BKCH ETF: The Bumpy Ride Towards The Future Of Blockchain

cgtoolbox

Blockchain is a relatively new innovation that many people are starting to take an interest in, regardless of whether they are interested in cryptocurrency or not. However, blockchain assets are some of the more volatile investments, and small-cap early-growth ETFs only out-perform unpredictable. Despite the volatility, I currently cover blockchain because I believe this technology could have a lot of untapped potential outside of just crypto. That said, I could see a number of companies adopting their technology over time. Some potential opportunities for blockchain include, but are not limited to, applications in health Service, supply chain managementand banking services. For this reason, I consider the Global X Blockchain ETF (NASDAQ:BKCH) a Hold.

I also think there can be better investment instruments with a little less volatility and better liquidity for those who want them to gain blockchain exposure. A more notable alternative to BKCH is the Amplify Transformational Data Sharing ETF (BLOCK), which I like to refer to as “the mother of blockchain ETFs”. More recently, small-cap ETFs often include their own risksinvestors may want to consider more veteran options when dealing with an industry as volatile as blockchain.

Strategy and inventory analysis

BKCH tracks the Solactive Blockchain USD Index using a full replication technique. This ETF’s designated index invests in blockchain companies. To qualify as a blockchain company, competing stocks must derive at least half of their revenue, assets or operating income from specific business endeavors. Such endeavors include, but are not limited to, those focused on digital asset mining, transactions, hardware and integration. Such companies are also required to meet certain market value and liquidity requirements. In particular, eligible companies’ market capitalization must not be less than $50 million, with also a minimum three-month average daily turnover of at least $500,000.

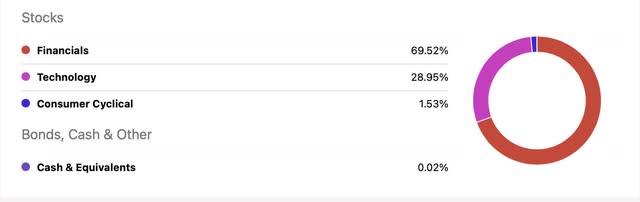

This ETF’s holdings are mostly classified under financials, with just over a quarter devoted to technology. All but a quarter of BKCH’s holdings are headquartered in the US. Non-US exposures in this fund are mainly in Canada and China. These places are associated with a lot of cryptocurrency usage, hence their high concentration of blockchain companies.

Seeking Alpha

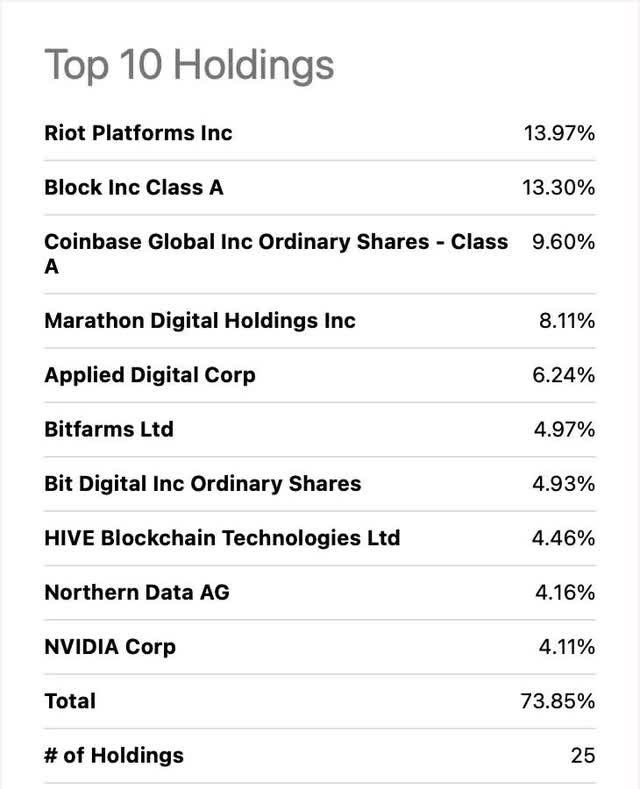

The top 10 holdings in this ETF account for 74% of the total portfolio, which consists of only 25 holdings. This makes BKCH very top-heavy. The top two holdings in BKCH are Riot Platforms Inc. (RIOT) and Block Inc. (SQ), which together make up more than a quarter of the entire fund.

Seeking Alpha

This will likely only add to the inherent volatility that blockchain funds possess, fueling this ETF’s drastic price swings. Investors may want to consider the possibility of concentration risk eating into their returns, especially as some of BKCH’s top holdings have highly volatile price trends.

Strengthens

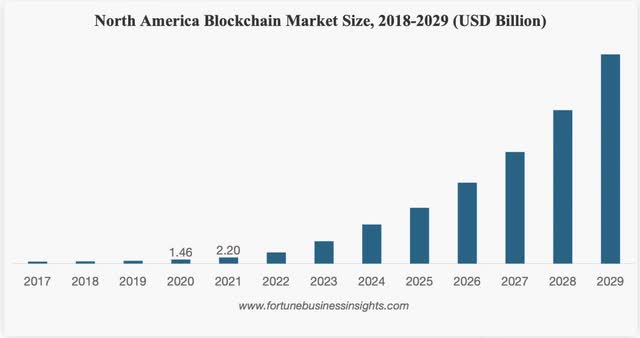

The blockchain industry is well positioned for growth, especially as its services extend beyond the crypto domain. At a rate of 56%, the North American blockchain market could grow to nearly $165 billion by 2029. Long-term blockchain growth could significantly increase the price of this ETF, especially as it is still in its early stages of growth.

Fortune Business Insights

Small-cap assets have come to light recently as investors turn to early growth potential amid the prospect of a market turnaround. While the market is likely to see more gains before a reversal, smaller funds like BKCH that follow emerging trends could be some of the first to profit from a revitalized economy. During this time, investors may become more open to putting money into more volatile securities with more room for long-term growth. This may even give BKCH an advantage over BLOK, as BLOK has already had several years to prove itself at this point.

Weaknesses

This ETF is quite volatile like other funds that are heavily focused on blockchain and crypto. Since crypto is often driven by speculation and less by educated investment and research, its associated assets are known to move erratically.

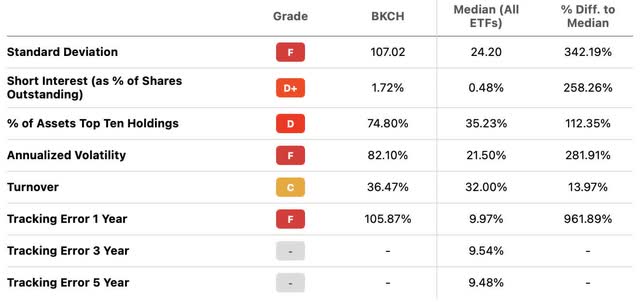

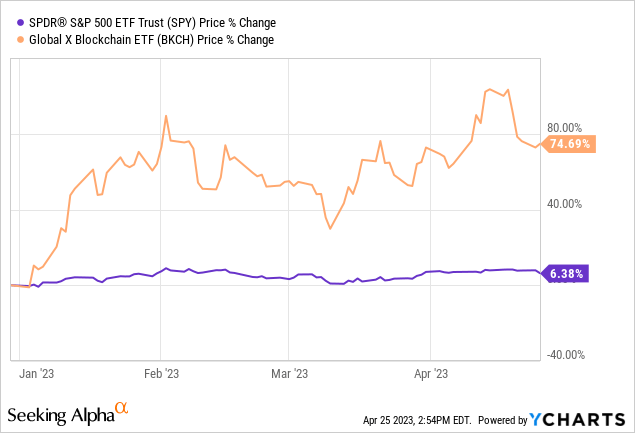

Seeking Alpha

Despite outperforming the market so far this year, this ETF moves quite spontaneously, which can make it very difficult to assess its trajectory going forward. In the current market conditions where uncertainty is already high, many investors may consider the risk unworthy and end up selling their shares.

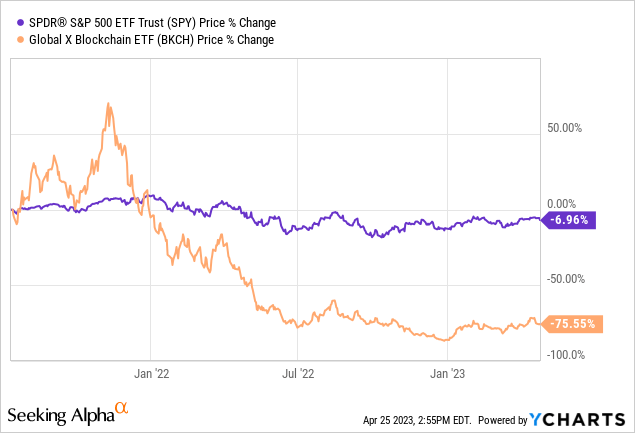

Looking back to the moment it was launched, this ETF’s movements have been far from consistent.

From the chart above, it appears that BKCH outperforms the S&P for almost half a year, then falls relentlessly for the next year and beyond. BKCH may have a fundamental problem with stability, which could hurt its long-term performance despite being a potentially profitable investment. Furthermore, BKCH is more likely to have underlying liquidity problems compared to alternatives such as BLOK. This is due to the fact that this ETF is relatively smaller and undiscovered compared to some of its peers.

Possibilities

Integrations of blockchain technology into bank payment systems could propel the blockchain market to new heights over the next few years. In time, banks may start using blockchain to improve the speed, security and transparency of their payment systems. This could work to foster a closer, more profitable connection between the blockchain, finance and fintech industries.

In addition to banking, blockchain is continuously strengthening its position in energy trading, which could position it well for long-term profits. For example, GridPlus is a blockchain energy company that specializes in wholesale energy distribution. In doing so, GridPlus uses Internet of Things (IoT) and blockchain mechanisms to allow consumers to make energy transactions directly with the grid rather than with retailers. As blockchain gains popularity, more companies like GridPlus may emerge, thus increasing the profits of both the blockchain market and BKCH.

Threats

The cryptocurrency industry may face scalability barriers in the coming periods, which may eventually eat into the profits of BKCH. In this regard, blockchain may have difficulty handling a large volume of transactions in a short period of time without encountering network problems and congestion. This may ultimately require relevant companies to sacrifice some degree of decentralization, which could be detrimental to the blockchain industry.

Cryptocurrency has previously been the subject of environmental scrutiny, as mining crypto involves extensive power consumption, which ultimately increases carbon emissions. Although it generally requires energy to protect the value of assets, crypto’s ability to generate alpha in the long term can still be questioned, and may become disproportionate to the carbon footprint it leaves behind. Over time, this could damage the reputation of various institutions within BKCH and eventually depress the price of this ETF.

Although many have come to associate cryptomining with environmental costs, this difficulty has also catalyzed the growth of new, more environmentally conscious cryptocurrencies. Such currencies may include Tezos (XTZ-USD) and Ethereum (ETH-USD). Time will tell if these investment companies’ ability to make money can match their energy expenditure.

Conclusion

This ETF is likely to struggle with both momentum and maintaining stable performance in the coming periods. At the same time, those who want to gain exposure to blockchain and crypto can consider more veteran funds such as BLOK, as smaller ETFs may have problems gaining enough momentum for now. This is likely to continue to be the case as the economy is positioned for more rate hikes throughout the rest of this year and possibly into next year as well. For these reasons, I rate BKCH as a hold.