Bitcoin Volume Spikes In UK – Bitcoin Magazine

Below is a direct excerpt from Marty’s Bent Issue #1269: “Interesting reaction from the UK” Sign up for the newsletter here.

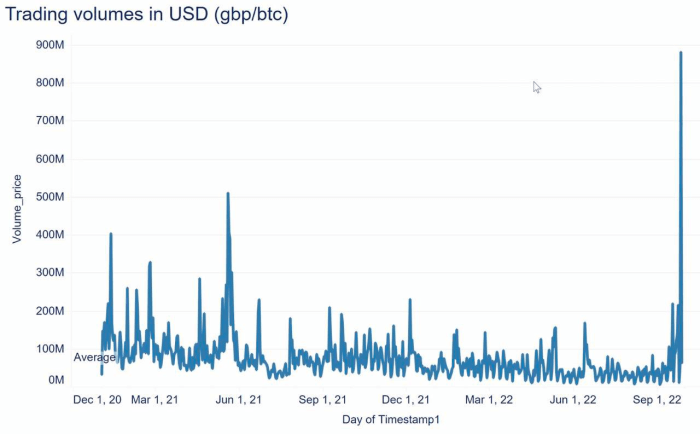

via Coin shares

Here is a chart that has been lingering in my mind throughout the week. It was shared by the team at Coinshares and highlights bitcoin trading volume in the UK earlier this week while the British pound was in freefall. As you can see, volumes exploded to just under $900 million, reaching their highest level in more than two years. It is difficult to see the intention of those who traded bitcoin in size over in the UK. It could have been people looking to take advantage of rapidly developing arbitrage opportunities, people looking to sell bitcoin to gain liquidity to service failing trades or people looking to buy bitcoin as a hedge against rapid currency depreciation.

We can’t say for sure, but if the volumes were driven by those seeking safety in bitcoin, it would represent a very interesting turning point for the nascent digital monetary commodity and how it is viewed by the wider market. One has to imagine that there are currency traders surveying the landscape of rapidly depreciating fiat currencies around the world starting to panic, especially when currencies like the pound and yen are wobbly as they have been for the past couple of weeks. . Even if the dollar tears, it’s the most polished piece of crap on the pile. Its relative strength doesn’t seem so strong when you consider the problems that exist throughout the American economy: inflation is high, energy policy is suicidal, and rising rates are starting to take a massive toll on American consumers — especially homeowners and those with significant amounts of credit.

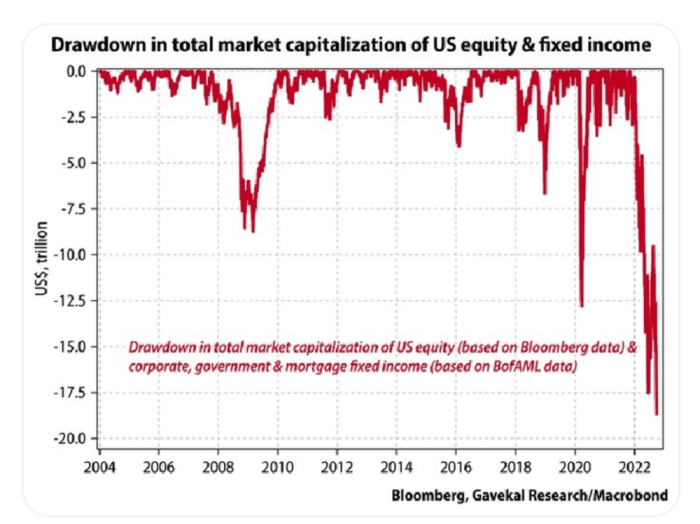

With all this taken into account, it is not hard to believe that more and more people are starting to wake up to the fact that bitcoin is a very attractive asset to exploit as a hedge against this madness. The network is distributed, the offer is limited and it is easy to own without taking any counterparty risk. Compared to other currencies, bonds and stocks in a world on fire, bitcoin’s superior qualities stand out like a sore thumb. Who knows whether the exchange volume from the UK indicates a growing recognition of bitcoin’s value proposition or not, but you should definitely have this potential trend on your radar, especially considering how much wealth has been destroyed so far this year.