Bitfarms sold more Bitcoin than was mined in Q3

Bitcoin mining company Bitfarms’ third quarter report shows that the miner sold more BTC than it earned in the quarter – the miner sold 2,595 BTC while mining 1,515 BTC.

The miner focused on strengthening its position to survive the bear market by cutting costs and significantly reducing its debt obligations during the quarter.

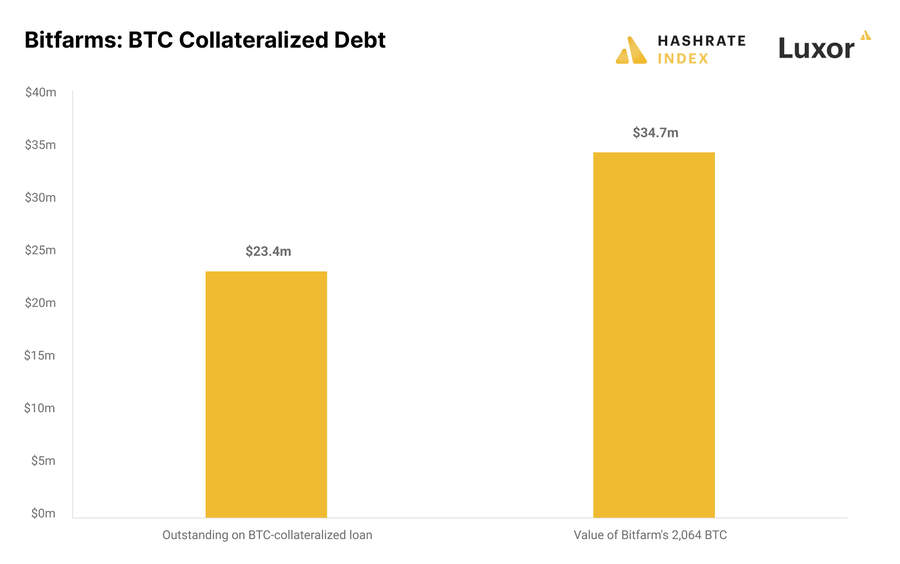

However, the miner still has $55 million in machine-secured debt and $23 million in Bitcoin collateral debt.

Bitfarms’ liquidity under the spotlight

Bitcoin mining analyst Jaran Mellerud said that while Bitfarms’ Bitcoin sales helped it reduce its debt burden, the miner doesn’t have much Bitcoin left.

Mellerud said:

“(Bitfarms) has $38 million in cash and 2,064 bitcoins. The problem is that 1,724 of those Bitcoins are pledged as collateral, giving the company a total uncommitted liquidity of just $44 million.

The price of the flagship digital asset poses another major challenge for the firm as it has to maintain a collateral value of 125% of the loan.

Mellerud said the miner’s entire Bitcoin stack of 2,064 equals 141% of the loan. So if BTC’s price fell to around $14,200, the company’s loan could be liquidated.

After this, analyst Mellerud concluded that “the company’s liquidity is insufficient to finance its planned expansions”.

Bitfarms keeps costs down

Bitfarms’ third quarter report revealed that the company’s general and administrative expenses were down 15% to $6 million, excluding non-cash stock-based compensation.

Mellerud praised the firm for minimizing production costs while keeping administrative costs relatively low compared to its competitors.

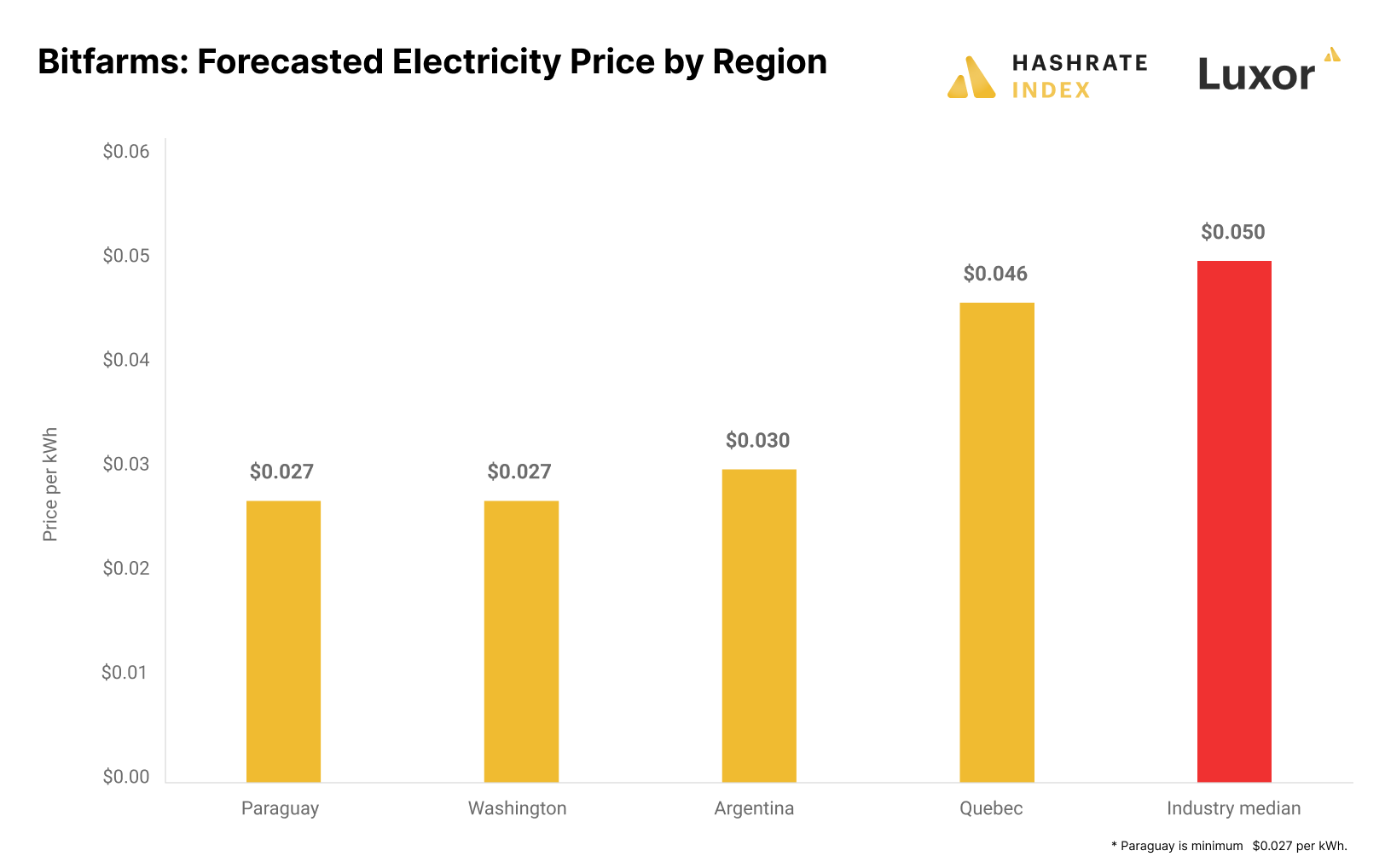

According to Mellerud, Bitfarm has access to cheaper electricity as the prices are significantly lower than the industry median of around USD 0.05 per kWh. Bitfarms expects to pay $0.027 per kWh in Washington, $0.03 per kWh in Argentina and $0.046 per kWh in Quebec.

Meanwhile, most of the company’s revenue comes from its Quebec facilities which account for over 80% of revenue.

However, the Bitcoin mining company’s plan to expand to South America is stalling due to red tape. Mellerud noted that the company may need external financing or cut back on expansion plans.