently at 51.14 and is in a bullish trend, indicating that there is more room for DOGE/USD to move higher. The 50-day moving average and 200-day moving average are both trending flat and are expected to act as support and resistance levels for the coin.

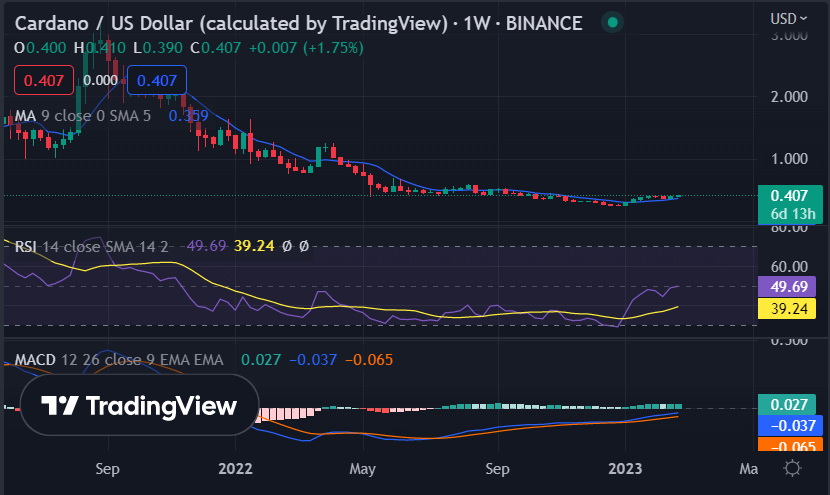

ADA/USD

According to our weekly crypto price analysis, Cardano followed an upward trendline for the past week, reaching a high of $0.4116. Today, the ADA/USD pair is trading at $0.408 with a gain of 1.12 percent over the past 24 hours and 12 percent over the past seven days.

The buyers are trying to break through the resistance at $0.4116 while the bears are trying to push the price below $0.39 to take control of the market. If the bulls manage to defend their position and break through this resistance, we could see ADA/USD rise all the way to $0.42 or more.

The RSI (Relative Strength Index) is currently at 49.69 and is looking to break through the overbought zone. The MACD (Moving Average Convergence Divergence) indicator, on the other hand, is slowly converging towards the zero line, indicating a bullish trend. The moving average indicator for the coin shows a flat trend at $0.359, which is just below the current trading level.

Weekly Crypto Price Analysis Conclusion

Overall, our weekly crypto price analysis shows that all the coins we have looked at are in a bullish trend and could potentially see further gains in the coming days. An understanding of technical indicators is key to successfully predicting the direction of cryptocurrency prices and making informed trading decisions. Buyers and sellers will try to defend their respective positions and break through support and resistance levels to gain an advantage in the market.