Bitcoin: Why Good Things May Not Come To Everyone Who Waits, Especially When BTC Hits…

- Updated information on the chain showed that BTC holders had plunged into losses over the past five years

- Still, the Bitcoin state reflected an undervalued position

Over the past decade, Bitcoin has [BTC] remained one of the most profitable assets to hold despite a series of price declines. Although that may no longer be the case for active traders of the royal coin who have held for the past five years, especially as average profits hit the neutral zone on June 9.

Read Bitcoins [BTC] Price prediction 2023-2024

According to Santiment, the struggle for long-term revival has now been met with another challenge. This was because the chain’s analytics platform agreed with a Reddit post that five-year holders were now in losses.

To put exact figures in, Santiment revealed that the average return during the period was -34%.

📉 Inspired by #Subreddit r/data is beautiful reporting like 5 years #Bitcoin holders are now under water… @santimentfeed reveals that the average active 5-year trader has a return of -34%. The return first went below 0% on 9 June. pic.twitter.com/bbRvXSXIpD

— Santiment (@santimentfeed) 17 December 2022

No assistance available for underwater exit

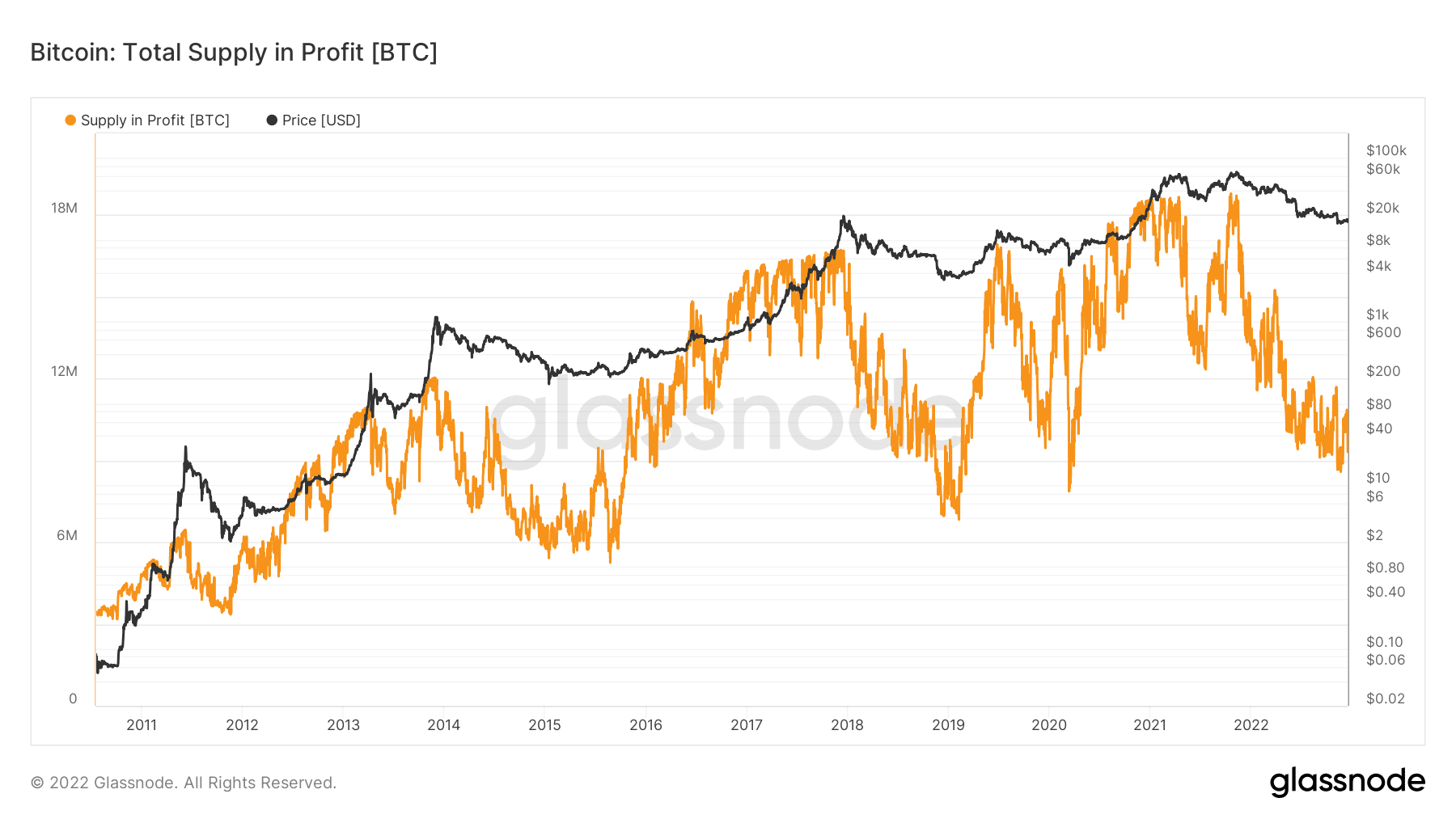

Besides the declining loyalty score, Bitcoin also collapsed in its general push for compensation. Glassnode data revealed that at press time offer in profit was 10.71 million BTC.

According to the information shown, this represented a decline from the value on 7 November even in the wake of FTX brouhaha. As a result, BTC trade below $17,000, meant that the price was below the value the average holder collected.

Source: Glassnode

Still, short-term respite existed for holders since a couple of analysts proposed that the BTC bottom was either inside or extremely close. At the same time, BTC may find it challenging to get holders out of the aforementioned double-digit decline.

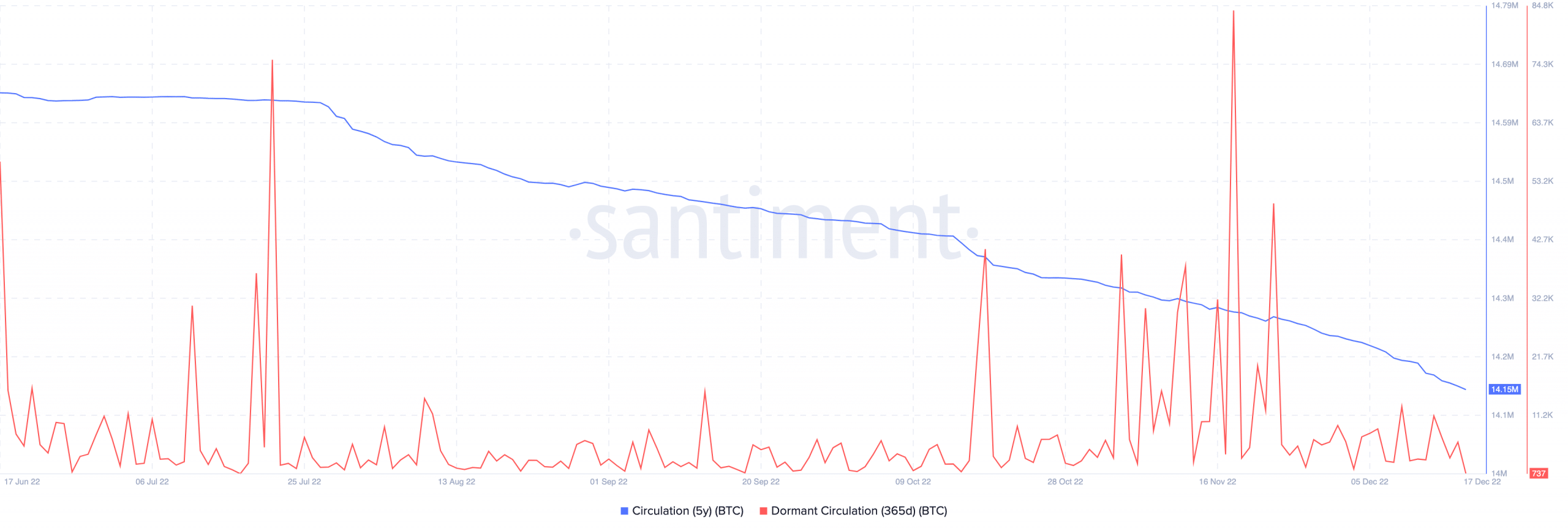

Elsewhere, Bitcoin’s long-term circulation was scarred with deformations. This was because data from Santiment showed that the five-year coin distribution withdrew to 14.15 million. One explanation for this state of affairs was that the offer was not at its best. In addition, coins used in the spell rejected by changing hands several times.

In the shorter period, there was a swing competition for long-term investors who rarely traded their holdings. At the time of writing, the 365-day dormant circulation was down to 737. The simplification translated into a refusal to sell in the face of diminishing gains and a tough market climate.

Source: Sentiment

When will the deadline return?

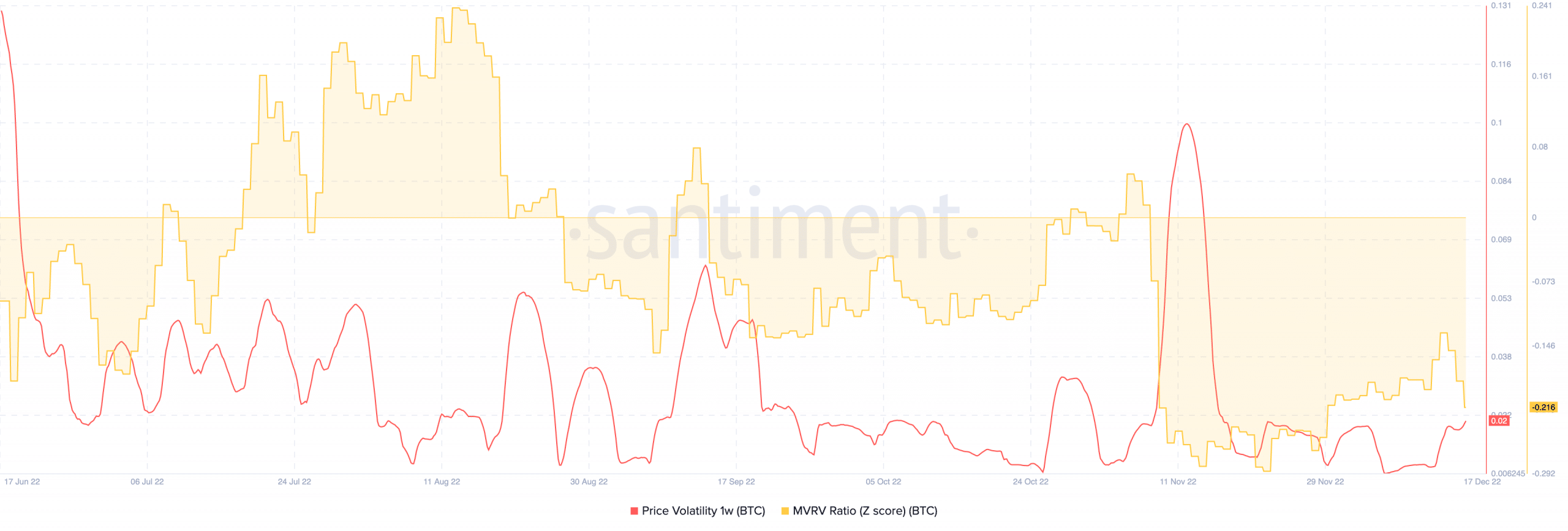

Bitcoin’s volatility dragged on and languished in extremely low regions. However, information is available at press time indicated that the rise was modest at 0.02. In particular, a rising volatility index, if sustained, may indicate an opportunity to buy.

However, the same situation is mostly accompanied by market fears. Therefore, it may be preferable to tread carefully before scooping up BTC. For Market Value to Realized Value (MVRV) z-score, Santiment showed that it fell to -0.216.

Without going too far, this score provides an assessment of the undervalued or overvalued state of BTC relative to its market value and realized. By its stance, it depicted a possible chance to find a buying strategy.

Source: Sentiment