As the fiscal year draws to a close, individuals who have made crypto donations may be curious about the tax deductibility of their contributions. The good news is that the Australian Taxation Office (ATO) acknowledges giving or donating a crypto-asset to an equity gift recipient (DGR) as an allowable deduction. However, it is crucial for taxpayers to understand the relevant conditions required to access this deduction.

In this article we will outline these conditions.

What can you claim?

In Australia, crypto assets such as cryptocurrencies or non-fungible tokens (NFTs) are considered property for tax purposes. Unlike gifts of money, which can be claimed as a deduction if donations exceed $2, different rules apply to gifts of property. To qualify for a deduction, the crypto asset must meet one of the following conditions:

- The asset was purchased within 12 months prior to the donation, regardless of value.

- The asset is valued by the ATO at more than $5,000.

For taxpayers wishing to donate less than $5,000 in assets acquired more than 12 months ago, it is advisable to convert the asset into Australian dollars and donate the equivalent amount. If the converted value is over $2, the donation will be eligible for a deduction. However, it is important to note that the conversion of the crypto asset to fiat currency and then to AUD is likely to have tax implications. Direct donations or assets therefore tend to be more effective.

Donations must be made to a DGR

The basic aspect leading to deductibility of donations is that they must be given to DGRs or approved charities. Donations to social media or crowdfunding platforms will not qualify for deduction unless the recipient of the donation has DGR status. To confirm an organization’s status, you can search for its name or Australian Business Number (ABN) in the Australian Business Register (ABR). For example, a search of UNICEF Limited shows its DGR status (as of the date of this article), making donations to it tax-deductible if they meet the above requirements.

DGR must be able to accept donations

As the popularity of cryptocurrencies continues to rise, so does their use in charitable giving. Many organizations including Variety accept crypto donations and use sites like The Giving Block to facilitate donations from Australians.

Calculate your deduction

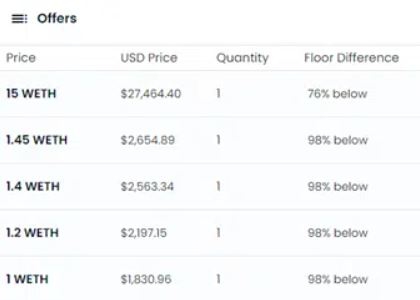

Complexities arise in the crypto space due to price volatility of some assets and limited valuation expertise. It is important to note that taking offer prices is not necessarily an accurate indication of the property’s value. For example, Wrapped CryptoPunk W#1043 recently received a significant selection of offers on Opensea.

To determine the deduction you can claim, you must convert the value of the crypto asset at the time of the donation to Australian dollars. If you estimate that the valuation will be greater than $5,000, it will be necessary to obtain a valuation from the ATO. Taxpayers who donate assets acquired within the last 12 months may consider using the purchase value, but should objectively assess whether the amount may be inflated.

What can’t you claim?

There are several exceptions to what can be deducted. It is especially important that donations for which you receive a personal benefit cannot be deducted. For example, payments for lottery tickets are not eligible for deduction.

Keep detailed records

Taxpayers are required to keep records relating to their tax affairs that are sufficiently detailed and document transactions. In the event of an audit, these records will likely need to be presented to the ATO. To substantiate the value of donated cryptoassets, you should keep detailed records that may include:

- the date you acquired the crypto-asset and relevant exchange details (if one was used);

- the value of the asset (in AUD) on the date of purchase and subsequent donation;

- transaction receipts or wallet or stock exchange statements showing the transfer are useful to show that you incurred the costs and owned the asset donated;

- receipts from DGRs clearly stating their name, ABN (if they have one) and the details of the gift; and

- other documents that show both your ownership and your donation.

We recommend using a spreadsheet that includes the date of the donation, summary of the transaction (eg donated 1 BTC to UNICEF) and the market value of the token on that date (eg 1 BTC = $40,000 AUD).

Foreign donations

You can claim deductions for donations to foreign organizations provided that these organizations have DGR status.