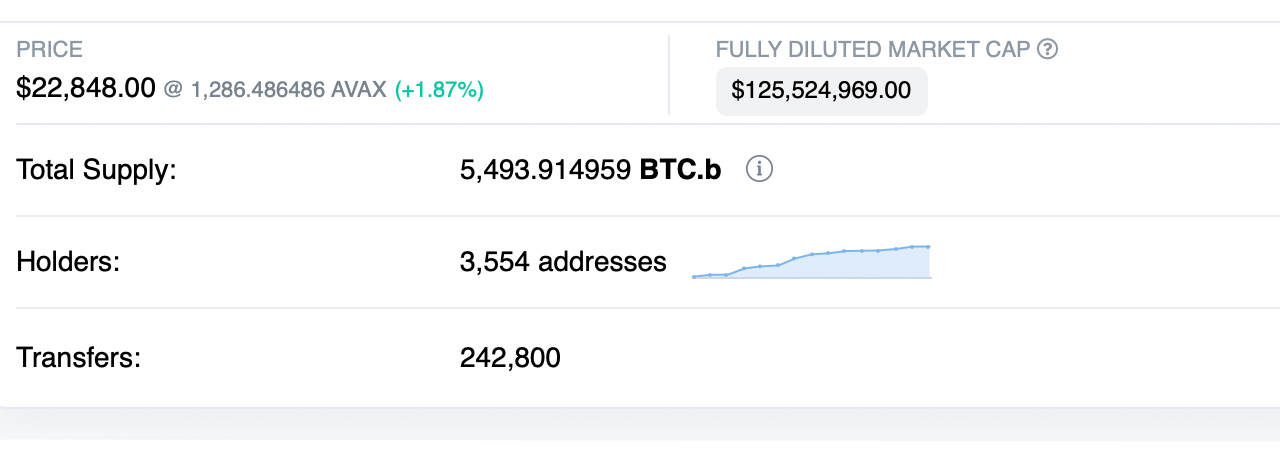

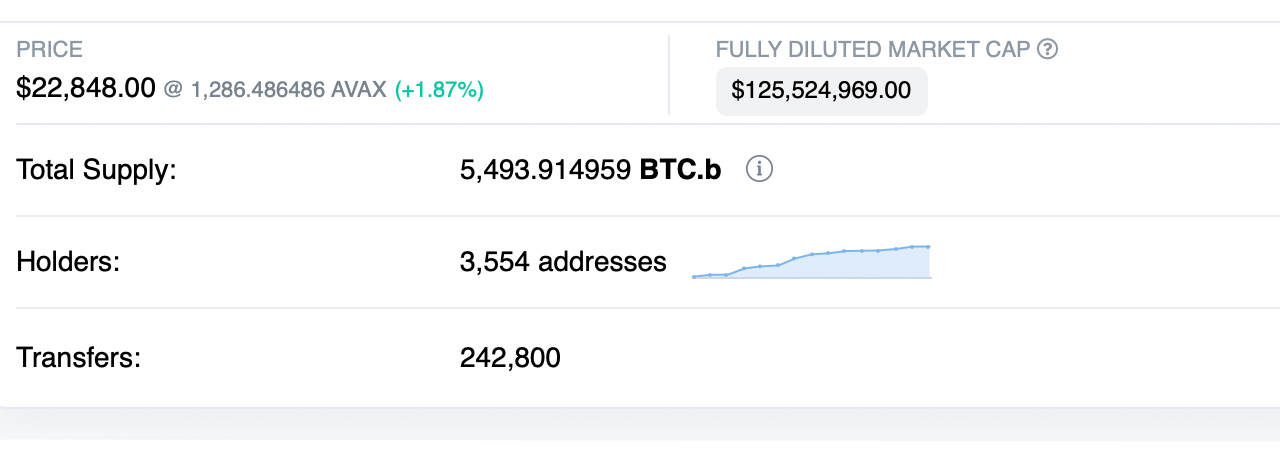

Members of the crypto community have discussed the number of bitcoins that have been wired over to the Avalanche network, which is now greater than the total value locked on the Lightning Network. At the time of writing, there are 5,493 bitcoins circulating on the Avalanche blockchain, while the Lightning Network has 5,248 bitcoins.

The number of Bitcoin bridged to Avalanche climbs past Lightning Network capacity

For the past week, digital currency advocates have been discussing the growing number of bitcoin (BTC) being connected to the Avalanche (AVAX) network. Seven days ago, the crypto asset known as BTCb saw its supply exceed the number of bitcoins locked on the Lightning Network (LN). The reason for the celebration is that it took much less time to beat LN’s total value locked (TVL) or capacity. At the time of writing, LN has about 5,248 bitcoin TVL, which is worth about $120 million using today’s BTC prices.

A week ago on January 16th, an Avalanche (AVAX) supporter known as “Ojrdev” tweeted about the number of bitcoins transferred to the AVAX chain. “The Avalanche have transferred more [bitcoin] (BTCb) than is locked in [the] Lightning Network,” Ojrdev tweeted. “The Avalanche consensus mechanism is also faster than Lightning.” Many other AVAX supporters agreed and celebrated the milestone. While LN currently has 5,248 BTC, the number of BTCb, according to snowtrace.io, is around 5,493 BTCb, worth $125.5 million using current BTC exchange rates.

In the same period, the largest number of tokenized bitcoin on any blockchain is the Wrapped Bitcoin project, which uses the Ethereum blockchain network. Currently, there are 179,697 WBTC in circulation, according to the WBTC dashboard. There is also a total of 52,888.86 BTCB hosted on the Binance Smart Chain (BSC). BSC’s cache of bitcoins is larger than that hosted on AVAX. However, the BTCb amount is greater than the 3,564 BTC locked on Blockstream’s Liquid Network, and also greater than the 3,496 RBTC on the RSK network.

The number of tokenized bitcoins on alternative blockchains, networks and sidechains has increased since 2017, but the pace accelerated when WBTC was launched in 2019. The main goal was to make finality faster and transaction costs cheaper. In 2020, however, fees on the Ethereum blockchain skyrocketed. In mid-May 2021, the average ETH fee was almost $40 per transaction.

As a result, tokenized bitcoins have moved to alternative blockchains in addition to LN and Ethereum. The rise of BTCb on AVAX suggests that many crypto followers find value in using a connected version of BTC on an alternative chain. Meanwhile, the large number of circulating WBTC hosted on the Ethereum blockchain has declined over the past 12 months.

Tags in this story

alternative blockchain, alternative blockchains, alternative chain, Avalanche, Avalanche Blockchain, Avalanche Network, AVAX, Binance Smart Chain, Bitcoin, Blockstream, BSC, BTC, BTCB, capacity, circulating, consensus mechanism, Crypto Supporters, Ethereum, Ethereum blockchain, Fees, finality, lightning network, floating network, ln, network, Ojrdev, Peg, RSK network, sidechains, snowtrace.io, tokenized bitcoin, tokenized bitcoins, transaction costs, TVL, WBTC, packaged bitcoin

What do you think about the emergence of BTCb on the Avalanche network? Share your thoughts and opinions in the comments below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.