Bitcoin’s frenzy of activity pushes average transaction fees above $7, a nearly 2-year high

A surge in transactions on the Bitcoin blockchain involving Ethereum-style tokens and non-fungible token (NFT)-like “inscriptions” has fueled congestion on the network, pushing the average fee rate to the highest in nearly two years as they overflow miners with the cryptocurrency with additional earnings.

On Wednesday, the average fee per Bitcoin transaction rose to $7.25, the highest since July 2021. By comparison, the rate so far this year had fluctuated between about 50 cents and $4, data from BitInfoCharts shows.

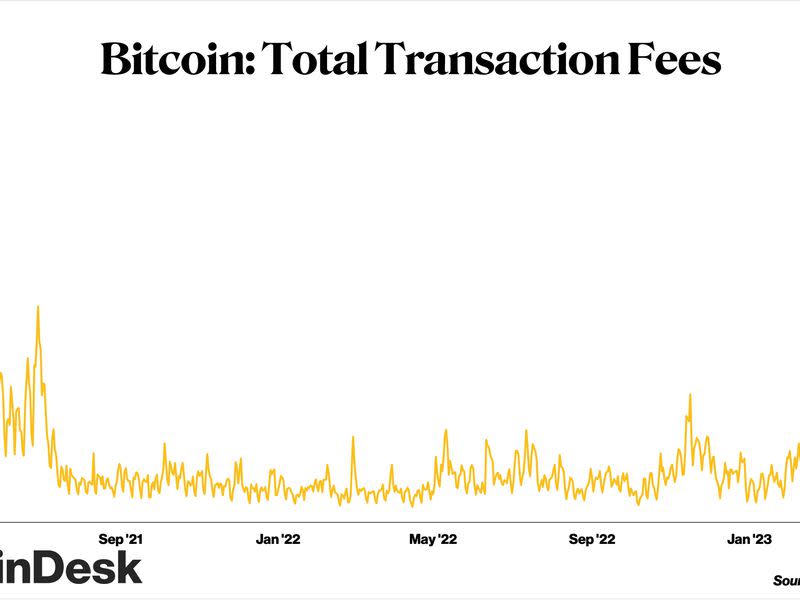

As transaction activity also increases, the total fees on Bitcoin have also increased.

Per blockchain analytics firm Glassnode, Bitcoin’s total transaction fees, which are paid by users to miners, rose to around 124 BTC or roughly $3.5 million on May 3, representing a 484% increase over the past 14 days.

“This current fee spree is an anomaly,” wrote Colin Harper, chief content officer at Luxor Technologies, a full-stack Bitcoin mining pool.

In recent days, a token type called BRC-20 (a play on Ethereum’s ERC-20 token standard), which facilitates the issuance and transfer of fungible tokens on the Bitcoin blockchain, has accounted for about 6% of all Bitcoin activity since the start in early March, according to pseudonymous analyst and yield farmer Dynamo DeFi. This year has also seen the rise of Ordinals inscriptions, which are similar to NFTs and can be images or text strings written into Bitcoin-based transactions. Both activities require transaction fees.

“Inscriptions are the main driver here,” Harper said. “The biggest difference now between this jump in transaction fees and previously with inscriptions is that the BRC-20 standard is a new way of writing. Adopting this standard increases fees.”

“The increase in transaction volume of that token standard has fueled the demand for Bitcoin blockspace,” said Jimmy Zhang, who works in the business operations and strategy department at blockchain computing firm Artemis.

Kyodo, vice president of the Stanford Blockchain Club, told CoinDesk via direct messaging on Telegram that “Blockspace is the core commodity of any blockchain. People have found a new use case and usage skyrocketed. BTC is more than money now.” Kydo said they only use one name publicly due to privacy concerns.

Miners who secure and maintain the Bitcoin network are the beneficiaries of the recent increase in BTC transaction fees because they are rewarded in BTC fees for processing users’ transactions.

Harper predicts that the increased transaction fees currently occurring in the ecosystem are “a temporary phenomenon and that transaction fees will soon return to a manageable means.”

Kydo said they think the current phenomenon will last for a while, “given how much people like NFTs.”

The price of BTC has increased 1.2% in the last 24 hours to $28,884, at press time. The average transaction fee on Bitcoin is $7.25. According to the data website cryptofees.info, Bitcoin’s average seven-day fee stands at about $2 million, second only to Ethereum’s $12.5 million. BNB Smart Chain is next with about $575,000.