Bitcoin: Why the Low Social Activity Around the Leading Coin Should Worry You

- Bitcoin has had low social dominance in recent weeks.

- Some analysts speculate that the price could fall further.

Data from the leading analysis platform in the chain Sentiment revealed that recent weeks had been characterized by low social activity for the king coin Bitcoin [BTC]. BTC’s social dominance remained low as traders continued to shy away from the leading coin in favor of altcoins.

Read Bitcoins [BTC] Price prediction 2022-2023

Consider this, in the last week, Dogecoins [DOGE] The price rose by 30% while BTC’s price only grew by 2%.

At the time of writing, BTC’s social dominance health line was -6,196, indicating that the discussions around the leading coin were below average. This also suggested increased interest in altcoins and a possibility that BTC’s price could remain significantly volatile in the meantime.

It is commonplace that there is a close relationship between a crypto asset’s social activity and price activity. As noted by Santiment, “one of the most important ingredients for ALL prices to rise is a high BTC social dominance.” As such, the lack of growth in BTC’s social dominance may culminate in little or no growth in price.

But what else do we see on the chain?

Support for shocks

At press time, BTC was still trading within a narrow range, holding just above the $16,000 price mark. The price rose by just 3% in the last 24 hours, while trading volume rose by just 1%.

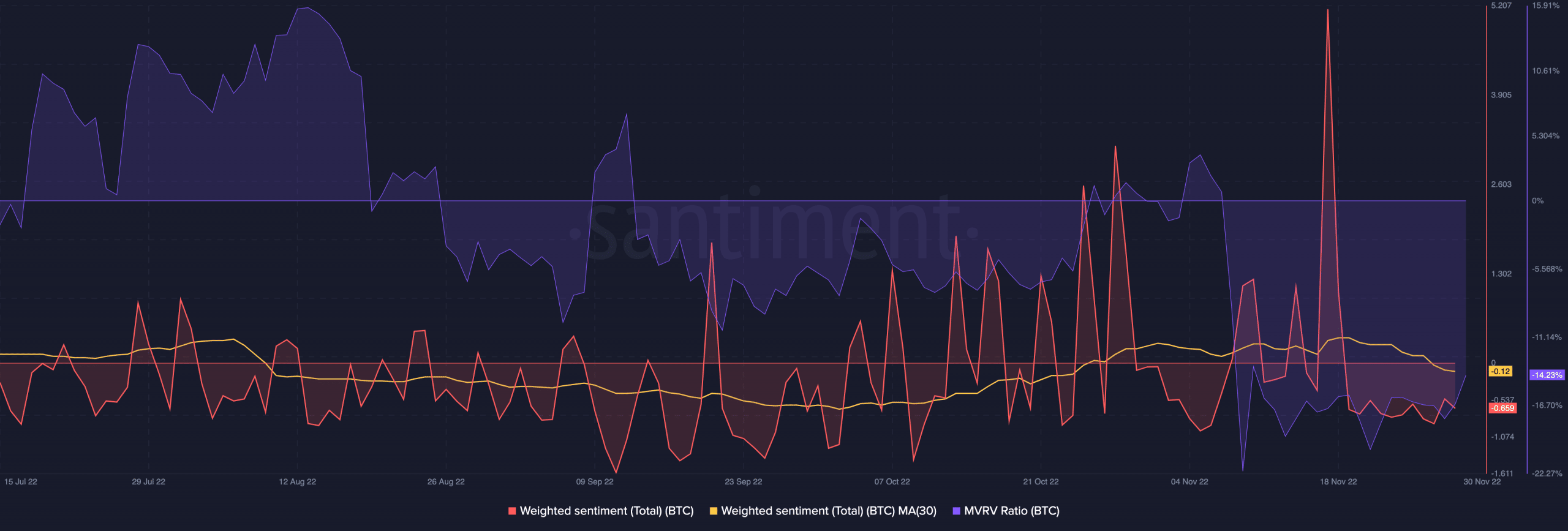

In addition to low social discussions, data from Santiment showed that investors’ bias towards BTC was negative. The asset’s weighted sentiment turned from positive to negative on November 19 and has since been in negative territory.

At press time, BTC’s weighted sentiment was at -0.659. On a 30-day moving average, this was -0.12.

This showed that after the huge fall in asset value following FTX’s implosion, R&D in the market caused many investors to lose their conviction of a positive price increase in the interim.

In addition to this, holding BTC has been a largely unprofitable venture for many since the collapse of FTX. Per data from Santiment, BTC’s MVRV ratio has been negative since November 8.

This indicated that most holders were selling below their cost base, thereby incurring losses on their investments. At press time, BTC’s MVRV ratio stood at -14.23%.

Source: Sentiment

The head is restless

While the rest of the market expects BTC’s price to pick up as the market recovers from FTX’s unexpected collapse, some analysts believe the leading coin could see a further price decline.

CryptoQuant analyst Onchain Edge opined that BTC’s price could “fall in the next 10 days.” According to Onchain Edge, BTC’s Network Value to Transaction (NVT) ratio “flashes a warning signal when it crosses above the 2.20 level.” The analyst found BTC’s NVT value to be 2.44 and could go as high as 2.77.

Another CryptoQuant analyst abramchart considered BTC’s Taker Buy Sales Volume/Ratio indicator along with its 250-day moving average and concluded that,

“When the value rises above 1.02, there are sell areas and buy areas when the value is less than 0.98. Now the indicator is moving above 1.02 and touched 1.05 momentarily, so I expect selling to prevail and there are better areas to buy than the current ones.”

Source: CryptoQuant