Bitcoin Whales Behind Huge Price Swings: Here’s How!

Have you ever wondered who is behind the huge Bitcoin price swings? The answer lies in a group of individuals or entities known as Bitcoin whales.

These individuals or organizations own large amounts of Bitcoin, allowing them to significantly influence market trends.

Characteristics of Bitcoin whales

Two main features define a Bitcoin whale:

Wealth concentration

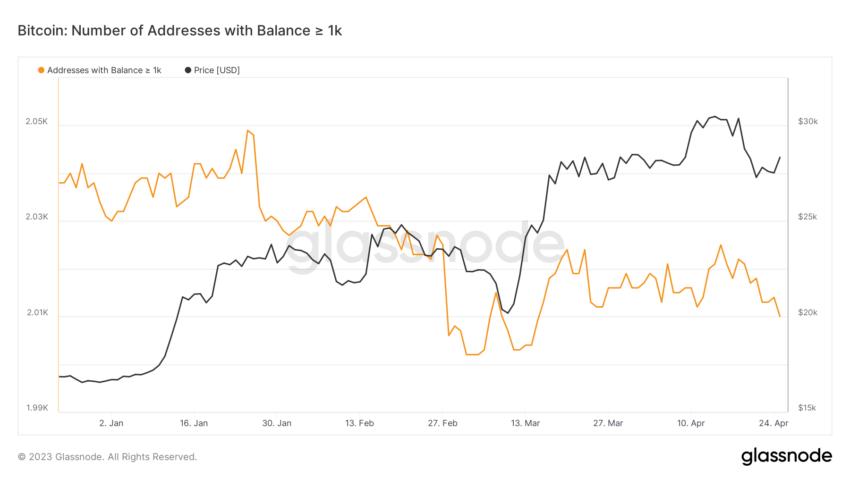

Whales usually own a large number of BTC tokens, which gives them the power to influence the market through their trading activities.

In some cases, a single whale can own thousands of BTC tokens, which translates into millions of dollars in value.

Anonymity

Bitcoin whales often keep a low profile and prefer anonymity. This makes it challenging to identify and track their activities, allowing them to easily maneuver the market.

How whales affect prices

Whales can cause significant price fluctuations in Bitcoin through two main methods:

Large buy and sell orders

Since whales hold significant amounts of Bitcoin, their large buy and sell orders can cause significant price swings.

For example, a whale placing a massive sell order can cause a sudden drop in the Bitcoin price, while a large buy order can cause the BTC price to rise.

Market manipulation

Market manipulation is another tactic used by whales to influence Bitcoin prices. Some common manipulation tactics include:

Pumping and dumping arrangements

In a pump-and-dump scheme, whales buy large amounts of Bitcoin, driving up the price. When the price reaches a certain threshold, they quickly sell off their holdings, causing the price to plummet.

This allows them to profit from the price increase while leaving unsuspecting investors with a loss.

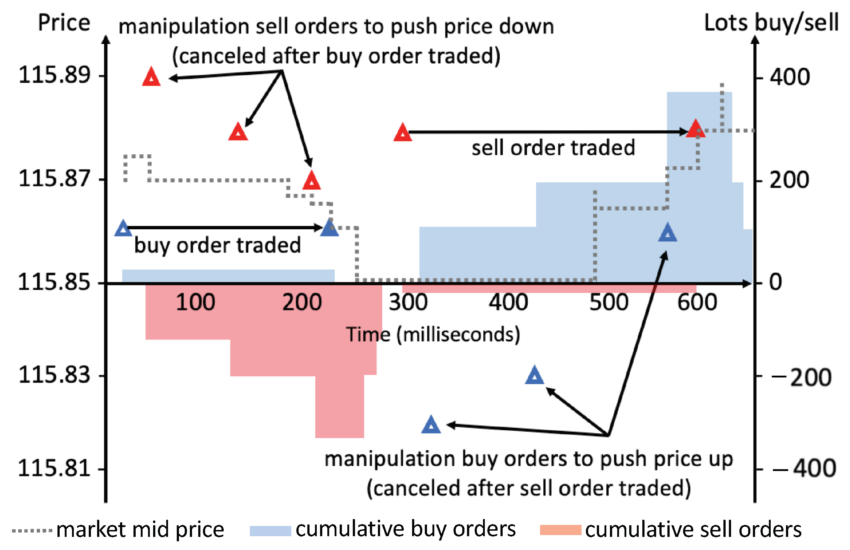

Spoofing

Spoofing involves entering fake buy or sell orders to create the illusion of high demand or supply. Whales can use this tactic to manipulate market sentiment and get other traders to trade in their favor.

Once the desired price movement is achieved, they cancel the false orders and profit from the market reaction.

Impacts of Bitcoin whale activity on the market

Whale activity can have several effects on the Bitcoin price, such as:

Volatility

The whale’s actions can result in sudden and dramatic price swings, leading to increased market volatility. This can create both opportunities and risks for traders and investors.

Market confidence

Whale-induced price fluctuations can negatively affect market confidence, especially when manipulation tactics are involved. This can lead to a reluctance to invest in Bitcoin, affecting its long-term growth potential.

How to protect yourself from whale-induced Bitcoin price swings

While it is impossible to control the whales’ actions, there are steps investors can take to protect themselves from their influence:

Diversification

Spreading investments across multiple cryptocurrencies and other asset classes can help reduce the risk associated with whale-induced Bitcoin price fluctuations. By diversifying portfolios, investors reduce the impact of any single market event.

Regular monitoring and analysis

Paying close attention to market trends and news can help investors identify potential whale activity. Analyzing market data, such as trading volume and order books, can also provide insight into whale movements.

Long-term investment strategy

Adopting a long-term investment approach can help protect investors from short-term price fluctuations caused by Bitcoin whales. By focusing on the long-term growth potential of Bitcoin, investors can be less affected by temporary price fluctuations.

Sums it all up

Whales have significant power in the cryptocurrency market, and their actions can cause significant price swings.

By understanding their tactics and using protective measures, investors can minimize the impact of whale-induced price fluctuations on their investments.

Common questions

A Bitcoin whale is a person or organization that owns a large amount of Bitcoin, giving them the power to significantly influence market trends.

Bitcoin whales can cause price fluctuations through large buy and sell orders and market manipulation tactics, such as pump and dump schemes and spoofing.

You can protect yourself by diversifying your investments, regularly monitoring market trends and data, and adopting a long-term investment strategy.

Although it is difficult to definitively identify Bitcoin whales, monitoring market data and trends can provide insight into their activities.

Not necessarily. While some whales engage in market manipulation, others may simply be long-term investors who have amassed a large amount of Bitcoin.

Disclaimer

In line with Trust Project guidelines, this price analysis article is intended for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, objective reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.