Bitcoin unchanged this week amid banking uncertainty, Fed pauses hope, regulatory heat

hocus focus

Bitcoin (BTC-USD) is on course to end the week largely unchanged as confidence in traditional banking took a hit, adding to the rally in the top cryptocurrency, and hopes that the Federal Reserve will halt rate hikes grew. But gains were limited by ongoing regulatory control in the industry.

Recent regional bank failures and concerns over the stability of established lenders have weakened confidence in the traditional banking system. “We believe, as the US banking crisis deepens, bitcoin is more likely to behave as a risk-on asset,” Bernstein analyst Gautam Chhugani said. “Correlations (with stocks) have reversed for risk assets in recent days, and that could be a critical signal for investors to monitor.”

Meanwhile, the Fed raised its benchmark interest rate by 25 basis points, as expected, ruling out a rate cut this year. However, some investors appear to be hopeful of a quarter-point rate cut in June, according to fed funds futures.

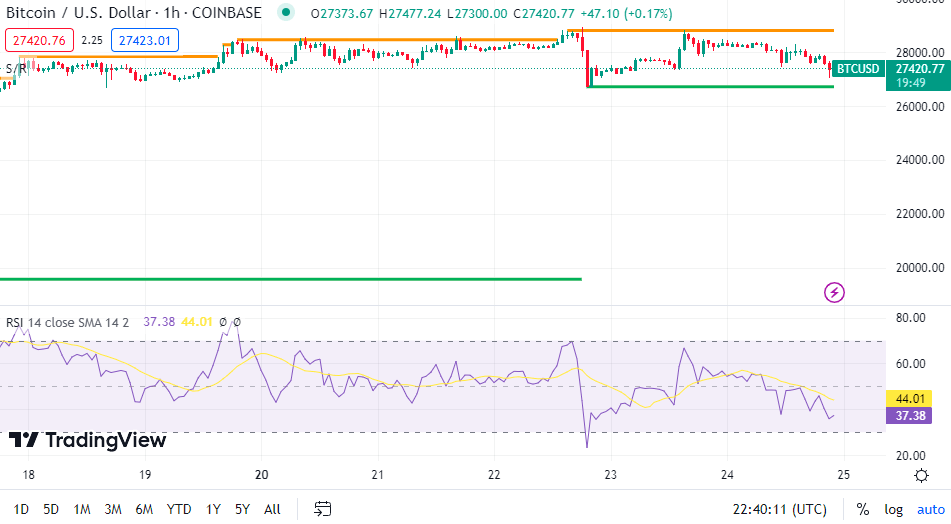

Bitcoin (BTC-USD) surged to a more than nine-month high of $28.8,000 on the day the Fed announced its decision. It traded in the $26.6K-$28.8K range this week.

The total crypto market cap is currently $1.15T, down 2.8% over Thursday, according to CoinMarketCap.

Bitcoin (BTC-USD) was briefly hit on Friday by Binance, the largest crypto exchange by trading volume, which temporarily suspended spot trading due to a glitch.

The breakdown continues

US regulators continue to crack down on crypto companies, the latest being Coinbase Global (COIN), which was warned of potential charges by the SEC.

A day after, the SEC issued an investor alert warning that the risk of loss for crypto investors “remains significant”. It also voiced concerns about crypto exchanges that may not comply with federal securities laws.

The SEC also charged Tron founder Justin Sun and three of his firms with fraud and other securities law violations. Eight celebrities, including actress Lindsay Lohan, were charged with illegally targeting Tronix (TRX-USD) and BitTorrent (BTT-USD).

Meanwhile, a person suspected to be fugitive Do Kwon, co-founder of Terraform Labs, was arrested by the police in Montenegro. Terraform was behind the collapsed crypto Luna (LUNA-USD) and sister token TerraUSD (UST-USD).

US Senator Ted Cruz (R-TX) proposed legislation to stop the Fed from creating a digital central bank currency, to ensure that “big government doesn’t try to centralize” crypto. His views echo those of Florida Governor Ron DeSantis, who proposed a law that would ban the use of CBDC.

In other news, investors await a landmark court ruling on the SEC’s lawsuit against Ripple Labs, which will determine whether or not XRP (XRP-USD) is a security.

Bitcoin price

- Bitcoin (BTC-USD) fell 3.1% to $27.42K at 6:45 PM ET and ether (ETH-USD) crashed 3.6% to $1.75K.

- SA contributor The Freedonia Cooperative believes the recent banking crisis looks set to help bitcoin’s (BTC-USD) already positive 2023 momentum. “A key crypto indicator, the MVRV ratio, signals that the next BTC bull run may already be underway.”

More about Crypto Clampdown

Coinbase downgraded after Wells warning

Coin base: All is not well

Bitcoin benefits from banking sector fallout