British crypto companies are asking for help to break a banking barrier

Hello and welcome to the latest edition of the FT’s Cryptofinance newsletter. This week we look at the UK and crypto banking crisis.

The demise of crypto’s favorite banks in the US has slimmed the industry’s access to the traditional financial system, fueling theories that crypto is being run out of town, at least in the US.

Fewer banks accepting crypto means fewer places for businesses to park their customers’ assets. But this trend—dubbed “Operation Chokepoint” by a few feverish people on social media—doesn’t stop at America’s borders. British banks are also freezing crypto.

NatWest and other major UK banks have imposed limits on how much money can flow to and from crypto exchanges. Citing a challenging regulatory environment, online payments provider Paysafe recently said it would discontinue services to UK customers of Binance, the largest trading store crypto has to offer.

Along with the swing in America, the trend has set off alarm bells. Lobby group CryptoUK this week wrote to the UK’s Economic Secretary Andrew Griffith expressing “deep concerns” about blanket bans and restrictions on transfers from UK banks to crypto-asset platforms.

The group urged the government to “find a way forward” and consider facilitating meetings between banking and crypto C-suite heads.

You can see why they think it’s worth a try. The UK government has been explicit about embracing crypto.

“I’m selling the UK as a place to set up shop, but if you can’t get bank backing, what’s the point? Potential newcomers just won’t bother coming here, Ian Taylor, board member of CryptoUK, said over the phone.

Lisa Cameron, an MP who chairs the all-party parliamentary group on crypto, told me she raised the crypto banking issue with Kevin Hollinrake, parliamentary under-secretary at the Department for Business and Trade.

“It is counterintuitive to the UK’s crypto vision. De-banking the industry could undermine the UK remaining an international hub for fintech,” she said.

In my view, the more pressing question is whether the banks – in their aversion to risk – are actually doing more of a disservice to British consumers.

The risk is that the business will only be carried out offshore, where it is more difficult to track down money or managers. As we have seen over the past year, companies in offshore jurisdictions can still fleece customers. FTX in the Bahamas and Terraform Labs in Singapore are good examples.

Banks already do KYC and anti-money laundering checks for crypto companies in the UK. The authorities in the UK have not been explicit at all about the risks to banks of accepting crypto business, unlike in the US. So what has changed?

“It is a moral hazard. It is not good consumer protection, said an industry professional working in London. “The banks do not accept that they play an important role in protecting people from fraud.”

But asking banks to embrace crypto is still a tough sell. A bank’s choice of its customer is a decision taken by a private, commercially run company.

“My concern is that over time the hyperbole will be negative for crypto because it makes the industry look a bit like it’s throwing its toys out of the pram,” said one person who works in London’s crypto scene.

CryptoUK does not help itself when its members generate their own regulatory controversies. A good example is Binance, which the Financial Conduct Authority decided was unable to be effectively regulated after the exchange failed to provide the agency with basic information.

CryptoUK said it “proactively engages” with its members when negative feedback from regulators is received, and will leave a member if issues “remain unresolved.”

However, a person familiar with Westminster’s approach to digital assets told me recently that the government was not keen to be first on digital assets, nor swayed by any first mover advantage.

Let someone make the mistakes first and then pick up the pieces, they said. So no matter how many turn up to do battle in the crypto corner of the halls of Westminster, it may all fall on deaf ears.

What’s your take on the UK’s crypto tug-of-war? Send me an email at [email protected].

Weekly Highlights: America’s Attack on Crypto

-

Authorities in Montenegro arrested Do Kwon, co-founder and CEO of Terraform Labs, the company behind the terraUSD and luna tokens whose collapse triggered last year’s epic crypto market crash. The country’s interior ministry said Kwon was arrested for using a forged passport from Costa Rica on his way to Dubai. To top it off, Kwon was subsequently indicted on criminal charges in the United States late Thursday. Read my story – along with colleagues Marton Dunai and Joe Miller – here.

-

The Securities and Exchange Commission sued crypto entrepreneur Justin Sun, whose companies include Tron and BitTorrent, as well as a number of celebrities for falsely naming crypto tokens.

-

The White House also cracked down on crypto. In an annual financial report, it said that “crypto-assets do not currently offer widespread economic benefits” and that much of the crypto activity was covered by existing regulations.

-

SushiSwap, a decentralized finance project, says it has been subpoenaed by the SEC. A post on social media this week wants to establish a defense fund to pay legal fees.

Soundbite of the week: Coinbase vs SEC

It was not a good week for Coinbase. The Securities and Exchange Commission told the Nasdaq-listed crypto exchange that it is considering a potential enforcement action over possible violations of securities laws. Coinbase said it covered its staking products, where customers agree to unlock their tokens in other crypto projects, against a high return.

The stock fell 13 percent on Thursday. Check out my story with Stefania Palma here. That prompted a furious online pushback from the company, led by chief legal officer Paul Grewal. He said on Twitter:

“When Coinbase filed to go public in 2021, our S1 described our business in detail, including 57 references to efforts and details about our asset listing process. The SEC approved us to go public, knowing those details. Now they’ve changed their mind about what is allowed.”

One can sympathize to a certain extent; Coinbase has offered these products openly for years and has other SEC licenses.

But that SEC S1 ‘approval’ only applies to the accuracy of the disclosures. In the risk section of that filing, Coinbase warned of legal uncertainty surrounding several of its products. It even highlighted one in particular. “For example, there is regulatory uncertainty regarding the status of our betting activities under US federal securities laws,” it said.

Perhaps Coinbase’s management was surprised by the SEC’s move, but the lawyers who wrote the S1 couldn’t have been surprised.

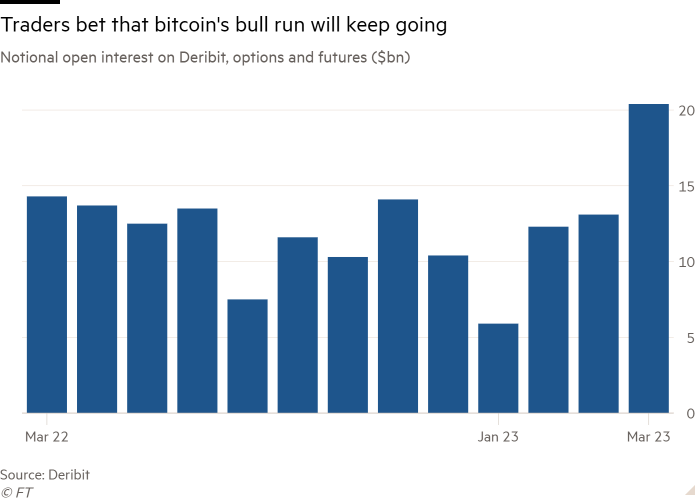

Data mining: Open interest on Deribit reaches all-time high

The world’s largest crypto options exchange is not Binance, but a little-known exchange called Deribit. You may recall Deribit helped push Three Arrows Capital into liquidation, claiming the hedge fund hadn’t repaid it $80 million.

According to data provided by the exchange, open interest on the platform has exceeded $20 billion this week for the first time. More than $18 billion in positions are options on bitcoin and Ethereum. Options give investors the right, but not the obligation, to buy the coins by a certain date in the future.

Most calls expire at the end of March, and most of these contracts have a strike price of $30,000. This suggests that crypto investors are optimistic, at least for the next week.

Cryptofinance is edited by Philip Stafford. Send any thoughts and feedback to [email protected].

Your comments are welcome.