Bitcoin: Why BTC’s Monetary Policy Connection Shouldn’t Be Overlooked

- Bitcoin cannot escape its correlation from traditional markets

- Short-term sentiment was caught between waning optimism and increasing gloom

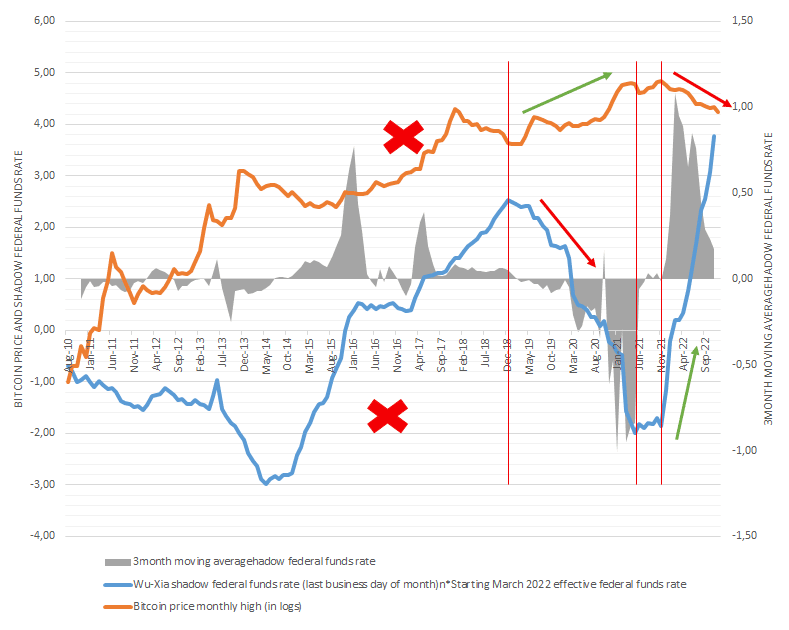

Bitcoin [BTC] has had a connection to monetary policy since the advent of the new market cycle, according to Quantum Economics expert and chain analyst Jan Wüstenfeld. In its December 4 CryptoQuant releaseWüstenfeld believed BTC’s negative sentiment, accompanied by a declining economic outlook, was no coincidence.

Read Bitcoins [BTC] Price prediction 2023-2024

According to him, BTC and the traditional market were not aligned until the current bear market. But the fact that multiple institutions were now involved in the coin meant that escaping the correlation was inevitable. At the same time, the increase in interest rates on federal funds also played its part.

Source: CryptoQuant

It is no longer in retail control

The analyst also believed that the market was later freed from the control of private investors. While justifying his point of view, Wüstenfeld said,

“We have seen more widespread use of Bitcoin in recent years. Futures markets are being introduced, institutional interest is increasing, etc. So naturally, Bitcoin has become more connected to the traditional financial markets and is no longer just driven by retail investments.”

Of course Bitcoin had correlated with the stock market at some point. Indeed, in some cases the royalties had also reacted to the US inflation reports. However, the analyst’s estimate was rooted in a long-term context.

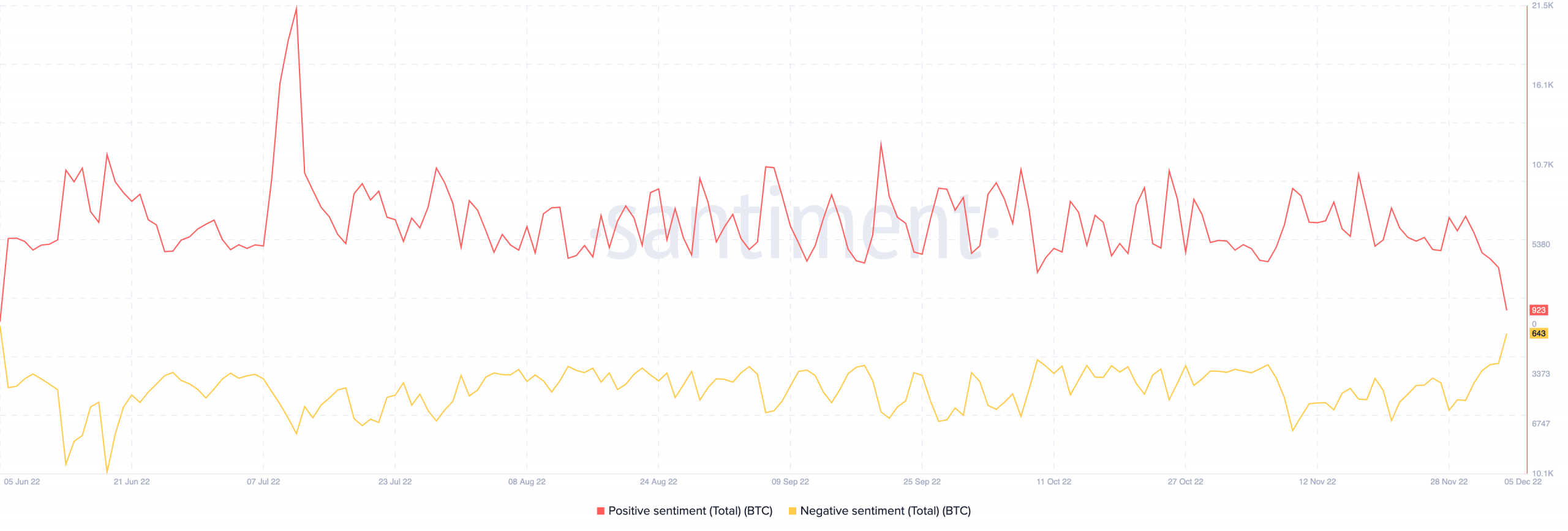

Despite the belief that Bitcoin would remain relevant for a long time, data on the chain showed that the current bias was negative. According to Santiment, the positive feeling offset the negative, at 923 and 643 respectively.

However, the chart showed that negative sentiment was on the rise, while positive sentiment was declining. Therefore, there was a chance that short-term bullish expectations diverged from today’s orders.

Source: Sentiment

Additionally, investors’ recent action was less likely to trigger a significant reaction from BTC. This was due to the state of the exchange data in the week just ended.

According to Glassnode, there was a close conversation between the central entrance and exit. The on-chain monitoring platform reported that outflows were $3.3 billion, while inflows were $3.2 billion.

🚨 Weekly exchange flow on the chain 🚨#Bitcoin $BTC

➡️ $3.2 billion in

⬅️ 3.3 billion dollars out

📉 Net flow: -$162.3 million#Ethereum $ETH

➡️ $2.4 billion in

⬅️ 2.5 billion dollars out

📉 Net flow: -$76.7 million#Tether (ERC20) USD USD

➡️ $3.9 billion in

⬅️ 3.7 billion dollars out

📈 Net flow: +$201.9 million— glassnode alerts (@glassnodealerts) 5 December 2022

With a relatively minimal difference, it meant that Bitcoin did not experience massive selling pressure. In the same way, buying momentum did not significantly exceed the trade-offs. So it’s no surprise that the king only coins recorded an increase of 1.77% in the last 24 hours.

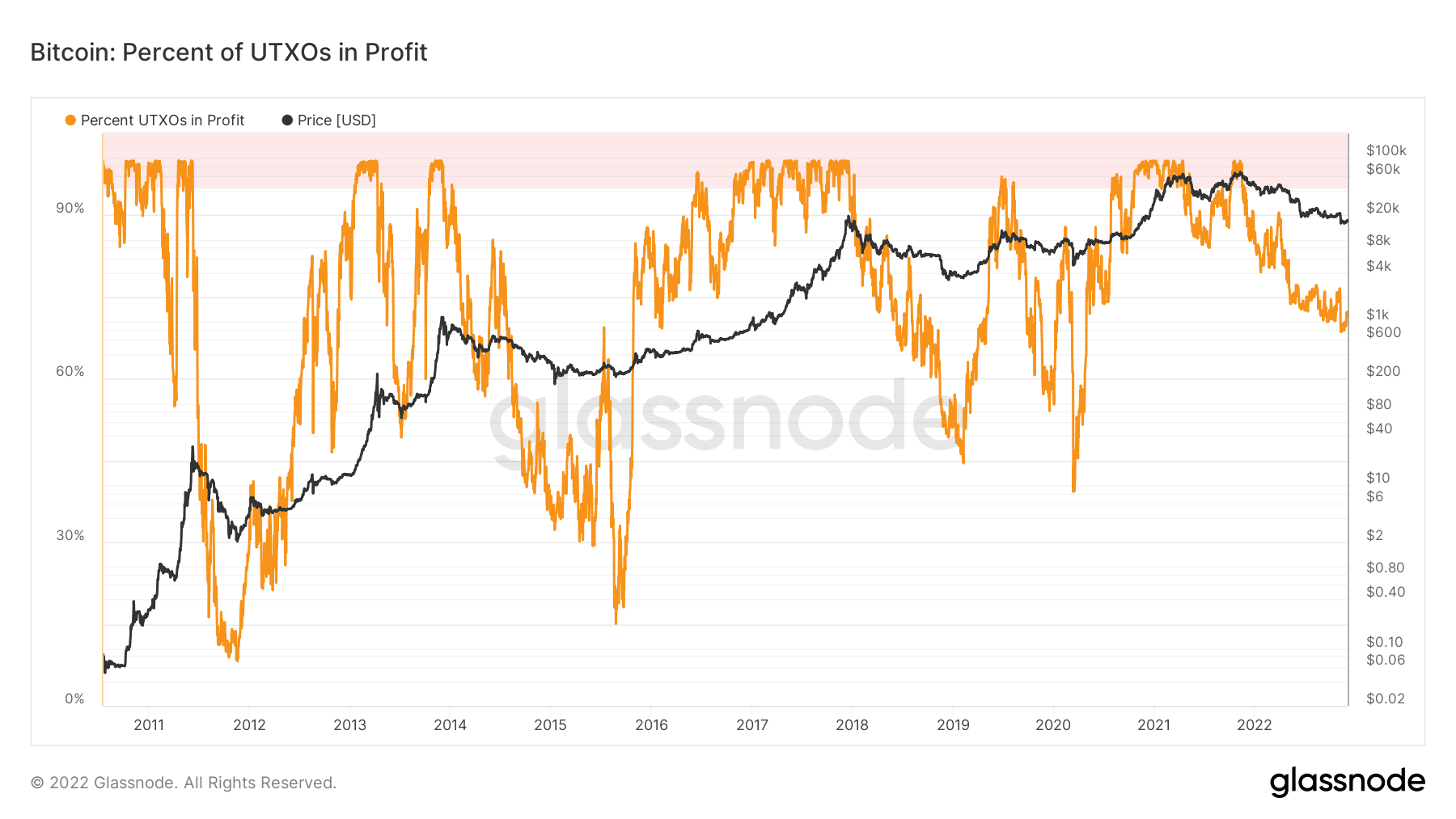

Bitcoin is here for a long time

On further prospects, Glassnode’s data knew that a good percentage of long-term owners still had a profit. This was because of the disclosures made by Unspent Transaction Outputs (UTXO). At press time, the UTXO percentage in results was 69.94%. Still, that didn’t negate the fact that newer investors saw their holdings plummet in value.

Source: Glassnode