Bitcoin was a winner during the US banking crisis, but illiquidity prevents it from being a USD hedge

Join the most important conversation in crypto and web3! Secure your place today

If it was a bitcoin marketing team, the last month would be as good as it gets for them.

Confidence in banks in the US and Europe has been decimated and people are looking for an alternative to protect the dollar. Enter bitcoin (BTC), an asset created for this purpose—a truly decentralized form of money that cannot be controlled by any entity.

Conor Ryder is a research analyst at a crypto data firm Kaiko.

At first glance, the recent banking crisis seems like the perfect catalyst for a BTC price rally. But digging a little deeper into the reasons for the move points us in the direction of liquidity, and more specifically the lack of it.

While the narrative makes sense and has resulted in many people looking for bitcoin at exactly the same time, illiquidity has almost certainly been a strong price driver.

I’ll take a moment here to congratulate the BTC maxis. They have had little to cheer about lately. But this is the moment bitcoin was created for, and it is the first time since its inception that there has been a crisis of confidence in the banking system.

See also: Bank Consolidation Threatens Freedom, Makes Case for Bitcoin

For the first time since 2008, people are starting to realize that the US dollars (USD) they hold are more at risk than expected, making BTC look quite attractive as a percentage of a broader portfolio.

But while these types of narratives meant to explain or predict price movements are powerful, the current market structure cannot be ignored.

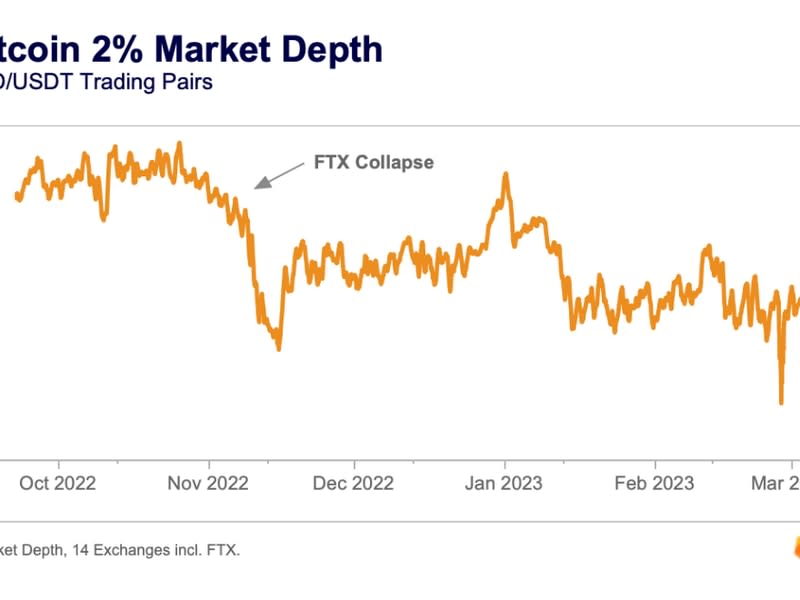

When liquidity is low in any financial market, volatility is high in both directions. Prices have less support on both the downside and the upside. In this case, the narrative of bitcoin as a hedge against financial disaster gave BTC the push it needed. But there was little upside resistance to the hurdle above: BTC market depth, the number of orders waiting to be filled in an order book, hit a 10-month low this week — lower than levels seen since the collapse of FTX exchange and sister firm Alameda Research.

The fall after FTX is something we call the “Alameda Gap”, which explains how the liquidity of the crypto market evaporated in the absence of one of the biggest market makers for digital assets. That liquidity gap has not recovered and continues to set new lows in the wake of the Silvergate and Signature banking crises that cut off market makers from key USD payment rails. When market makers face these kinds of unprecedented operational challenges, their reaction is to pull liquidity from their order books until they get some clarity.

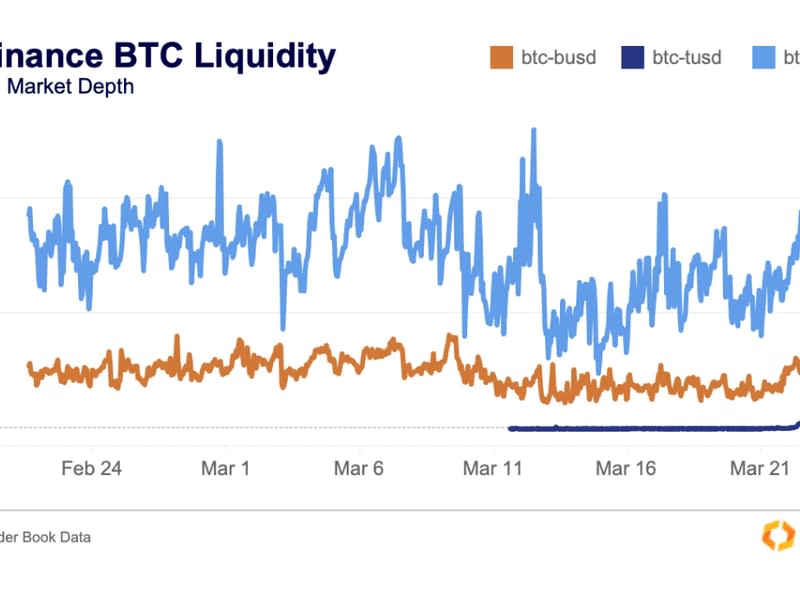

Another word of caution is the reintroduction of fees on Binance’s BTC-USDT and BTC-BUSD trading pairs. We have noticed a sharp drop in liquidity on these pairs in recent days as fees have been reintroduced. A fee means that market participants on these pairs can no longer justify their wide spreads (the difference in price between buy and sell), meaning they have to offer tighter spreads that affect their profitability.

As a result, liquidity on the BTC-USDT pair on Binance, the most liquid crypto pair, fell 70% overnight. The only zero fee pair is now BTC-TUSD. If liquidity does not flow into that pair, the order books could be further depleted in the coming weeks.

All this means is that it now requires less and less “size” to move the price of BTC, potentially causing volatility as more traders are able to influence prices. Fortunately for investors, the crisis of confidence in the banks led to a strong buying pressure, which has pushed the price upwards so far.

See also: US Banking Cutoff opens up opportunities for crypto in Europe | Conor Ryder

But the lack of support on the upside also applies to the downside, meaning we need to be just as wary of an outsized move down in the coming weeks. All this to say that it is too early for a bitcoin maxi victory lap.

While rotation of capital into BTC certainly makes sense given everything we’ve seen in traditional markets over the past two weeks, illiquidity arguably played the biggest role in the crypto wave.