Blockchain Games surpassed DeFi in weekly number of UAWs

Blockchain games continued to make headlines while the decentralized finance (DeFi) space struggled in 2022. Even the start of 2023 is the same. But the question arises: can the hype and traction continue?

Blockchain games are an innovation in the genre of video games. These differ from traditional video games by allowing players to convert points into real money.

The ecosystem also rewards players for the time they spend playing the game. These games are gaining immense popularity in the developing world, playing into larger conversations about what the metaverse is, what the crypto market looks like, and what it does for people, especially financially vulnerable people.

The business model of the blockchain gaming spectrum really stands out. This was one of the reasons why it has consistently performed well over the years. Especially when talking about blockchain industry activity and the mass adoption rate of blockchain gaming. Both can be zoomed in on by looking at the UAWs, or unique active wallets.

DeFi Space lost in 2022

Last year saw many twists and turns for the cryptocurrency and blockchain industry. The collapse of established multi-million dollar firms created a ripple effect across the board. Despite the losses, the decentralized application space saw some positives, thanks to the blockchain gaming industry.

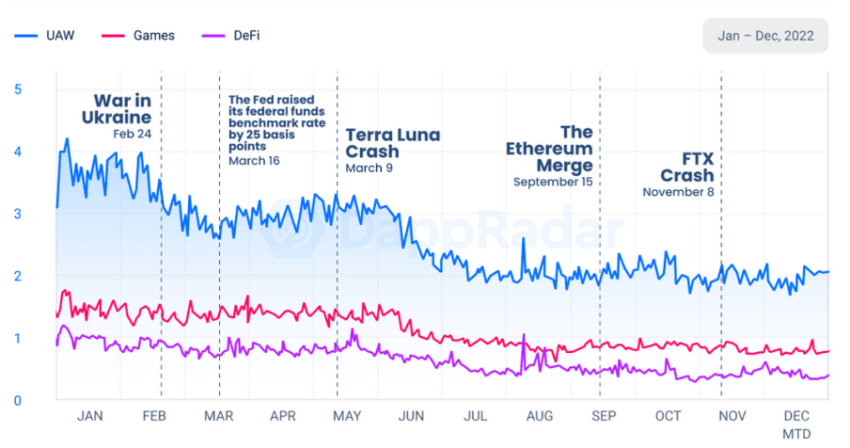

DappRadar’s annual report for 2022 paints an exciting picture.

As seen above, the decentralized finance space was significantly affected by the collapse of institutions such as Terra’s stablecoin debacle and the FTX debacle. The fall in TVL, or the total value locked, amounted to $40 billion at the time of writing. By comparison, TVL at the start of 2022 was around 150 billion dollars, according to data from DefiLlama.

This is evident in the diagram below.

A DappRadar executive told BeInCrypto in early 2022 that 80% of DeFi apps could disappear if the bear market continues for one year. A significant proportion of the participants saw the exit gate.

The Rise of Blockchain Games

While this was the case for DeFi, the blockchain gaming space hasn’t deviated much from its path, accounting for an average of 1.15 million daily UAW.

“While [decentralized finance] and overall blockchain activity has been on the downside, the Unique Active Wallets (UAW) game continues to rise, reaching nearly 1 million daily wallets,” Pedro Herrera, DappRadar’s head of research, told BeInCrypto in an email.

Indeed, this is the case even at the beginning of 2022, as GameFi remained the dominant niche in the blockchain industry, accounting for over 50% of the activity in the space. Polygon, Harmony’s DeFi Kingdom, Axie Infinity and Splinterlands were some of the top protocols in the sector.

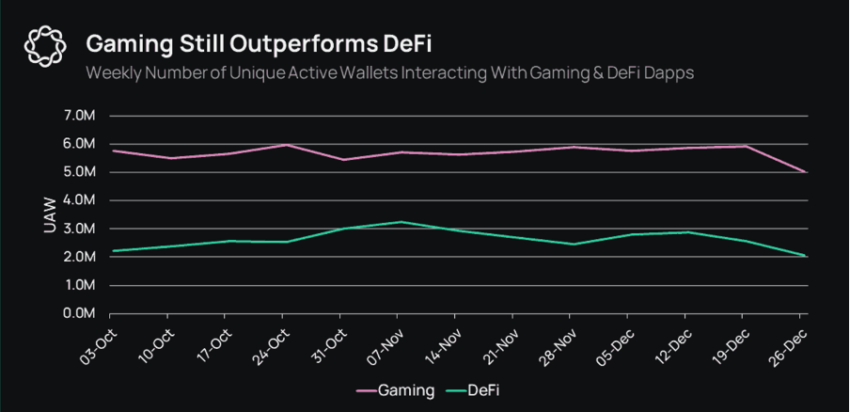

Even at the time of writing, the difference is still significant between the gaming sector and DeFi. Delphi Digital, a crypto research firm, compiled the latest statistics to highlight the above narrative.

“Gaming has over 2x the unique active wallets than Defi,” the executive stated.

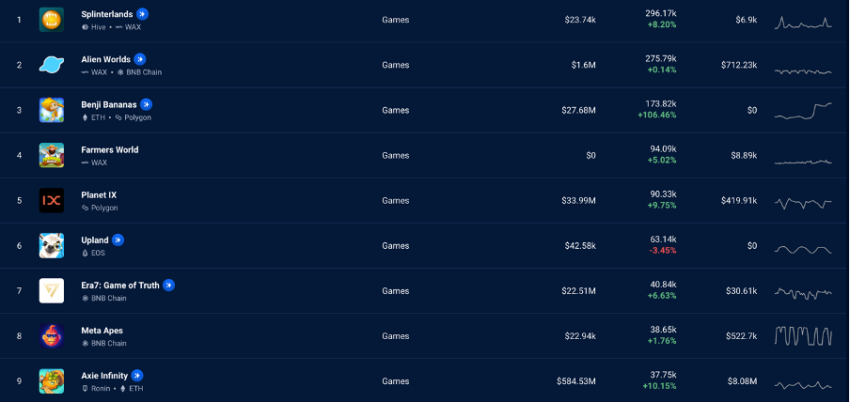

Meanwhile, in terms of the top games that made it to the top of the blockchain games list, Splinterlands was number one, registering around 300,000 UAWs over a week. Other big names in the same period were as follows:

And UAWs connected to gaming surpassed those connected to DeFi in 2021, accounting for 49% of blockchain industry usage.

The unprecedented rise created many headlines. But the question remains, can the hype continue in 2023?

Matters of concern

Opponents of blockchain games, mainly the veterans of the traditional gaming industry, believe these games could permanently damage the gaming industry. While proponents of blockchain games suggest that NFTs allow players to own objects beyond the individual games, even if the games cease to exist, these assets can be moved and used in other games.

Traditional game designers argue that while this concept seems promising in theory, in practice this is not a plausible use case since each game has its own environment, story and ecosystem. Thus, these assets from other games become meaningless in foreign territories. Even if blockchain game developers could build a cooperative ecosystem, a foreign object comes with the risk of errors that could destroy the host ecosystem.

Another area for improvement is accountability for profits. Game companies build games to make money. With assets moving from the games to an external public ledger, it becomes challenging for companies to keep track of their finances.

A player can earn thousands of dollars worth of assets in game A, move to game B, and start selling those assets to players in game B, possibly at lower prices than the game owners. In doing so, Game B’s undercut developers, leading to a price war that the gaming industry would never accept.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.