‘Blur’ pushes NFT volumes, but is wash trading involved?

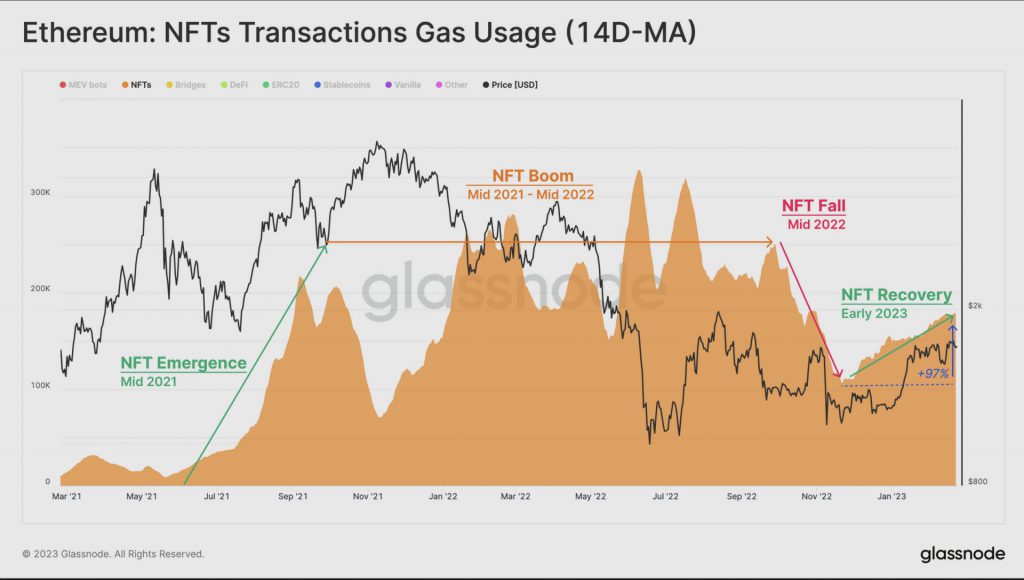

The NFT (Non-fungible Token) markets are seeing renewed interest from users. Towards the end of 2022, the space witnessed a significant decline in user activity. Now, according to Glassnode, NFT transactions have increased their overall gas consumption by 97% in the last two months. Activity levels reach those during the boom in the non-fungible area.

The introduction of new collections by some of the biggest competitors has been credited for the renewed interest. Nevertheless, the events surrounding the Blur Airdrop are primarily responsible for the increase in gas demand over the past two weeks.

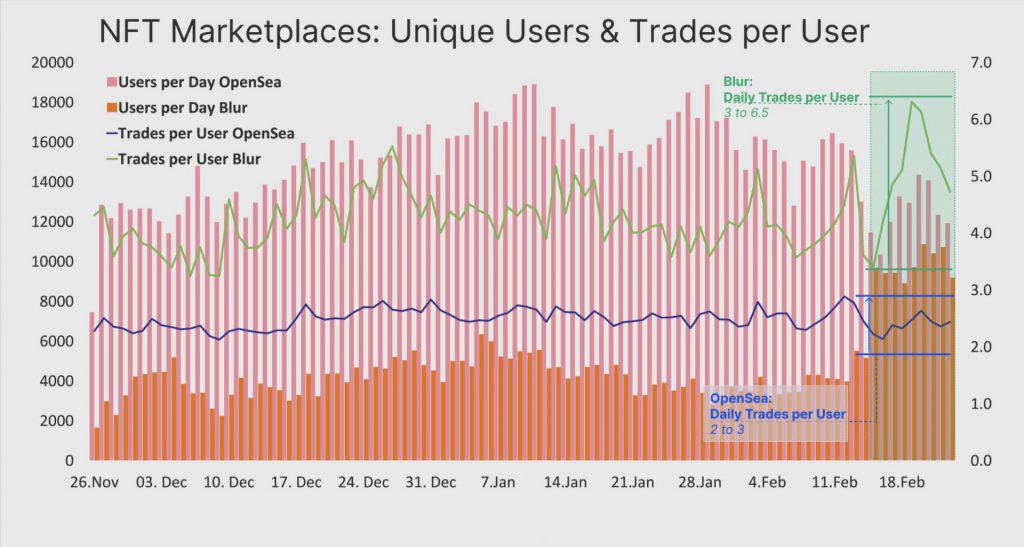

Following the February 14 airdrop, Blur took over OpenSea and now controls 78% of NFT transfer volume. Despite the token’s recent 13% decline in value, the airdrop renewed interest in the upstart contender. Blur’s market share increased by 34%, cutting OpenSea’s share by more than half, from 36% to 15%. OpenSea restructured its pricing model and policy to compete with its new opponent. However, it has not been able to retain its market share.

With 4 to 5 trades per user per day, Blur is clearly in the lead. On the other hand, OpenSea only averages two trades per user per day.

However, the recent interest in NFTs seems to appeal to current users and is not doing anything to draw new users to the Ethereum network just yet. However, Dune offers some arguments to the contrary, which we will look at in more detail in the next section.

Is laundry trading the reason behind the NFT peak?

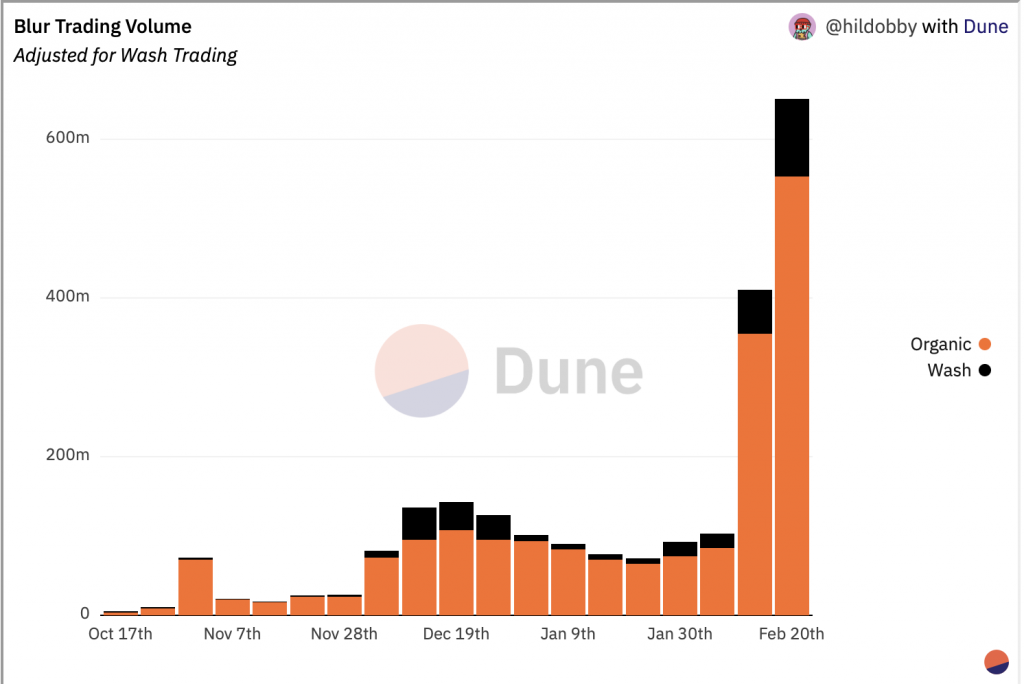

According to CryptoSlam, at least $577 million in laundered NFTs related to Blur have been discovered. According to Scott Hawkins, a data engineer at CryptoSlam, the laundered trades follow suspicious patterns such as NFT resales that happen quickly at values close to the assets’ initial transactions. Some Blur users may have bought NFTs from themselves and sold them to themselves to buy Blur tokens (BLUR) and earn airdrop points.

However, a member of the Dune community has pointed out some reasons why Blur’s volumes are legal. First, only 11% of trade volume was detected as wash trades.

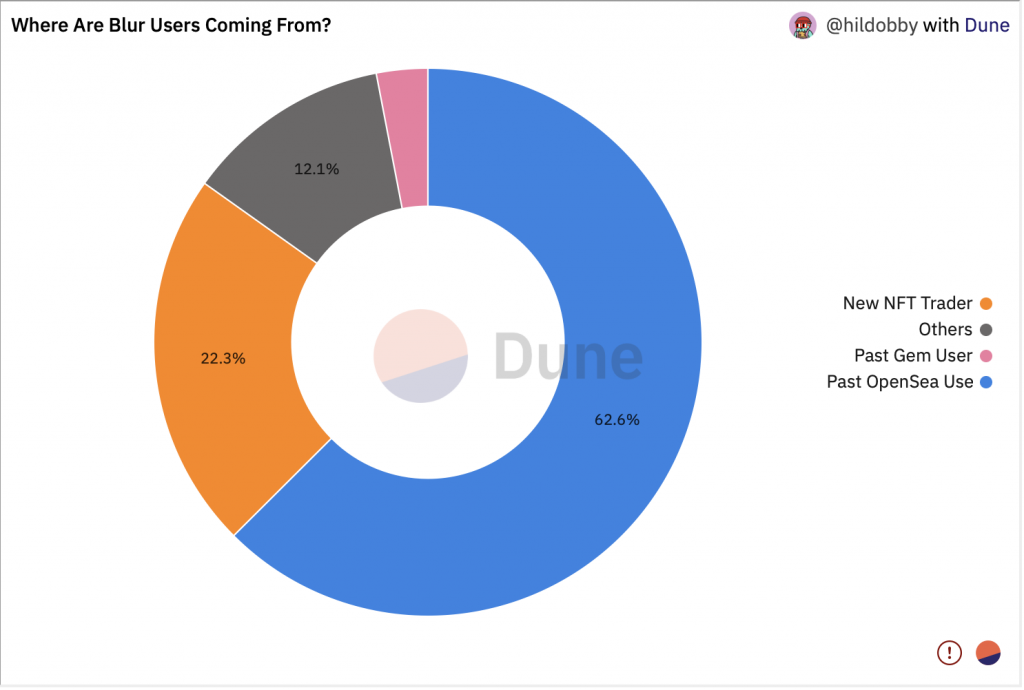

Second, the analyst examined the source of the users. 62.9% of users have come from OpenSea, while 3% are from Gem. Also, 22.3% were new traders, contrary to Glassnode’s analysis.

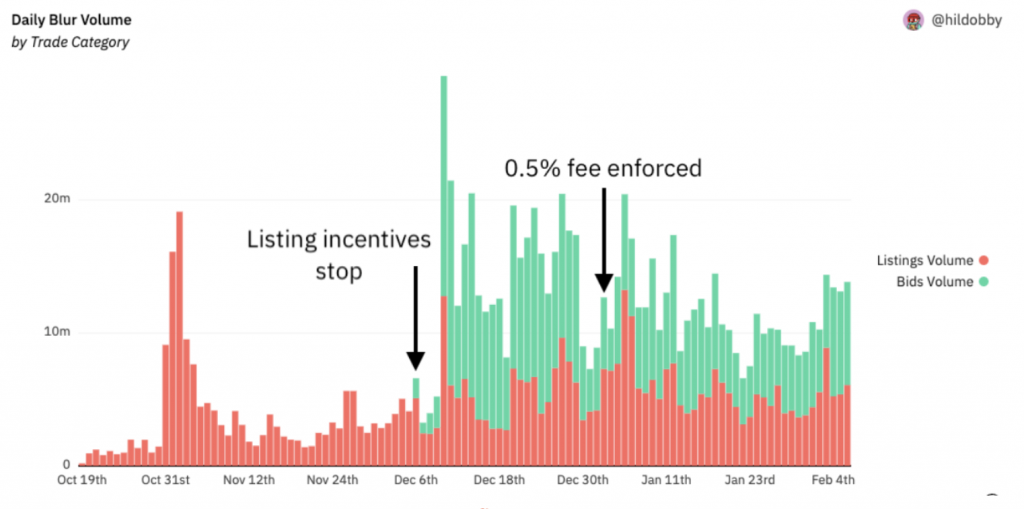

Third, the analyst points out that volume is holding even after incentives have stopped, which is a good sign for organic activity.

And finally, compared to Blur, the hourly volume on LooksRare and X2Y2 tells a different story. Huge occasional spikes coexist with hours of no volume in these two wash ports. Blur, on the other hand, has an hourly volume consistent with a healthy routine of natural activity and a wide range of users.

Based on both analyses, we can agree that Blur can bring bank rates to the NFT market. The space is in dire need of some awakening, and Blur might just be the spark that brings it back to life.