Blur overtook OpenSea to gain 82% of NFT trading volume

Blur is the latest newcomer to the Non-Fungible Token marketplace and has quickly become one of the best platforms for trading NFTs.

A week after NFT Marketplace rejected the fees collected on trades, Blur, its upstart rival, hasn’t missed a beat. According to the news source, the four-month-old NFT Marketplace has captured 82% of the trading volume on the Ethereum Blockchain compared to last week.

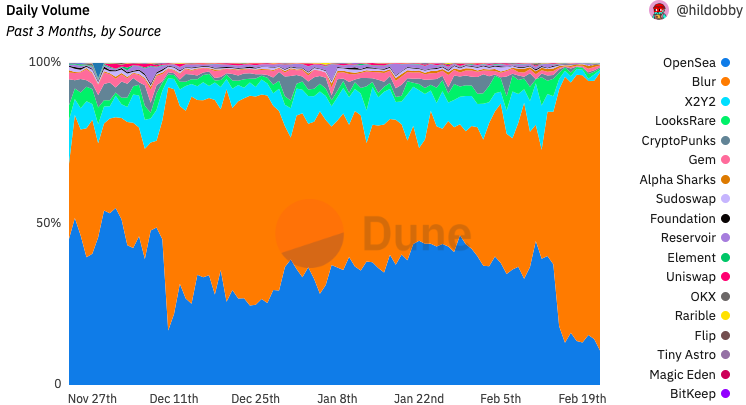

The data below shows how Blur rules the NFT marketplace after an airdrop.

As reported, Blur went into overdrive after the project, which airdropped 12% of its blur tokens on the NFT marketplace on February 14th. Blur accounts for more than 70% of daily NFT trading volume on Ethereum every day, which since the airdrop, Opensea has been motivated to cut fees.

What attracts more investors to Blur is that it has no marketplace fees and optional creator royalty fees. This step will allow users to earn more money since the platform does not charge any marketplace fees.

Reportedly, Blur also has its own Token. This is correct; it eventually launched its long-awaited token, $BLUR, and airdropped $400 million worth of tokens priced for early adopters of the marketplace.

According to the official website of Blur, 360,000,000 BLUR tokens were distributed to the community in the first season, and season 2 has now started.

On February 23, 2023, the marketplace announced on Twitter that “300M+ BLUR will be distributed to the community in Season 2.” Blur also mentioned that the method to maximize the airdrop is through “loyalty”, which can be proven if users show their NFTs, especially on Blur for sale.

Blur also revealed 3 ways to maximize loyalty in a long Twitter thread.

Meanwhile, Blur commented, “The majority of BLUR will be distributed to community members who contribute to the protocol’s success, and loyalty is one of the best ways to do that no matter how much listing and bidding you do!”

Kofi, a contributor to Defilama, mentioned on Twitter, “Marketplaces are killing their profits, long-term relationships with creators, and future growth prospects to compete for ~500 professional traders.” Kofi also claimed that Blur got 53% of the volume from 500 wallets.

Blur performance was better compared to OpenSea in terms of volume since December last year, but in recent days the NFT platform has increased its lead in comparable volumes and left OpenSea in the number of users for the first time. Probably, user numbers on Blur are more important than lead volume, as it could be that pro-traders on Blur were engaged in wash trading to increase the allocation of token airdrops, resulting in false volumes.

According to reports, Blur has overtaken OpenSea to gain a 45% user market share compared to OpenSea’s 43% and an 85% market share in trade volume compared to OpenSea’s 10%.