Bitcoin up? Answer: The Dow Jones/Bitcoin Spread Theory

By Dan Weiskopf

Market optimism shines these days. Some, like Astoria Portfolio Advisors CEO John Davi, are even declaring that recession fears were overblown and that the 2022 bear market is over. Also check out the Dow Jones index! Now the question is also whether “winter” will now become “spring” in the crypto markets. Chart technicians will point out that the 50-day moving average held up well for the Dow Jones (31,711) and now the 100-day average (32,803) appears to be gaining momentum. Based on the Dow Jones/Bitcoin spread reaching a historically wide margin and the signal turning green, Bitcoin optimists (maximalists) can of course call for a rally for their asset class to head towards 33,966 (200-day Dow Jones Moving Avg) .). Great to hear the bulls are back! Which billionaire passionately said “going to the moon”? Rocket Ships are built by Elon Musk, Jeff Bezos and my favorite, Richard Branson. But to be honest… bullishness has not always been consistent! At least not for Bitcoin!

Wait? Who cares about the famous Dow Jones index of 30 stocks? Isn’t it a narrow group of stocks?

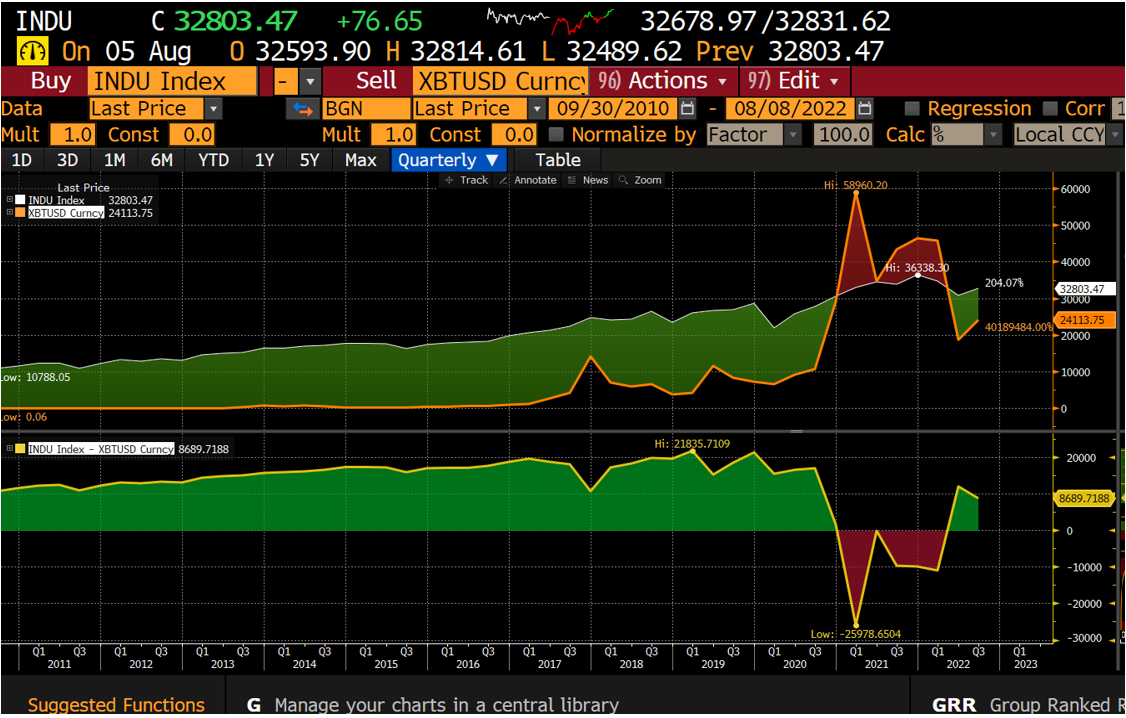

Who cares you ask? What about the folks promoting the “Dow Jones/Bitcoin” spread index (using Bloomberg INDU in gold is the Down Jones index and XBTUSD in white is the Bitcoin Spot). Look carefully at the diagram above. As the Dow Jones falls, the price spread between these two markets inevitably narrows, as shown in green. This has historically been followed by the Bitcoin price accelerating. Ultimately, should these two markets trade in parity to illustrate market liquidity soaking up demand? The “model” or thesis is based on general market optimism and the “fact” that 82.5% of companies in the Dow Jones have Crypto/Blockchain projects on the strategy table. All of this, of course, reflects adoption by some large companies, and the utility of Web 3.0. To name a few key companies: American Express, Apple, Cisco, Honeywell, Intel, IBM, McDonalds, Microsoft, Visa, Walt Disney, Walmart, Salesforce, Nike and yes – even Goldman Sachs. Don’t you believe us? Check out the helpful links below!

Based on hundreds of thousands of hours of research, we can say with certainty that the spread is greatest when the value is “widest”. Check out our whitepaper. Due to the fact that the Dow Jones closed at $32,800, Bitcoin closed at $23,803, the spread is close to an all-time wide margin and in the green, buyers of Crypto should pour in. After all, in the Metaverse, so many companies are reaping the rewards. Why shouldn’t the index established in 1896 be the Bitcoin bounce indicator?

Still not convinced? Well, in the white paper we created, which includes testing back to 1896 when the Dow Jones was originally created, we outline how it would all work. Of course, it had errors, so hopefully you’ll just take us by the Bloomberg chart (see above) going back to 2010. Unfortunately, Bloomberg has a certain limitation with this analysis. Despite these limitations, you can clearly see that if you bought Bitcoin when it was in the green, you made money! Evidence enough? Need I say more? Still skeptical? Check out the work completed in 2018 from Cryptopas.

What does this mean? Wait? WAIT! WAIT!!!!!!!

Is “winter” or the bear market over?

No, don’t short the Dow Jones index against your Bitcoin! No, in truth we wonder at the reality that there has been far too much curve fitting by too many smart people in our business hoping to justify their analysis and investment positions. The two markets have nothing to do with each other in terms of signals and curve fitting with words is just silly. We agree that these 30 major companies’ support of blockchain and, to a lesser extent, crypto would not actually be a trend anyway. Still, the links are genuine and meant to be read. Hope our readers aren’t mad that we haven’t gone crazy. We are realist ETF geeks at the ETF Think Tank.

Okay, we had some fun here with some ridiculousness. YES, TO BE CLEAR, THIS HAS BEEN A PARODY FOR OUR READERS!!! Hope Cryptopas don’t get mad at us. We realize that the link is not working.

Apologies to our readers

Bitcoin and the Dow Jones have nothing to do with each other, except that $32,800 on Bitcoin would feel good to some of our readers. Arguably, the only point of all this is that blockchain and thus crypto is ubiquitously embedded in corporate America. The companies that embrace it as a competitive advantage are undoubtedly seeking a non-traditional strategy to expand their business or reduce operating costs. Likewise, those who ignore it risk having a Kodak or Blockbuster moment. Kodak was in the Dow Jones index for 74 years, but was removed from the index in 2004. Blockbuster never qualified for the exclusive Dow Jones 30 club, but unfortunately went bankrupt when Netflix took over the market. We sincerely apologize to our readers who may have been frustrated by the use of their time. Having said that – all too often we find “investment strategists” rationalizing the outcome of market conditions as if they knew or want to know the future. The truth is that a long-term investment process and discipline trumps theory. Ultimately, we believe in Bitcoin, the utility of crypto in general, and most importantly, the blockchain. It is obviously also American business.

Riddle me a funny: Email us if you know how many years passed between the creation of Bitcoin and the creation of Down Jones!

Hint: 3 January 2009 to 26 May 1896

Mediation

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be regarded as an individualized recommendation or personal investment advice. The aforementioned investment strategies may not be suitable for everyone. Each investor must review an investment strategy for their own particular situation before making any investment decision.

All opinions are subject to change without notice in response to changing market conditions. Data contained here from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

The examples are for illustrative purposes only and are not intended to reflect results you may expect to achieve.

The value of investments and the income from them may go down as well as up, and investors may not get back the amounts originally invested, and may be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic conditions. development and other variable factors. Investment involves risk including, but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any return or return on capital invested. This commentary material is provided for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any securities, and nothing herein shall be construed as such. All investment strategies and investments involve the risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of a specific result or profit. Although we have gathered the information presented here from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented, and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information contained in this material is confidential and proprietary and may be used only by the intended user. Neither Toroso nor its affiliates nor any of their officers or employees of Toroso accepts any responsibility for any loss arising from the use of this material or content. This material may not be reproduced, distributed or published without the prior written permission of Toroso. Distribution of this material may be restricted in certain jurisdictions. All persons who come into possession of this material should seek advice for details of and observe such restrictions (if any).