Bitcoin will be good again

Join the most important conversation in crypto and web3! Secure your place today

Good morning. Here’s what happens:

Prices: Bitcoin is pushing past $28,000, but may face some resistance at $30,000.

Insight: What is driving the recent surge in bitcoin’s price? Investors are looking for a safer bet in crypto, but liquidity remains an issue.

Prices

CoinDesk Market Index (CMI)

1205

+26.6 2.3%

Bitcoin (BTC)

$28,006

+825.2 3.0%

Ethereum (ETH)

$1780

−2.8 0.2%

S&P 500

3,916.64

−43.6 1.1%

Gold

$1,980

+9.9 0.5%

Nikkei 225

27,333.79

+323.2 1.2%

BTC/ETH prices per CoinDesk indices, as of 07:00 ET (11:00 UTC)

Bitcoin escapes its banking woes

Good morning Asia.

Bitcoin continues its demolition as Asia begins its workday.

The world’s largest digital asset by market capitalization recently pushed past $28,000, gaining 3% in the past 24 hours.

Remember how the decline of crypto-friendly banks was meant to stifle crypto?

That narrative did not last long. It turns out that after the first chapter of the book, where Silvergate and Signature die, there is a systematic crisis of confidence in the global financial system that has revived an appetite for risky assets as TradFi liquidity dries up – despite unstable fiat pipelines.

In Asia, things are a little different.

David Bachelier, Asia-Pacific managing director of Flowdesk, points out that Singapore and the rest of Asia were not really affected by the collapse of Silicon Valley Bank and the rest of the US banking crisis, but it is still uncertain whether the banks will step up. in and try to fill the gap.

“SVB was a key player in providing financing and other services to high-growth companies that many Asian banks do not offer,” he told CoinDesk in a note. “This is a critical moment for the venture industry in Asia, with an opportunity to fill the gap left by the collapse of US players.”

Bachelier highlights that while there may not be an Asian SVB anytime soon, one thing these banks are doing is stepping up and offering fiat pipelines for crypto.

“The recent announcement by Coinbase highlighting bank partnerships in Singapore is also interesting to note as it highlights a US company expanding further into the Asian region, suggesting the relatively minimal disruption in response to these banking crises,” he said.

The question, however, is how long will this rally last?

Joe DiPasquale, CEO of digital asset manager BitBull Capital says bitcoin is preparing to test $30,000, but fundamentally there may not be support there.

“From a technical aspect, the current price action is overheated and we could see a correction towards $25K in the near term. The biggest market mover will most likely be the FOMC, in about 3 days, where the majority of analysts believe we will see a rise of 25 bps at best,” DiPasquale told CoinDesk via email.

So maybe we are not going to make 1 million dollar bitcoin by June.

Biggest winners

Biggest losers

Insight

Crypto Investors’ “Flight to Quality”

In the days following the closure of Silvergate Bank, the collapse of Silicon Valley Bank, and then Signature Bank, many concluded that the only place crypto prices could go was down. But then the Fed intervened in the sector (just don’t call it a bailout) and bitcoin seems to be on its way back to the moon, starting the week at just over $28,000, up 27% over the past week.

One may wonder how this is possible when the market is still predicting that interest rates will rise in March and later in May.

It is the Bank Term Funding Program (BTFP) for the win.

While some, such as former BitMEX CEO Arthur Hayes, have called the BTFP a greater stimulus target for bitcoin than Covid-induced quantitative easing, reduced liquidity appears to be a knock-on effect.

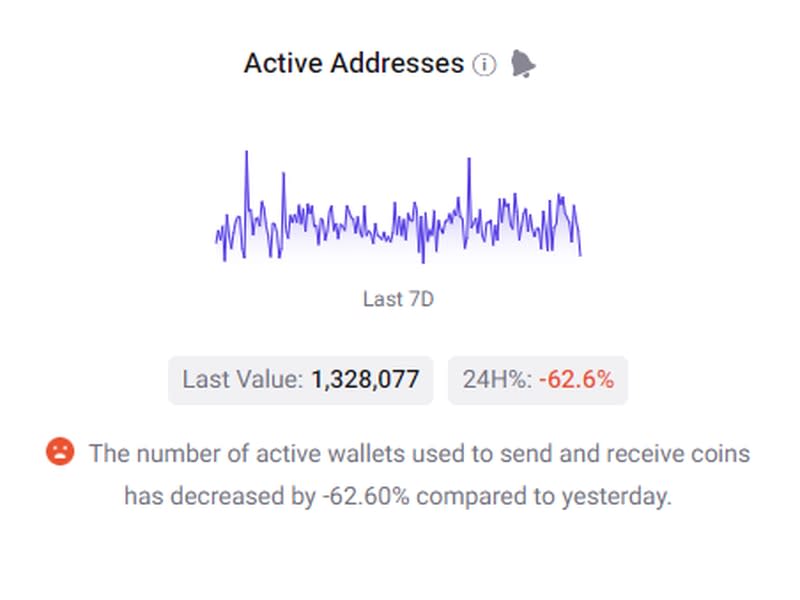

Data from CryptoQuant suggests the market is as dry as it gets. Transfer volume, active addresses and transactions are reduced by two digits.

Crypto analytics firm Kaiko has been concerned about the lack of liquidity in its order books since February.

“This is tremendous buying pressure on the markets,” said Kaiko research director Clara Medalie during a recent appearance on CoinDesk TV. “As the markets are not that liquid, significant buying pressure is likely to have a significant impact on prices as a whole.”

However, the extent to which liquidity is a problem is up for debate.

BitMEX acting CEO Stephan Lutz downplayed concerns in a recent interview with CoinDesk. “Bitcoin’s liquidity is still very solid and healthy,” he said. “We have not seen people reduce their trading volumes, just the other way around, which is probably due to the fact that many of our loyal and large customers are Bitcoiners.”

In a recent report that the exchange released on Monday, BitMEX plays out a scenario in which risk appetite recovers as the Fed swings on inflation. But this was written before BTFP came into the picture.

“Even if you have another rate hike, [BTFP] just flooding the market with liquidity again, he said. “Quantitative Easing Is Back in Another Disguise.”

While Lutz points out that it will still be difficult to sell a large amount of bitcoin without moving the market, sophisticated market participants do not do this and have algorithms to calculate how to split the order to close the deal without affecting the price.

“If they really want to liquidate … that’s not a problem,” he said.

Lutz argues that bitcoin’s recent rise is a “flight to quality,” almost paralleling what you would see in traditional markets in a time of crisis.

“You’re seeing stablecoin anxiety. People are getting out of the stable and back into bitcoin,” Lutz said, noting that the latest trading patterns he’s seen involve creating synthetic US dollar-equivalent positions in derivatives markets via shorts.

The BitMex clientele – Bitcoiners at heart – would rather go into altcoins than US dollar stablecoins.

Liquidity doesn’t just refer to the market’s ability to absorb movements back and forth to bitcoin. It’s also about fiat to crypto pipes.

Lutz said that BitMex was not affected by the recent US tech and crypto banking crisis, mainly because BitMex is not in the US and it does not offer fiat ramps.

But this was really expected, since the exchange has always been disconnected from the fiat system – a strategy that has avoided the panic over liquidity that some of its competitors were cursed with.

Important events.

Paris Blockchain Week 2023

NFT Los Angeles 2023

09:15 HKT/SGT(1:15 UTC) People’s Bank of China interest rate decision

CoinDesk TV

In case you missed it, here’s the latest episode of “First Mover” on CoinDesk TV:

Silicon Valley Bank’s former parent company has filed for bankruptcy; Bitcoin flirts with $27K

Silicon Valley Bank’s former parent company, SVB Financial Group (SIVB), filed for Chapter 11 bankruptcy protection on Friday in the US Bankruptcy Court for the Southern District of New York. Former New York State Department of Financial Services Superintendent Maria Vullo shared her reaction. Separately, bitcoin (BTC) is flirting with $27,000 Coinbase Institutional Research Head of Research David Duong discusses his crypto market analysis.

Headings

Polygon partners with Salesforce for NFT-based loyalty program: Salesforce’s partnership with the blockchain platform marks another major company’s investment in customer engagement initiatives using Web3 technologies.

How Effective Altruism Power Brokers Helped Make Sam Bankman-Fried: Academic philosophers covered up Sam Bankman-Fried’s moral failings as long ago as 2018—and reaped the rewards.

Bitcoin is a clear winner of the US banking crisis: The narratives surrounding bank failures, stablecoins and interest rate hikes seem strong enough to drive the price of bitcoin, says CoinDesk’s George Kaloudis.

SVB collapse shows root in US banking and dollar: Bank balances and money itself are actually illusions. Reserve co-founder Nevin Freeman is considering an alternative.

The truth about artificial intelligence and creativity: Artificial intelligence allows creators to be creative, but even sophisticated AIs are really just an advanced form or copycat, says David Z. Morris. This feature is part of CoinDesk’s Culture Week.