BRC-20 and Bitcoin NFTs – A New Era for Bitcoin?

- NFTs imprint on BTC!

- Over half a million BTC transactions are getting stuck and unconfirmed!

- Txn fees go up over $40!

- People in El Salvador and Africa cannot buy their daily bread!

- BSV price +30%

- BTC core developers trying to figure out how to censor certain txns from the ‘uncensorable’ blockchain!—All transactions are equal, they say, but some transactions are more equal than others1it seems.

- The “big block” narrative, dormant since 2017, appears to be experiencing a revival

Boy, it’s been a busy week in Bitcoin, and yes, all of the above happened within days.

How? Why?

How: Thanks to Taproot changes deployed last November, it is possible to embed more than the standard 80 bytes of data per txn into the BTC blockchain (which has been hotly debated in the BTC developer community as recently as February this year, while others Bitcoin theirs2 has supported since 2017). Some smart people figured out how to wrap encoded data into txn and created the Ordinals project, which outlines the process by which you can create NFTs on the BTC blockchain. Almost overnight, the BTC network exploded with activity, and given that BTC had bet its scaling model on layer 2 solutions like the Lightning Network, network performance slowed to a halt, even forcing Binance to halt withdrawals of BTC.

This results in backups of txns making confirmations take longer and longer while the average fee rates climb higher and higher.

Why: All this is just because use of the Bitcoin network blown up. The supply of block space could not meet the sudden increase in demand, as fee rates reached an all-time high of $80 to process a Bitcoin transaction. BTC experienced its first block in its history where the total txn fees outweighed the total subsidy reward (6.25BTC). While BSV reached this milestone in 2021, BTC has never previously earned more in fees than the miner subsidy, which marked a new era in the financial regime of Bitcoin for miners.

Some people, like Michael Saylor, a well-known BTC investor, heralded the change.

Many others called this an “attack on the network”, and proposals came from core developers and small block advocates such as Luke Dashjr to ban the transactions outright. A group of anonymous people even took it upon themselves to create a censorship patch (cheekily called Ordisrespector) for BTC nodes, filtering out unwanted or landlord transactions unworthy is entered on the blockchain. Unfortunately, even while distributed by many home nodes, mining nodes simply ignored them and continued to add these transactions to the blocks that filled up the blockchain, resulting in long txn processing latency delays across the network.

Longtime core developer Andrew Poelstra lamented the issue, but apparently also classified the new use of BTC as “crap” and “toxic.”

Hypocrisy?

While people are entitled to their own opinions, I find it particularly striking that the same people who continually extol Bitcoin’s “censorship-proof” nature are the same people who are now trying to implement censorship themselves.

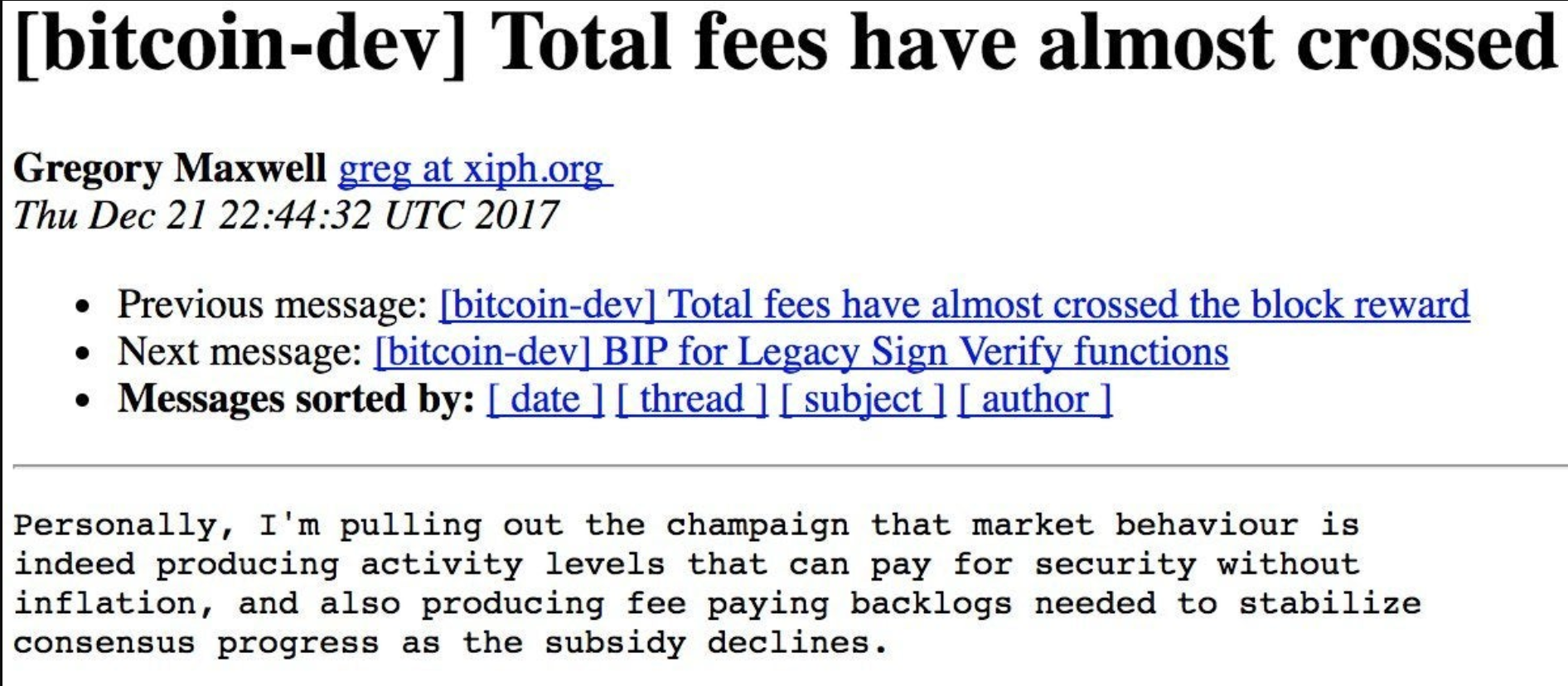

Even better, they seem to be prosecuting the new users of BTC for crimes they are guilty of – how does one decide if one type of use of the blockchain is permitted while another is prohibited? Remember that the users of the new ordinals technology to create NFTs are not breaking any consensus rules or doing anything illegal to the network. They even pay the higher fees in full just like everyone else. It is simply because of the large number of txns being created and the broken scaling model of BTC that as more people use the system, the more fees the average user has to pay. This is the highly sought after “fee market” that Greg Maxwell was famously quoted for3 when describing the perfect state of the BTC system.

So if fee-paying users want to enter data into the chain, using technology that allows them to do so, regardless of what we think of the nature of the data they enter, who are we to judge what is appropriate or inappropriate? If people started adopting BTC en masse next month, in a year or five years, will we have to look to these “gurus” to tell us if the use of the network was “blessed”? Or an attack that should be censored?—This decentralized dream is starting to look like a nightmare.

Time will tell how this unfolds, but for the first time two power blocs have been pitted against each other in BTC, the miners and investors (the rich) vs. the network users (the poor). And amidst all this are countless accounts of people in El Salvador, where the average daily wage is $50. People are forced to pay $20 in fees just to withdraw their $50 of bitcoin. What can be done to help them? This topic has apparently divided the BTC supporters into two camps. Those who want the network to be usable and affordable for everyone, and those who say that “Bitcoin is not for people who make less than $2 a day4“. The difference between 2017 and now is that back then not many people have been promoting Bitcoin in developing countries like El Salvador and Kenya. Bitcoin was still just a toy for the first world. But now it seems that after having sold its history to so many of the lower classes, BTC experts will be forced to deliver on the promise of BTC being used as digital cash.

Shouldn’t Lightning Networks fix scaling?

Well, it was marketed as the ‘scaling solution’5‘ for BTC, but after eight years of always being “18 months away” from being done, it still only handles a tiny fraction of the amount of BTC in circulation. The reason is that there is a massive barrier for entering and exiting the platform. To use LN you must first lock your BTC to channels6, which are shared accounts between others who lend you liquidity. Normally you connect to large hubs with many other channels7 to other people so you can forward payments between hops until you hopefully pay the intended party you want to pay. The problem is that if the person you want to pay is not connected directly or indirectly to you, or the channels connecting you do not have enough liquidity, you have to open a new channel directly with them. Every time a channel opens, you have to make a real BTC transaction, which means waiting 10 minutes and paying normal BTC network fee.

Similarly, every time you want to withdraw money from LN (sometimes heavily if your counterparty is trying to steal from your channel), you must also publish a real BTC transaction.

Do you find the problem? When the real BTC network is congested, the open/close channel txns are backed up and the LN network liquidity channels are effectively frozen, unable to change or assign themselves. You can only pay the person you already have a connection with, and then only up to the amount you have left in the channels. If this sounds horribly complex and a nightmare of a system to try to manage and use… you’re not alone. Researchers from the University of Illinois have formally documented the failures of LN, which only worsen when the underlying network is overloaded. This appears to be why, even after years of publication, it has seen only lukewarm adoption by the non-lawyer public.

The irony is that this rush to use NFT coining on BTC is driven by greed. Standard greed for all players in ICOs or NFTs or DeFi. The rush to try to grab “rare digital assets” and get in before everyone else so you can flip them quickly for profit or buy and hold them for the long term and wait for appreciation like a store of value. Sounds familiar? This is exactly what the staunch BTC supporters have always advocated. But as soon as the speculation and focus is on something other than “BTC”, even if it uses the same BTC blockchain, they won’t stand for it. It’s toxic data, a DDoS attack. This is a sign of either a serious lack of understanding or self-awareness.

Maybe both.

Will update more as this story unfolds.

Jerry Chan

WallStreet technologist

***

NOTES:

[1] —Samson Mow mocks poor people for being too poor to use bitcoin.

[2] As much as walking is a scaling solution to not having a car.

[3] If this sounds a lot like an attached sidechain to you… you’re not alone. But it is best to keep quiet; otherwise you will be beaten by the LN fanatics.

[4] If this sounds a lot like a bank to you… you’re not alone. But shhh, don’t tell anyone.

[5] Yes, this is a quote from Marxist Leninist Communism.

[6] BSV and BCH have embedded full images in TXNS since 2019.

[7] and he famously put champagne on the roof of the Blockstream offices when fees rose above $50 in 2017.

New to Bitcoin? Check out CoinGeeks Bitcoin for beginners section, the ultimate resource guide for learning more about Bitcoin – originally envisioned by Satoshi Nakamoto – and blockchain.