Block: Fintech Powerhouse Wipes Out Q3 Earnings (NYSE:SQ)

B4LLS

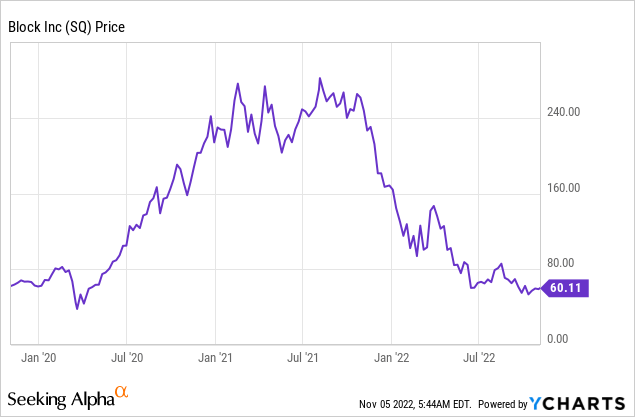

Block (NYSE:SQ) formerly known as Square is a fintech powerhouse that has an ecosystem of financial products. Founded by the legendary Jack Dorsey (who also founded Twitter), Block has grown its popular Cash App rapidly. In the third quarter of 2022, the company beat top and bottom line growth estimates. This despite macroeconomic headwinds and a decline in Bitcoin revenues. The stock price is down ~77% from all-time highs, and so in this post I’ll break down the Q3 earnings in detail, before revealing the valuation, let’s dive in.

Strong third quarter

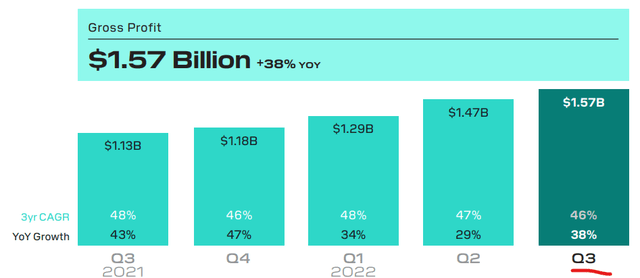

Block generated strong financial results for the third quarter of 2022. Revenue was $4.52 billion, up 18% year-over-year, beating analysts’ expectations by $47 million. As mentioned in previous posts on Block, Bitcoin trading accounts for ~40% of total revenue and therefore the decline in price and popularity has affected the results. Excluding Bitcoin, total net income was $2.75 billion, a brisk 36% year-over-year increase. Therefore, it is clear to see that Block’s core business is growing strongly. It should also be noted that Bitcoin trading has never been a major profit driver for the company and was the low margin part of the business. The company generated gross profit of $1.57 billion in the third quarter of 2022, which increased by a rapid 38% year-over-year. Block has two main ecosystems, “Cash App” and “Square”, these are connected by Buy Now, Pay Later [BNPL] supplier Afterpay which was acquired at the end of 2021. I will now dive into each of the “ecosystems” in turn and the central economic drivers.

Gross profit (Q3 Earnings Report)

Cash app ecosystem

The Cash app is a mobile application that enables consumers to make simple peer-to-peer payments with the iconic “cash tag” derived from the “hashtag” commonly used in social media. However, the application has expanded to include Bitcoin trading, stock trading and more. As Block says, the app is the “easy way to send, spend, bank and invest”. In the third quarter of 2022, the application generated $2.68 billion in revenue, up 12% year-over-year. Excluding Bitcoin and the BNPL platform, Cash App revenue was $817 million, a brisk 41% year-over-year increase.

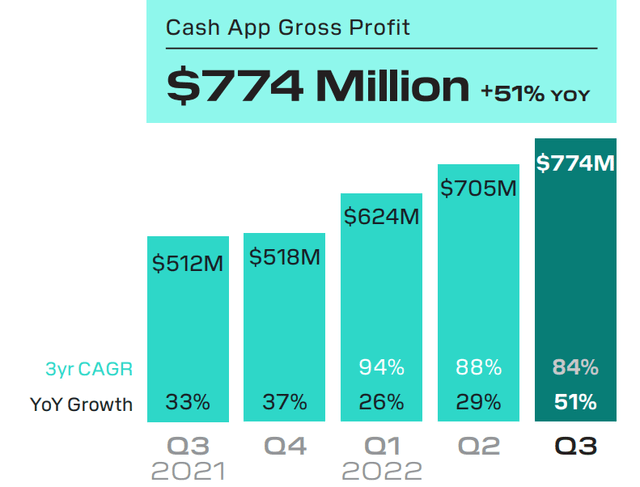

The Cash app saw a huge boost in popularity during 2020 as more stimulus checks resulted in a cash-rich consumer. Throughout 2022, consumer sentiment has been very different, and so have most people’s financial positions. Despite these challenges, Block has managed to grow its Cash App gross profit to $774 million, up 51% year over year.

Cash App (Q3 Earnings Report)

Cash App’s gross profit is driven by three leading indicators, these are Actives, Inflows Per Active and Monetization Rate on Inflows. The company has invested significantly in building the community, financial services and commerce parts of the app in the last quarter, which has been successful. Cash App’s organic peer-to-peer network has enabled the application to spread virally. Block has executed a series of targeted marketing campaigns to reach “high value” audiences. The campaigns have been successful as the company grew its transactional active users to 49 million, up 20% year over year.

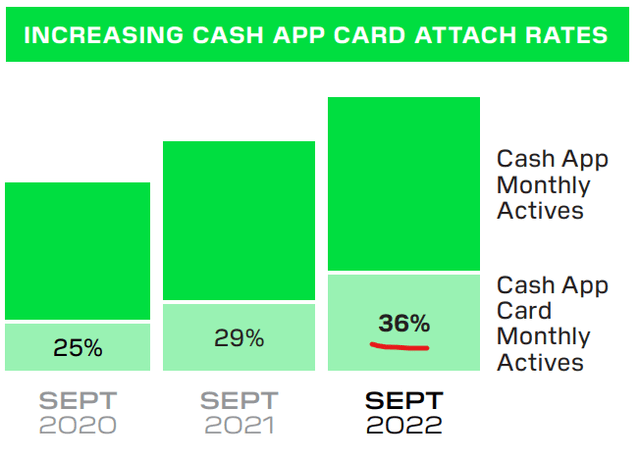

The company has gradually expanded its product to include Banking and aims to merge offline with online through a Cash App Card. This is a brilliant system, as my mobile application retention studies found that users are more likely to stick with an application and feel more connected to a brand if they have a physical card. Additionally, a tokenized debit card in an Apple Pay wallet also helps keep the brand top of mind for the consumer. The Cash App Card has proven immensely popular with the attachment rate reaching 36% of monthly active users. Block has also introduced direct deposit, check deposit and even paper money. The ability to add “Paper Money” to a mobile application is brilliant. Here’s how they enable this, Block has partnered with major merchants like Walmart, 7Eleven and more. A user simply walks into the store and has the merchant scan a barcode to deposit. Since its launch last year, the Cash App has had over $3.5 billion in paper money deposits of all time.

Cash App (Q3 Earnings Report)

Square ecosystem

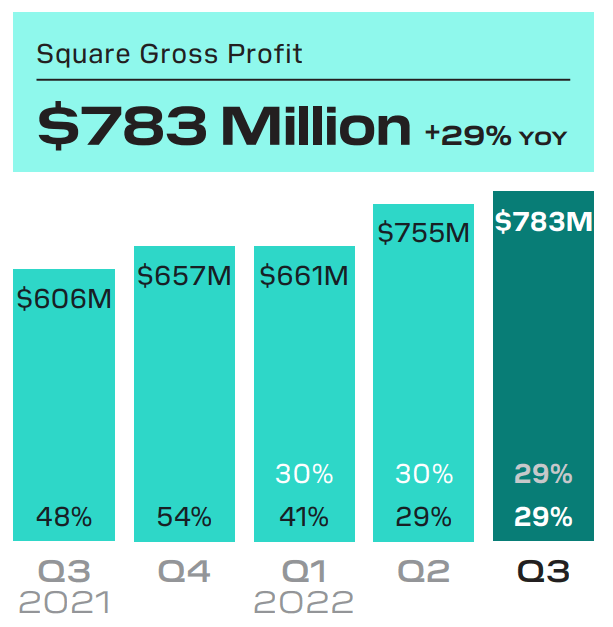

The second “ecosystem” is Block’s iconic point-of-sale commerce solutions [POS] devices and software. The Square Ecosystem generated $1.77 billion in revenue in Q3.22, up 27% year over year. While the company also generated $783 million in gross profit, up 29% year over year. The Buy Now Pay Later platform generated ~$105 million in revenue and $75 million in gross profit.

Gross profit squared (Q3 Earnings Report)

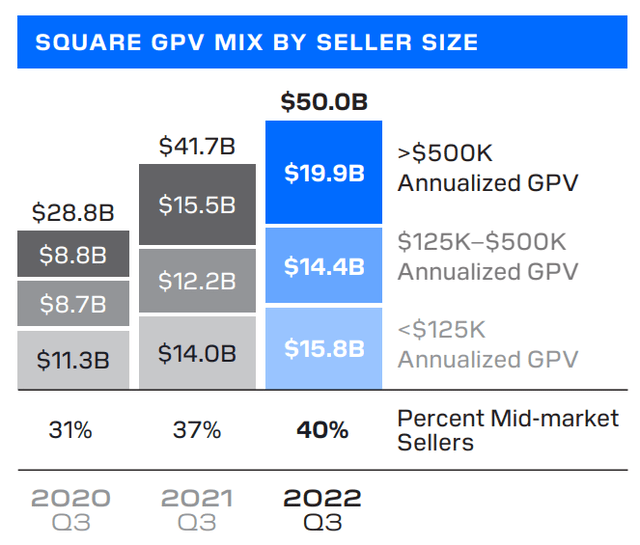

The company reported a lower percentage of debit card transactions that were close to pre-pandemic levels. Its total gross payment volume [GPV] increased by 20% year-on-year, with strong growth in international markets which increased by 40% year-on-year. This is part of Square’s strategy to expand internationally. In the third quarter, the business introduced Instant Transfers in Australia and Square Loans in the UK, as well as expanding Buy Now Pay Later to Canada and the UK. In Japan, QR code payments are extremely popular, and the most dominant provider is a company called PayPay, which has 51 million customers and captures two-thirds of Japan’s QR code GPV. Therefore, instead of competing directly with PayPay, Block has enabled merchants to accept PayPay QR code payments through their points of sale. Square has also gradually moved “upmarket” targeting larger sellers with over $500,000 in Annualized GPV. The percentage of mid-market sellers has increased from 31% in 2020 to 40% by 2022.

Gross payment volume (Q3 Earnings Report)

The Square ecosystem is beautiful as the business captures all the transactions the merchant experience. Square can then use this data to identify spending patterns and underwrite loans via the Square Loans service. In the third quarter of 2022, the company made 126,000 loans worth $1.14 billion, a rapid increase of 92% year-over-year.

Square’s developer platform is also a key selling point for the system. This enables merchants to create customized solutions and scale their business across multiple locations faster than with existing solutions.

Total expenses and profitability

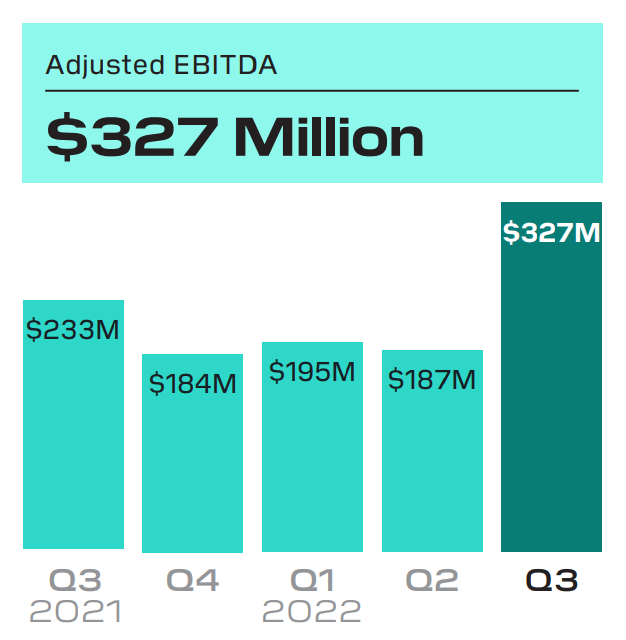

Back to the overall economy, Block reported $1.62 billion in operating expenses in the third quarter of 2022, which was up an eye-popping 46% year-over-year. This was driven by product development costs, which increased to $548 million, up 52% year over year. Overall, this expense is not a big issue as the company expanded its headcount to include more of these people in computer science and engineering. Sales and marketing expenses increased 19% year over year to $485 million. While G&A expenses increased 48% year over year to $395 million. G&A growth was again driven by headcount related to finance, legal, HR to support the Afterpay platform. Block generated adjusted EBITDA of $327 million, which was up a brisk 40% year-over-year, which was positive.

Adjusted EBITDA (Block)

Earnings per share [Normalized] was $0.42, which beat analysts’ expectations by $0.19. Excluding any adjustment, the company reported negative EPS of -$0.02, which still beat analyst expectations by $0.24 when analysts expected a big loss of $0.26.

Solid balance

Block has a solid balance sheet with $6.5 billion in cash, cash equivalents, restricted cash and short-term investments. The company has long-term debt of $4.5 billion, but only $460 million of that is short-term debt (due within the next two years), so it’s manageable.

Advanced valuation

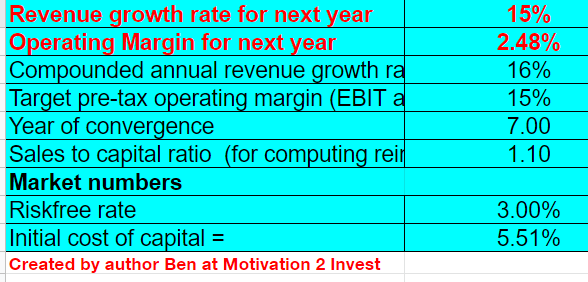

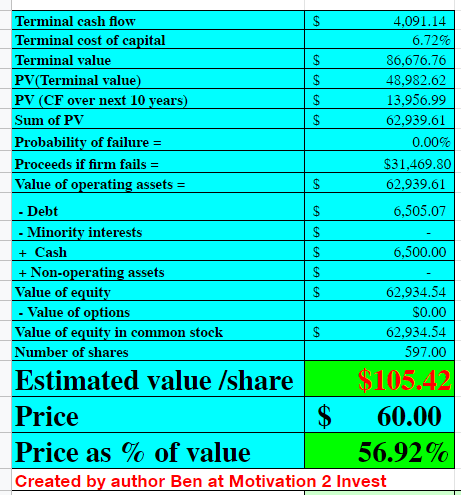

To value Block, I plugged the latest economics into my advanced valuation model that uses the discounted cash flow method of valuation. I have forecast revenue growth of 15% for next year, which is slightly slower than the previous 18%, given the macroeconomic environment. However, going forward into years 2 to 5, I predicted a slightly higher (but still conservative) 16% growth rate.

Block share assessment 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have included the company’s R&D expenditure on the balance sheet, which has increased the operating margin to 2.48%. Additionally, I estimate that this operating margin will expand to 15% over the next 7 years as the company’s investments begin to pay off and operating leverage begins to take hold.

Block share assessment 2 (Created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $105 per share, the stock trades at $60 per share at the time of writing and is therefore ~44% undervalued.

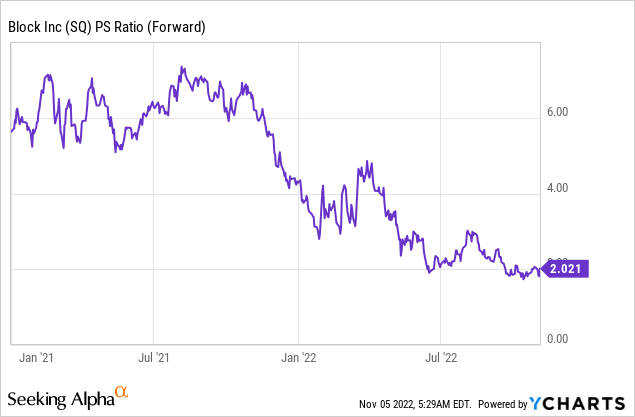

As an additional data point, Block trades at a price-to-sales ratio = 1.89, which is 75% cheaper than its 5-year average.

Risks

Recession/lower payment volume

The high inflation and rising interest rate environment has led many analysts to predict a recession. Inflation increases input costs for both consumers and businesses, this usually results in a decrease in consumption and thus means a lower payment volume for Block. The good news is that recessions tend to be cyclical in nature as the economy bounces back, so will the consumer.

Longer term, the company is focused on “balancing growth and profitability” as it aims to moderate cost growth. According to management, the Cash app should be a key area where operational impact will be seen in 2023.

Final thoughts

Block is a fintech powerhouse that has emerged from the pandemic as a much stronger business. The two growth engines (Cash App and Square) are producing good results, and the Buy now, pay later application is starting to gain traction. The share is inherently undervalued and can therefore be a great long-term investment with strong future growth prospects.