Bitcoin volatility expectations remain muted despite warm US inflation numbers – what this means for BTC price

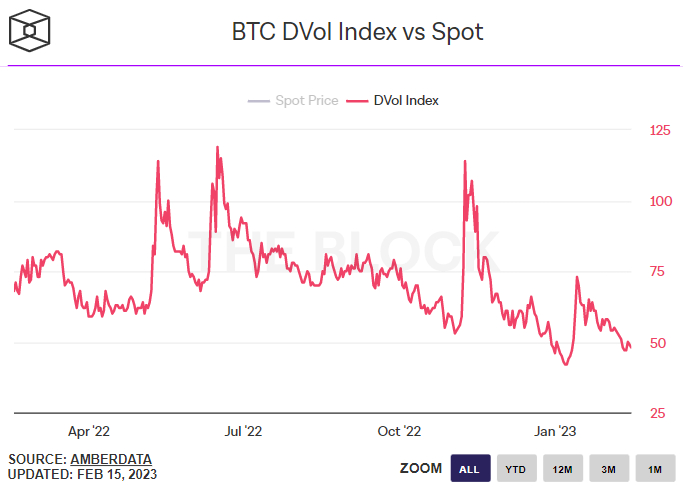

In the wake of Tuesday’s US Consumer Price Index (CPI), which confirmed an expected jump in MoM price pressures and revealed a smaller-than-expected decline in the annual inflation rate, Deribit’s Bitcoin Volatility Index (BTC DVol) surprised some analysts by remaining largely unchanged. The lack of movement in BTC DVol, which was last at 48 on Wednesday versus 50 on Monday and still not far above record lows, is consistent with the post-CPI sentiment seen in the Bitcoin market.

Bitcoin, which last changed hands around $22,800, has gained about $1,000 or 4.5% from its pre-US CPI data levels on Tuesday and is up about 4.7% for the week. That’s despite Tuesday’s CPI data and stronger-than-expected US retail sales data on Wednesday, which combined to push US 2-year yields around 10bps so far this week, and the US Dollar Index (DXY) up around 0.5%.

The moves in US bond and currency markets reflect markets increasing their tightening bets from the US Federal Reserve. According to CME’s Fed Watch Tool, the odds of the Fed raising rates by at least 75 bps (to at least a 5.25-5.50% target range) are now above 50%, as suggested by 30-day Fed Funds futures price data. That’s up from an implied probability of just around 6.0% this time last month.

Bitcoin’s surprising resilience

Given movements across bond and currency markets, many analysts are shocked by Bitcoin’s resilience. Higher yields typically weigh on Bitcoin as 1) Bitcoin is a non-yielding asset, so the so-called “opportunity cost” of holding it rises as short-term US interest rates rise and 2) higher yields on US Treasuries, an asset considered risk-free, reduces the incentive to hold assets considered risky, such as Bitcoin, which many see as a new, speculative financial technology.

Meanwhile, when higher short-term interest rates are driven by expectations of tighter Fed policy, it can also be interpreted as higher risk of weaker US growth/a recession, as higher interest rates weigh on economic activity. Weaker growth expectations can normally be assumed to hurt risk-sensitive assets such as stocks and crypto.

But Bitcoin still holds onto the lion’s share of 2023’s rally. The cryptocurrency is still trading up around 38% this year versus 47% when it is at its peak in early February around $24,000. And, as already mentioned, options markets are not pointing to stormy waters ahead. On the contrary, BTC DVol has only printed at current or lower levels 11 times in Bitcoin’s history, suggesting that investors are positioned for an incoming period of historic price calm.

What this means for the BTC price

If the options markets are correct, Bitcoin will likely remain range bound in the coming weeks and months. Analysis of major support and resistance levels suggests that Bitcoin may remain capped within a range of $20,000-$25,000. The $20,000 level is important because of its psychological significance and the presence of Bitcoin’s 200-day moving average and realized price just below. The $25,000 level, meanwhile, is an important level of support-turned-resistance from 2022.

Bitcoin remaining range-bound in the coming months makes sense when considering fundamental macro, chain and network fundamentals. On the one hand, it is unrealistic to argue for a continuation of January’s ferocious rally and a rise to new record highs in the short term in the context of a Fed that remains intent on raising interest rates at least a couple more times to tame the US. price pressure.

On the other hand, various metrics continue to signal the inexorable growth of the Bitcoin network – mining hash power and non-zero balance wallet addresses both recently hit records. Meanwhile, various chain indicators are also signaling that the 2022 bear market appears to be over. Just as a rally to all-time highs feels unlikely, a breakout below the 2022 lows also feels unlikely.