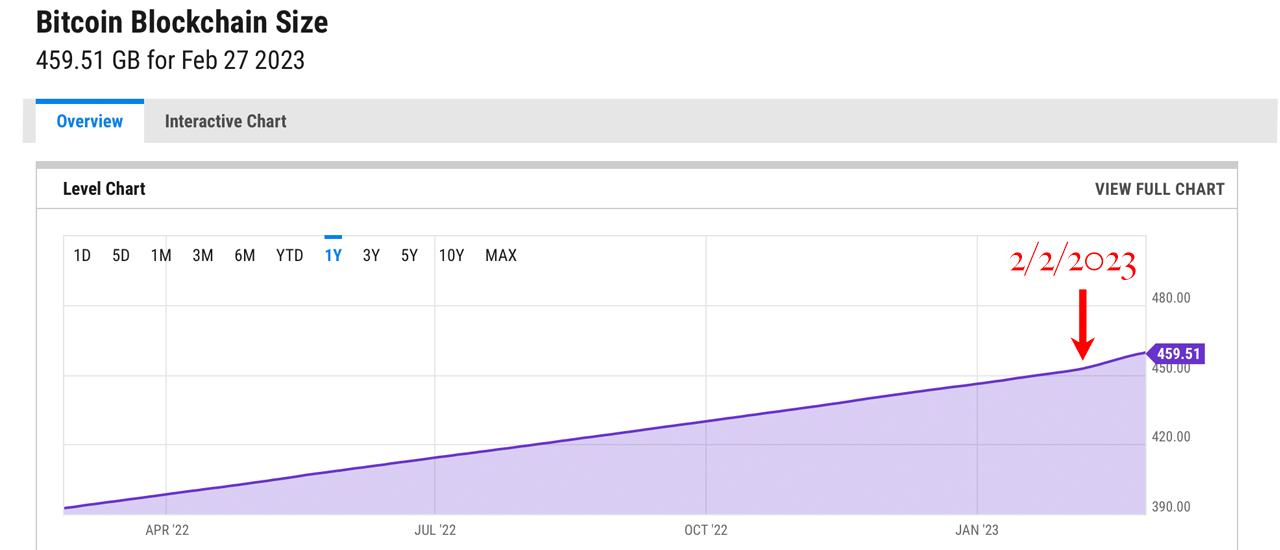

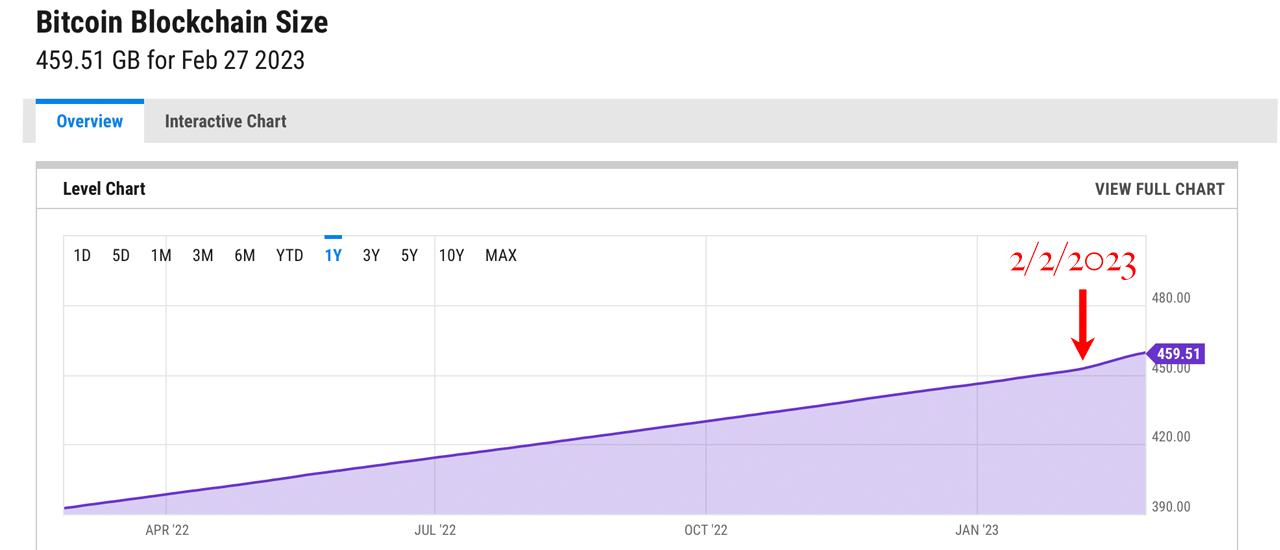

The Bitcoin blockchain has 40.49 gigabytes (GB) left until it reaches half a terabyte (TB), and with the recent trend of Ordinal inscriptions, it will likely get there faster. The average block size peaked at 2.52 megabytes (MB) on February 12, 2023, but block sizes have been decreasing and decreasing to an average of 1.634 MB by February 27. Nevertheless, the blockchain grew at a rate of 0.288 GB per second. day, compared to the previous rate of 0.173 GB per day recorded before the Ordinal inscription trend began.

The Impact of Ordinal Inscriptions on Bitcoin’s Network Metrics

Ordinary inscriptions started on December 16, 2022, but did not really take off until February 2, 2023. That was the day a 3.96 MB block was mined, and since then 214,028 inscriptions have been added to the Bitcoin blockchain. The trend of Ordinal inscriptions between February 2nd and February 27th, or roughly 26 days, increased Bitcoin’s average network fee and average block size. Both the network fee and block size peaked around February 12th and have been declining ever since. During that time, data shows that the size of Bitcoin’s chain grew faster.

For example, statistics show that the Bitcoin blockchain was 459.51 GB in size on February 27, 2023. Measurements show that during those 26 days, the blockchain grew by 7.77 GB, or about 0.288 GB per day. The spike can be seen visually by looking at a chart of Bitcoin’s blockchain size from February 2nd to today. But before Ordinal inscriptions started trending and larger blocks were mined more regularly, the blockchain’s growth was much slower. It took 45 days, from December 19, 2022 to February 2, 2023, to reach 7.77 GB.

At that time, over the course of 45 days, the Bitcoin blockchain grew at a rate of 0.173 GB per day. Bitcoin’s average fee on February 28, 2023 is 0.000077 BTC, or $1.82, per transaction, while the median fee is 0.000033 BTC, or $0.777, per transaction. Transactions are also confirmed with prices ranging from 2 satoshis per byte, or $0.07, to 19 satoshis per byte, or $0.62, per transaction. The earnings miners accumulated per day amid the Ordinal enrollment trend peaked on February 16, 2023 at $28.21 million (block subsidies + fees), compared to today’s $21.36 million. Still, bitcoin (BTC) miners are earning more revenue than they were on December 24, 2022.

It will be interesting to see how another month of Ordinal inscriptions affects metrics like average block sizes, median and average fees, and the overall growth of the Bitcoin blockchain. Although the hype surrounding Ordinal inscriptions has subsided, these metrics remain high compared to pre-February 2nd and the subsequent influx of inscriptions. Average and median fees are still higher than before the Ordinal trend, and average block sizes remain above the 1.60MB threshold after staying below it for several months.

Tags in this story

3.96 MB, Average, Bitcoin, block sizes, Blockchain, Blocks, bytes, chart, confirmation, Cryptocurrency, data, Decentralized, Fees, GB, gigabytes, growth, Hype, MB, median, calculations, Miners, mining, network, Network Fees , nft, NFT, nodes, Ordinal inscriptions, Ordinal Trend, Ordinals, Profitability, revenue, satoshis, Security, size, subsidy, terabyte, Transaction, trend

What are your thoughts on the impact of Ordinal Inscriptions on the growth of the Bitcoin blockchain? Share your thoughts in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.