Bitcoin Will Rally Again: Here’s What You Need To Know (BTC-USD)

Olemedia

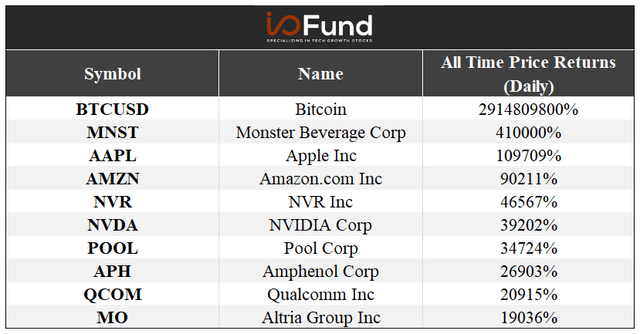

Bitcoin (BTC-USD) is the best resource in our lifetime. Given the history of Bitcoin’s awe-inspiring returns shown below, the most important question for every investor in the market today is whether this gravity can do it again.

The bears want you to focus on the -77% bear market, as they have for all four major drawdowns Bitcoin has experienced. You won’t hear a Bitcoin bear admit the truth, which is that Bitcoin has broken every stock performance record in 15 short years.

I/O fund (YCHARTS)

Nevertheless, there is important evidence showing how Bitcoin today is stronger than it was during the previous three withdrawals. The reason you don’t want to ignore this is because – despite steep +80% sell-offs, Bitcoin has regained new highs within 3.5 years, every time. Therefore, it is not only the size of gains that Bitcoin has made that places it as the #1 asset of all time, but it is the speed at which this is achieved that is also remarkable.

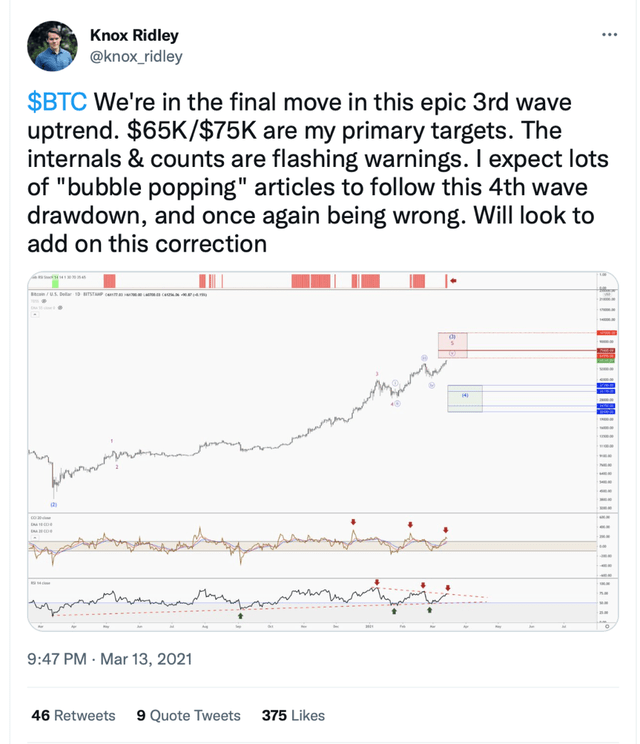

I want my readers to be armed with facts—not emotions— and what I present below is the culmination of a history of accurate calls which I have created previously on Bitcoin plus new quantum level information presented by Vincent Duchaine of Wealth Umbrella who has created an automated buy/sell signal in Bitcoin using chain metrics.

Twitter/I/O fund

Quick note on the crypto panic

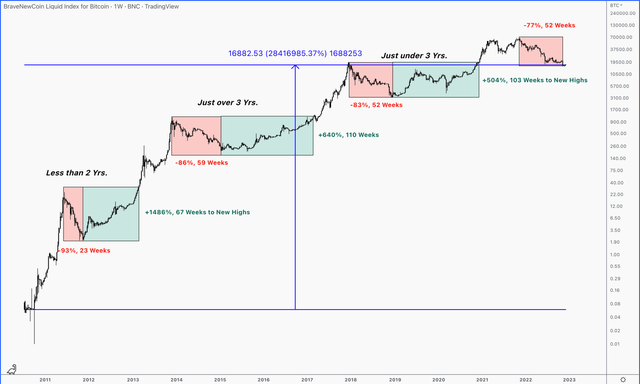

Below is an illustration of the history of how quickly Bitcoin has regained its all-time high in the previous withdrawals.

I/O fund

The average time period for Bitcoin to regain its all-time high is between two to three years, with 3.5 years being the maximum time. The chart shows the maximum drawdown for each bear cycle in red, followed by the recovery in green.

Remember, breaking even after an 80% drop requires a stock or asset to rise 400% just to break even. Qualcomm, for example, suffered a similar decline in the dot.com bust. It took approximately 20 years for QCOM to regain its 2000 height. Cisco, another late ’90s darling, has never recovered its 2000 peak.

This asset hit the market during the Great Financial Crisis, and unlike most tech companies in the market today, has not only survived an economic recession, but actually found traction in 2009 at a time when tech was faltering to withstand macro pressures.

On 3 Januaryrd, 2009, the bitcoin network was created when Satoshi Nakamoto mined the starting block of the Bitcoin chain. Within the coin base of this first block was the text “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”. This note refers to a headline published by The times and has been interpreted as both a time stamp and a commentary on the instability caused by fractional reserve banking systems. Bitcoin quietly set out to disrupt the centralized banking system, something previously unthinkable, at a time arguably more uncertain than the one we face today.

One reason for this is because Bitcoin has succeeded in becoming a global store of value – a feat that only a handful of currencies/commodities have achieved. Many have argued against this claim based on bitcoin’s volatility. Those making this claim fail to see that the two most popular stores of value – the US Dollar and Gold – have terrible results.

In 2022, gold peaked with a drawdown of ~45%. It took gold nearly 10 years to regain this high, which it was unable to sustain. As of today, gold is about 8% below its 2011 high. The US dollar is arguably the worst store of value. Since 1913, it has lost 97% of its purchasing power. Bitcoin, on the other hand, is up over 28 million percent since it began trading in 2010, recovering from bear cycles in a relatively short time. It’s no wonder that residents of emerging markets – facing extreme inflation – love this store of value.

This specific utility in Bitcoin is further supported when we correlate crypto adoption to a specific county’s level of corruption and/or monetary instability. For example, some of the counties with the highest crypto adoption are Ukraine, Russia, Argentina, Turkey, Brazil, just to name a few.

To these people, Bitcoin offers a safe and efficient exit from the turmoil of inflation and centralized manipulation of their personal income. Essentially, the lofty goal Satoshi Nakamoto established in the October 2008 White Paper, which was to offer an exit from the fiat system, has manifested today in real time.

Bitcoin’s Upcoming Rally – What You Need to Know

Bitcoin has no earnings reports, management overhauls or supply chain disruptions to affect its price. Whenever people come together in a codified arena and begin trading an asset with their instinct for safety as the primary driver, patterns develop throughout price history. Therefore, to find out what Bitcoin does next, we need to measure sentiment.

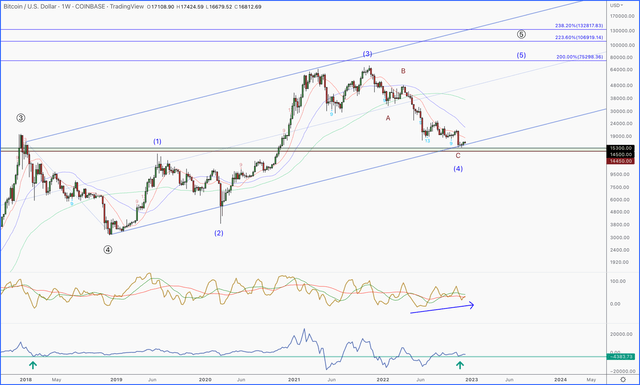

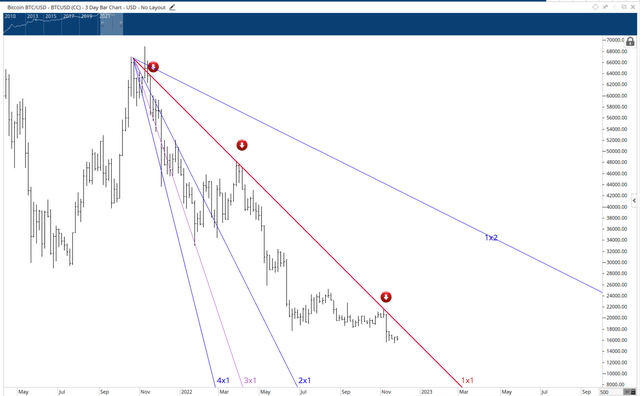

One of the easiest patterns to measure is an uptrend moving in 5 waves up, then correcting in a 3 wave pattern down. When we get 5 waves up and 3 down, we repeat this pattern in a fractal way. As of now, since the 2018 low, we only have 4 waves in place, which means we have one more 5th wave pressure before the larger bull cycle ends.

I/O fund

A couple of points I would like to make about the chart above. We have from the 2021 peak a very complete and completed correction pattern. Recently, Bitcoin pushed down on the FTX (FTT-USD) scandal, which has now given us the first bullish divergence on a weekly chart since the 2021 bear market began. This is when the price goes lower with less speed. This tends to mark the end of major drawdowns.

Another of my favorite patterns can be found in the detrended oscillator below. This is simply measuring the difference between two moving averages, and when set to a seven-year period, it tends to give very interesting signals. Most importantly, the oscillator is currently finding support at the 2018 low, and the oscillator is now building a new uptrend. When a new uptrend builds, this oscillator will tend to build this new uptrend on previous crash lows, which are playing out now.

The chart below shows a general early warning sign of when the trend is changing. The red line running down the chart is a 45 degree angle, and has stopped every attempt at a recovery since 2021. When we regain this angle, it will mark an early and meaningful trend change. As of now, that level is around $18,100.

I/O fund

Analysis of the chain

This conclusion is further supported by on-chain analysis, which is a field of study that ignores price action, and instead looks at the fundamentals, utility and transaction activity of cryptocurrency and blockchain data.

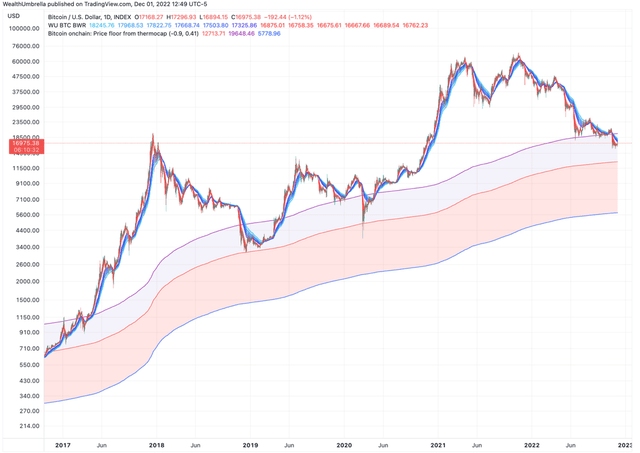

Dr. Vincent Duchaine of Wealth Umbrella is an AI and machine learning engineer. His team spent months analyzing chain metrics in the Bitcoin ecosystem to create an automated risk-on/risk-off signal for retail investors. Vincent stated that most of the chains his team analyzed point to Bitcoin forming a major bottom.

The level on most calculations is that we could have already seen it at $15.5000, while other calculations suggest that we could see the price drop to $13.2000 in a final top down.

Here are some examples of chain calculations from Wealth Umbrella that provide rare signals that have only been seen around major lows:

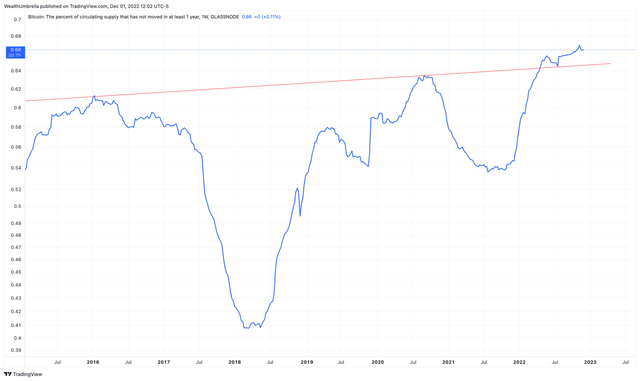

Shown belowthe supply of bitcoin has not moved in more than a year and was barely affected by the FTX scandal. Even after the latest drop, Bitcoin supply is hovering at a near-record high of around 67%, and again this level hasn’t moved in over a year

Wealth umbrella

Previous major events, such as Mt. Gox debacle in February 2014, or the price collapse in November 2018, saw a decline in the 2-3% range on this metric. Meanwhile, the FTX scare only reduced this value by 0.81%. Ultimately, what this tells us is that fewer market participants are now willing to sell their Bitcoin, which has historically put a floor under Bitcoin.

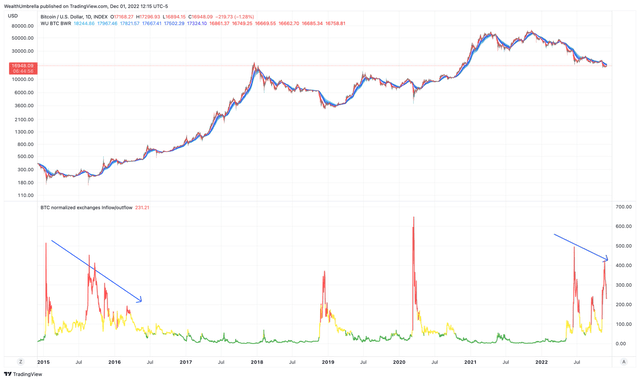

The recent low was also accompanied by another significant increase of outflows from exchanges. Despite a lower price low, this indicator did not make a new high, which shows that fewer and fewer people are now willing to sell Bitcoin.

Wealth umbrella

This type of behavior has been observed at the bottom (especially in 2015). It’s also worth noting that the June peak was also in the same area as the trough in 2015 and higher than what we saw in 2018.

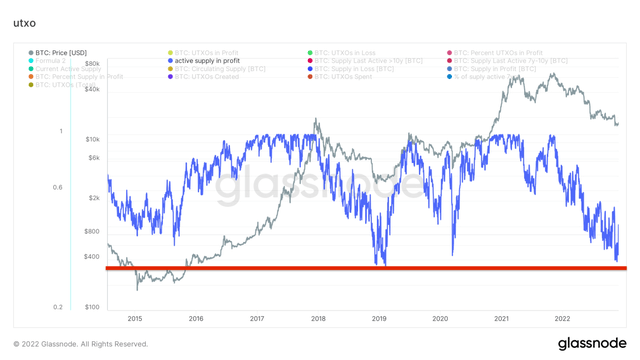

Another interesting calculation is Bitcoin percentage of the offer held in surplus for the addresses that were last active 7 years. This is useful for mitigating the effects of prolonged HODLers or lost supply. Here we can see that we are now approaching the all-time low of ~30% of supply held in profit, which is the kind of capitulation that marks meaningful lows.

Wealth umbrella

Overall, most on-chain metrics from all layers of the Bitcoin ecosystem provide infrequent readings that tend to flash around major bottoms. Until these calculations are restored, it is difficult to say with accuracy whether the bottom is already in or whether we have more to go in this correction.

One data set that suggests we could go lower is the ratio of Bitcoin’s market cap to thermocap. Thermocap is a more realistic means of calculating the size of Bitcoin, rather than using Market Cap. First introduced by Nic Carter in 2018, it is the cumulative sum of USD earnings that miners have generated to secure the Bitcoin network. This can be calculated by summing the value of each of the roughly 19 million existing Bitcoins at the price they were issued. Using this metric, lost coins and static coins, such as the 800,000 coins mined by the mysterious Satoshi Nakamoto, are counted in the total supply at the price they were originally mined.

Wealth Umbrella found that the price of Bitcoin relative to Thermocap is a great method of identifying high value zones that tend to highlight lows. We have entered that zone recently, which is rare, but it is also possible to support another low deeper into this value zone. However, this indicator, based on previous extreme declines, suggests that the current decline could see us head towards the $13,000 region before entering the meaningful low.

Wealth umbrella

Conclusion

The conclusion is that the use of Bitcoin beyond retail interest is growing. We are seeing more and more institutional investors, economies and businesses adopting Bitcoin. Although we are in 4th bear rides in Bitcoins history, the previous 3 cycles suggest where we are is a rare buying opportunity. There is plenty of evidence to support the $15,500 level is either a major low or very close to a major low. Both the technical and chain analysis support this. As Bitcoin continues to integrate into the global economy, we expect both volatility and epic returns to calm down. For now, we are content to buy Bitcoin at these lows with a long-term mindset.