Bloomberg analysts say that Bitcoin’s risk-to-reward will swing bullish for the second half of 2022

Bloomberg’s leading commodity strategist says the second half of this year may be Bitcoins (BTC) time to shine, after nearly eight months of bearish price movement.

Analyst Mike McGlone says his 47,000 Twitter followers that Bloomberg’s Galaxy Crypto Index, which follows a basket of the largest cryptocurrencies to track the market’s overall performance, reflects the behavior from the bottom of the bear market in 2018.

“With the Bloomberg Galaxy Crypto Index approaching a similar decline as the 2018 bottom and Bitcoin’s discount to its 50- and 100-week moving averages similar to previous foundations, the risk vs. reward of responsive investors in 2H is tilting.”

McGlone compares the current state of the crypto market to the internet bubble of the early 2000s. According to the analyst, a similar cycle is taking place where overvalued projects are cleaned out of space before the market turns the course of a long-term upward trend.

«Mid-year prospects [on] crypto assets – A common theme in crypto is to embrace the bear and build a better financial system, especially from the institutional and long-term focus, similar to 2000-02’s bursting internet bubble. Clearing out the profits was the state of all risk assets in 1H. “

While many cryptocurrencies fear the Federal Reserve for its potential to burden digital assets with hawkish monetary policy, McGlone says that from now on, the Fed may end up having to turn around in the face of a struggling stock market.

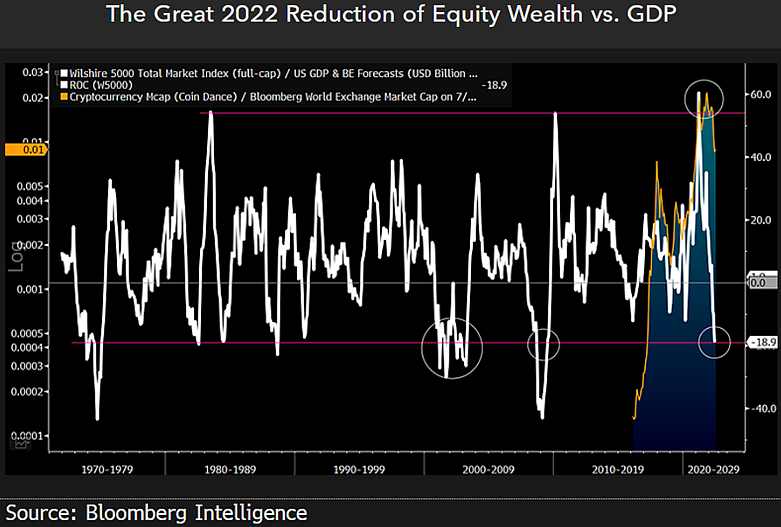

He shares a chart from Bloomberg that shows the S&P 500 potentially in a place where reversals have historically taken place.

“Breathing for the battered US stock market can be just a few political meetings from the Federal Reserve.”

Check price action

Don’t miss a beat – Subscribe to have crypto email alerts delivered directly to your inbox

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed by The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment adviser. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock / Nuth Vanglath / Melkor3D