Blockchain in Agriculture and Food Supply Chain Market to Reach Over USD 5059.78 Million by Year 2030

Blockchain in agriculture and food supply chain Markedsinfo

Blockchain in agriculture and food supply chain Markedseg

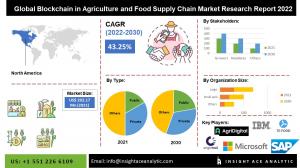

Global blockchain market in agriculture and food supply chain is estimated to reach over USD 5059.78 million by 2030, showing a CAGR of 43.25%

— Insightace Analytic

NEW JERSEY, NJ, USA, November 11, 2022 /EINPresswire.com/ — Insight Analytics Pvt. Ltd. announces the release of a market assessment report on “Global Blockchain in Agriculture and Food Supply Chain Market (by Type (Public, Private and Hybrid/Consortium), Applications (Product Traceability, Tracking and Visibility, Payment and Settlement, Smart Contract and Governance, Risk- and compliance management), organization size (SMEs and large enterprises), stakeholders (growers, food producers/processors and retailers) and supplier (application solution providers, middleware suppliers and infrastructure) Suppliers) – Market Outlook and Industry Analysis 2030”

The global blockchain in agriculture and food supply chain market is estimated to reach over USD 5059.78 million by 2030, showing a CAGR of 43.25% during the forecast period.

Request a sample:

The blockchain in the agricultural and food supply chain required a lot of erratic bureaucracy and reliance on paper-based record-keeping. Land records and other data can be securely stored on a blockchain using a structured blockchain platform, thus protecting them from natural disasters. Blockchain technology will revolutionize as it provides accurate, tamper-proof statistics on farms, storage, creditworthiness and food traceability. The rate of growth in agriculture and food supply chains has reached new heights due to the increasing use of new technologies, supply chain transparency and efforts to eliminate food production fraud. The growing adoption of blockchain technology in the agriculture industry is expected to boost market expansion due to the growing concern about food wastage. Increasing customer concerns about food safety due to the COVID-19 pandemic is fueling a desire for transparency in the supply chain, which is expected to drive the agriculture and food supply chain market throughout the forecast period. The need for blockchain in agriculture and the food supply chain will expand due to increasing demand for agricultural products and producers adopting smart agricultural practices. Furthermore, during the forecast period, openings for the market are expected to be caused by federal programs to adopt modern methods in agriculture, the increasing attractiveness of blockchain among merchants, and increased financing and development in agriculture and food blockchain.

Prominent players in the blockchain in the agriculture and food supply chain market:

IBM

Microsoft

Arc-Net

Ambrose

Sap See

Path of origin

Provenance

Agridigital

Abaco Group

Scratch.Io

Vechain

Chainvine

Agrichain

Skuchain

Bext360

Fce Group Ag

Coin 22

Tea-Food International Gmbh

Modum.Io Ag

Viveat

Eharvesthub Inc.

Grain chain

Cargo chain

Farm2kitchen Foods Pvt. Ltd.

Genuine

Agri 10x

Market dynamics:

drivers-

The blockchain sector is predicted to expand as the demand for supply chain transparency increases. Another factor expected to contribute to the market’s expansion is the growing use of blockchain technology in agriculture and food supply chain analytics to increase supply chain transparency and reduce food production fraud. A core component expected to drive the market’s expansion is the growing use of cutting-edge technologies such as blockchain and analytics that enhance agribusiness companies’ decision-making capabilities. Another factor that is expected to drive the market growth is the predicted increase in the use of blockchain technology in the agriculture sector due to growing concerns about food wastage.

Challenges:

Blockchain in agriculture and the food supply chain is expected to face challenges during the forecast period, including regulatory ambiguity, lack of industry standards, and poor data management among growers. A limited technological base will hinder the market’s expansion, especially in developing countries. Lack of qualified personnel or qualified expertise will also greatly hamper market expansion.

Regional trends:

The North American blockchain in agriculture and food supply chain is expected to register a large market share in revenue and is expected to grow at a high CAGR soon. Due to legislative efforts to invest in new and sophisticated technologies, technologically advanced adoption, favorable government and infrastructure, the existence of companies offering blockchain technology solutions, such as Microsoft and IBM, and retailers’ knowledge of the possibilities of blockchain technology.

Moreover, Europe held a significant share in the agriculture and food supply chain market due to its developed economy and increasing production adoption. This can be attributed to increasing expenditure in programs dealing with transactions and increasing consumption of goods from livestock.

Inquiry before purchase:

Recent developments:

• In June 2020, a new cross-industry partnership was announced between IBM and Sjmatbedriftene, Norwegian Seafood Association, to use blockchain technology and share supply chain data throughout Norway’s seafood industry to provide consumers worldwide with safer, better seafood. A high-quality, fully tradable product would be made possible with blockchain technology.

• In April 2020: A partnership between Nestle and IBM will allow Nestle to use the IBM Food Trust enterprise blockchain to trace the origin of its Zoaeas coffee brand. By scanning the QR code on Zoaea’s coffee, customers can find out where their coffee beans came from. Information about farmers, harvest dates, transaction certificates for individual shipments and roasting times will all be tracked via the IBM Food Trust enterprise blockchain.

Segmentation of Blockchain in the Agriculture and Food Supply Chain Market

By type:

• Public

• Private

• Hybrid/consortium

By stakeholders:

• Growers

• Food producers/processors

• Retailers

By suppliers:

• Application providers

• Middleware providers

• Infrastructure providers

By organization size:

• Small and medium-sized enterprises

• Large companies

After application:

• Product traceability, tracking and visibility

• Payment and settlement

• Smart contract

• Governance, risk and compliance management

By region

North America-

• United States

• Canada

• Mexico

Europe-

• Germany

• Great Britain

• France

• Italy

• Spain

• The rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• The rest of Latin America

Middle East and Africa

• GCC countries

• South Africa

• The rest of the Middle East and Africa

For customization: https://www.insightaceanalytic.com/customisation/1436

Priyanka Tilekar

Insightace Analytic Pvt. Ltd.

+1 551-226-6109

send us an email here

![]()