BITO: FTX Collapse A Potential Lehman Moment for Bitcoin

Vertigo3d

Overview

ProShares Bitcoin Strategy ETF (NYSEARCA:BITO) (the “Fund”) is the first US Bitcoin (BTC-USD)-linked ETF to offer investors exposure to Bitcoin.

The fund does not buy Bitcoin directly, but instead gains exposure to Bitcoin via futures contracts.

The fund has a cost share of 0.95% per year (10th cheapest among similar ETFs). VanEck and Global X offer similar ETFs with lower expense ratios.

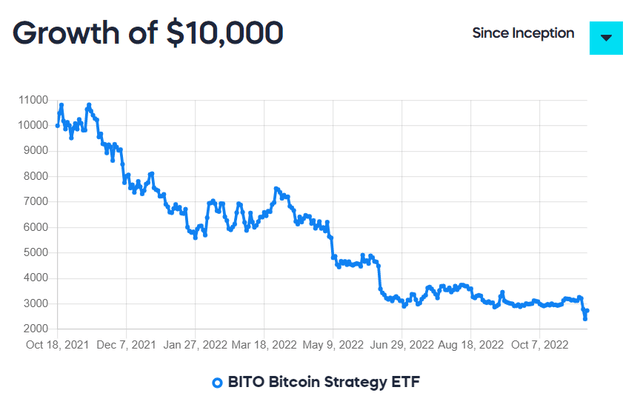

Performance

The fund’s results have not been good. A $10,000 investment at startup would be worth about $2,700 today, representing a capital loss of more than 70% on paper.

ProShares

Portfolio

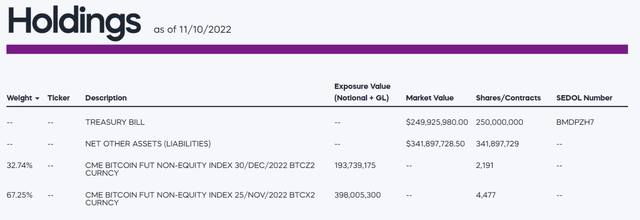

The fund does not invest directly in Bitcoin. There are currently no ETFs that offer direct exposure to Bitcoin. Instead, BITO seeks to provide exposure to Bitcoin via futures contracts.

ProShares

This week’s news of the collapse of FTX has drawn parallels with the 2008 financial crisis and the bankruptcy of Lehman Brothers.

What does this mean for BITO and Bitcoin? We will take a closer look at this in the next section.

Is the FTX Collapse a Potential Lehman Moment for Bitcoin?

Yes potentially. FTX filed for US bankruptcy protection due to a liquidity crisis during the week, and it’s impossible not to draw parallels with the 2008 financial crisis.

The financial crisis of 2008 has taught us a few things. First, the financial industry’s interconnections make the FTX collapse a potential Lehman moment for the crypto industry due to the possible risk of contagion.

FTX customers were stopped from withdrawing their deposits, raising many questions from regulators globally.

It was reported that FTX had used customer deposits to fund risky bets, which ultimately led to its demise.

Since the crypto industry is largely unregulated, there is a strong possibility that other platforms such as FTX have used customer deposits for speculative trading or lending, which could lead to contagion and eventual collapse of the crypto industry.

Like the banking system, trust is key for cryptocurrency exchange platforms to function.

The collapse of FTX will be a massive breach of trust for the public, and it will take time to recover.

FTX customer deposits are not insured by any public or private deposit insurance agency, which means people will lose their money.

After the financial crisis, the banking industry came under increased scrutiny and regulation by American regulators.

For example, the banking industry was required to comply with the liquidity coverage ratio to avoid liquidity crises.

I believe that the cryptocurrency industry needs to be more regulated as it will help restore confidence in the system.

Outlook for Bitcoin

The price of Bitcoin has fallen below the $20,000 mark, below its peak in 2017/18. It has been an absolute rollercoaster ride for Bitcoin holders.

Coindesk

With inflation out of control and uncertainty about how high interest rates will have to rise, I think Bitcoin will remain in a bear market until everything is sorted out.

I believe that institutional investors will re-evaluate their position on Bitcoin after the collapse of FTX. Until cryptocurrencies are fully regulated, the risk of fraud will be too high.

Institutional investors may be forced to sell their crypto assets to de-risk their portfolios, which will put downward pressure on the price of Bitcoin.

For private investors, I believe that inflation and high borrowing costs will eventually begin to affect income and the ability to save and invest. This will reduce the ability of retail investors to continue buying Bitcoin.

Additionally, better savings rates increase the opportunity cost of holding Bitcoin.

All these factors will put downward pressure on the price of Bitcoin.

Conclusion

Only time will tell what happens next. The interconnection of the crypto industry and the risk of contagion will be tested in the coming weeks.

The collapse of FTX and its impact on customer deposits has given regulators sufficient ammunition to begin strictly regulating the crypto industry.

Regulation is a double-edged sword for cryptocurrencies as it will help restore trust, but at the same time cryptocurrencies will lose their essence.

BITO is definitely a sell in today’s environment. A combination of new regulation, inflation and interest rates will continue to put downward pressure on Bitcoin and BITO.