BITQ ETF: Bitcoin Soup Recovers – A Crypto Lotto Ticket

Olemedia

Bitcoin remains the leader of the cryptocurrency asset class. At $23,475 on March 2, Bitcoin’s market capitalization was just above the $453.4 billion level, or about 42.4% of the total value of the $1.069 total asset class.

Bitcoin plunged from above $68,900 in November 2021 to a low below $15,520 in November 2022. While the top crypto remains much closer to recent lows than record highs, it has stabilized in recent weeks. In a mid November 2022 Seeking Alpha article about BITO, the ETF that tracks Bitcoin futures, I wrote, “Explosive and implosive price movements are nothing new for cryptocurrencies.” While the leading crypto fell 77.5% from November 2021 to November 2022, the decline was smaller than previous implosive moves. At the $23,485 level, Bitcoin is around 51% higher than its late 2022 lows, but if it follows a similar trajectory as above in recent years, the next explosive move may be in the early days.

Bitwise Crypto Industry Innovators ETF (NYSEARCA:BITQ) owns a diversified portfolio of stocks in companies that tend to move higher and lower with Bitcoin’s value. It could offer compelling value below the $5.20 per share level on March 2 if another explosive move is on the horizon.

Bitcoin is consolidating

Since hitting the last low in November 2022, Bitcoin has recovered and moved into a sideways trading range.

One Year Bitcoin Chart (Barchart)

The chart highlights Bitcoin’s consolidation from the low to the $18,335 level from November 21, 2022, to below $18,340 by January 11, 2023. Bitcoin then rallied and has ranged from $21,426.59 to $25,238.72 from January 23 through mid-2020 March. of the March 2 trading area at the $23,475 level. As the chart shows, the May 31 technical resistance stands at $32,329.54, but the $30,000 level is a critical psychological level and upside target for the leading cryptocurrency.

Fiat currency issuance favors crypto

The US is the world’s reserve currency, with the euro as the second best currency instrument. The dollar and the euro have been the traditional currencies used by central banks for international transactions and cross-border payments.

The US economy is facing a debt crisis as Congress and the administration must agree to raise the debt ceiling. The potential for a default is likely to have pushed the dollar lower against the euro since its lows in late September. Meanwhile, the division of the world’s nuclear powers and Russia’s alliance with China threaten the dollar and the euro as reserve currencies. Increasing use of non-dollar and non-euro exchange-traded instruments to pay for international cross-border transactions threatens the role of US and European currencies worldwide. Therefore, the euro and the dollar can weaken at the same time, regardless of the exchange rate between the two currencies. The over two decade increase in gold prices in dollars and euros is a sign that both currency instruments are weakening. Bitcoin, Ethereum and other cryptocurrencies can benefit from the weakness of the leading fiat currencies as they provide an alternative to the dollar and euro.

BITQ is Bitcoin Soup

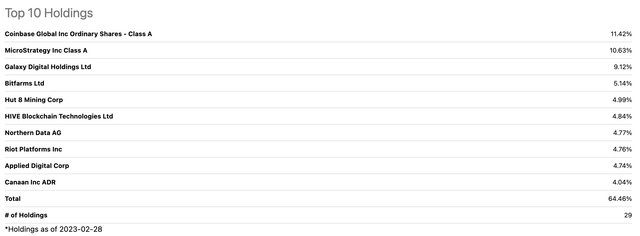

I call the Bitwise Crypto Industry Innovators ETF (BITQ) Bitcoin Soup because it owns shares in a diversified group of Bitcoin and cryptocurrency-related companies. BITQ is an asset class play as the companies in BITQ’s portfolio tend to rise and fall with their market capitalization. Recent top holdings include:

Top holdings of the BITQ ETF product (Seeking Alpha)

At $5.13 per share on March 2, BITQ had $52.272 million in assets under management. BITQ trades an average of 130,526 shares daily and charges a management fee of 0.85%.

BITQ rally

The Bitcoin rally from the November 21, 2022 low to the February 16, 2023 high took Bitcoin 62.7% higher.

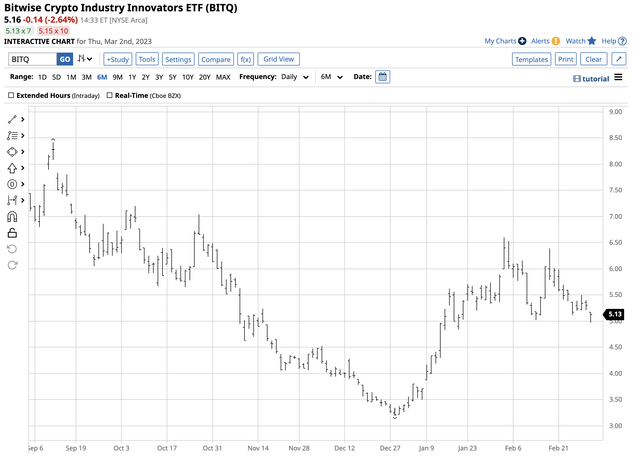

Six-Month BITQ Chart (Barchart)

The chart shows BITQ rising from $4.06 to $6.39 per share or 57.4% over the same period.

BITQ is likely to follow Bitcoin’s future implosive and explosive trajectory.

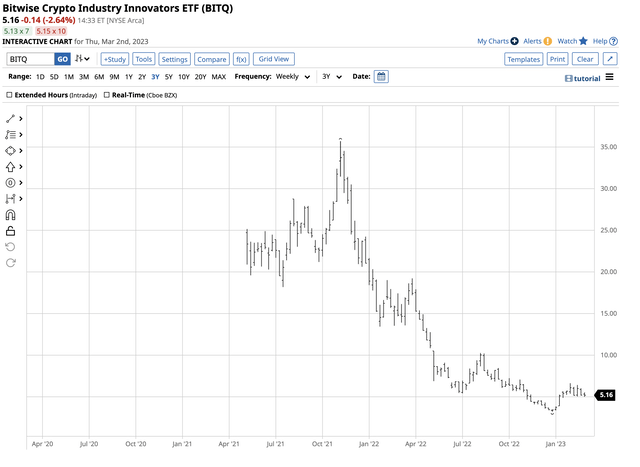

Three Year BITQ Chart (Barchart)

As the chart highlights, BITQ began trading in May 2021 and reached an all-time high of $35.68 in November 2022, the month Bitcoin traded at over $68,900 per token. The price fell 77.5% from that peak, while BITQ delivered a magnified result that fell over 91% from the high to the low. If Bitcoin takes off on the upside, BITQ could outperform the leading crypto on the upside, as it has a history of a leveraged ratio.

Risk vs. reward in a volatile asset class

At under $5.20 per share, BITQ is a highly speculative ETF with plenty of upside potential and corresponding downside risk. If Warren Buffett, Charlie Munger and Jamie Dimon are right, the ETF could lose most of its value. Yet, unlike Bitcoin, many companies in the portfolio have other business interests and exposures that are likely to save it from becoming worthless. Even if Bitcoin were to disappear, BITQ would likely survive.

On the other hand, if Bitcoin and cryptocurrencies take off on the upside, we could see BITQ outperform on a percentage basis. Moving back to the $68,900 high would take Bitcoin 191% higher, while BITQ at $35.68 would be an increase of over 570% from today’s price level.

BITQ is a lottery ticket that provides exposure to the crypto asset class. As with any highly speculative investment, only invest capital you can afford to lose.