Bitcoin’s fourth halving: Countdown to a non-event (BTC-USD)

BT Series / iStock via Getty Images

It is starting to look like the long-term support level for Bitcoin (BTC-USD) can only be zero. But Bitcoin HODLers are not deterred by this year’s cryptocurrency route. For them, the current crypto winter must inevitably be followed by next crypto spring, with the promise of higher peaks in the six or even seven digits. A particularly popular story is that BTC is not “dead”, but rather follows a four-year cycle driven by an event known as “halving”, or as some prefer to call it, “halving”.

Halving refers to a 50% reduction in the rate at which new BTC supplies are put into circulation, a decrease in issuance that occurs every 210,000 blocks, approximately every four years. So far, this has happened three times – in 2012, 2016 and 2020 – and is expected next time in the first half of 2024. (If you want a more accurate date, check out this “Bitcoin watch.”) Halvers will continue to last bitcoin has been mined, probably in 2040, when the supply will be permanently set at 21 million.

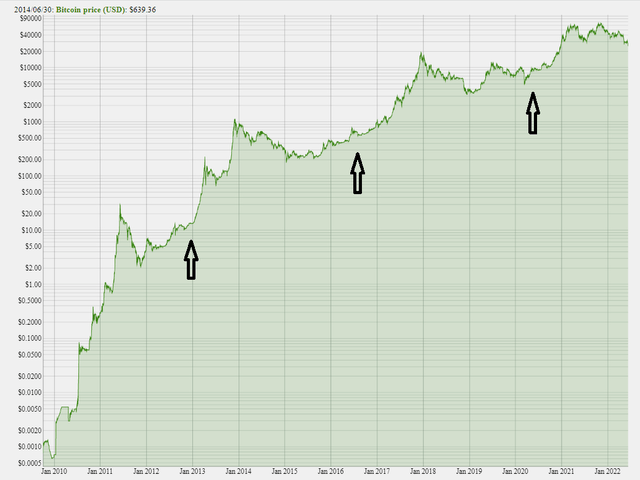

Bitcoin bulls like to point out that in each of the last three cases, a big bottom occurred about a year before halving and a new all-time high the following year (see Figure 1). If this pattern is set to repeat itself, those with large losses now have nothing to worry about. In a few more years, they will be sitting on big profits and rejoicing on Twitter over all the losers who still work dead end jobs for paychecks.

Figure 1. Bitcoin prices (log scale). Arrows indicate the previous halves November 28, 2012; July 9, 2016; and May 11, 2020. (Bitcoin.zorinaq.com, arrows added by the author.)

However, with a sample size of three (consisting of the last, and so far, only halves), there is not enough data to draw statistically significant conclusions about what will happen next. To be convincing, a story supported by so little evidence requires a supportive explanation. If I told you that Bitcoin followed a “US presidential election cycle” (2012, 2016 and 2020 are election years), you can be convinced, even without knowing why, if I could produce an unbroken record of such events back to the early years of the Republic . With only Obama, Trump and Biden pointing to, you would be more likely to say that this apparent pattern was just a coincidence if I could not explain how elections are relevant.

Similarly, for the history of the “halving cycle” to be credible, there must be some reason to believe that smaller increases in supply should be expected to lead to higher prices. There are in fact two often cited theories about the “halving cycle”, one based on supply, the other on demand. Unfortunately for the bulls, none of them make much sense.

The first is that a fall in the supply of new supply means a surplus demand at current prices (see, for example, this Investopedia article). This confuses total supply with new supply. Only the total supply means anything for the supply-demand balance, and this always increases (and will continue to climb until the terminal value of 21 million is reached). It is simply not the case, as Investopedia would have it, that halves reduce the “number of Bitcoin in circulation”. (See this chart, set to “all the time”, if you do not believe me.) Whether prices go up or not depends as much on the rate at which demand increases, as on the rate at which the new supply falls. In a world where demand was steady, prices would fall continuously as supply increased. It would only fall more slowly after the change instead of rising.

According to the second theory, the halving itself leads to an increase in demand as news of the event draws new classes of investors to the benefits of investing in Bitcoin (see, for example, page 2 of this article). Well maybe. But why should investors who had not previously been aware be expected to become interested in such a vague aspect of the Bitcoin protocol? A much more plausible idea is that most newcomers jump on the bandwagon when they hear that existing players have made money, and generally do not respond to information beyond what is visible in the price chart. Although they may come on board halfway up the reel, how these moves start in the first place, and why they should necessarily be associated with halves, remains a mystery.

The Bull case becomes even less convincing when one considers that it assumes that halves must necessarily be followed by new all-time highs, a claim that is difficult to justify on the basis of either of these two theories. Both mean that each halving should have a weaker effect than the previous one, as the new supply reduction will be an ever smaller percentage of existing supply and the number of investors left to drink Kool-Aid will continue to decline. This is actually what Figure 1 shows in percentage each beef market represents a smaller increase from bottom to top than last.

The problem with being long now, even for believers in the cycle, is that a bottom is not expected until the first half of next year (one year before halving). Bitcoin can fall much more between now and then. If we afterwards only get a relatively high, this may well be below today’s price, leaving HODLs with an even greater loss than if she had sold today. For example, we could fall to $ 10,000 next April, and then reach a peak of only $ 18,000 in 2025 (the year after halving), above $ 3,000 below today’s level. (Of course, these numbers are for the sake of argument, not predictions.)

None of this is to say that Bitcoin can not move higher from here or eventually have to go to zero. In fact, after the recent fall in US bond yields, a continuation of this week’s upturn is not unlikely. The close correlation between crypto and NASDAQ growth stocks makes such a scenario an even better bet in case the latter continues to increase.

My point is simply that there is no reason to expect the fourth halving to push BTC to new heights. If you are going to be tall, it should be for another reason.

The author would like to thank Tim Swanson, Head of Market Intelligence at Clearmatics, for checking out this article.