Bitcoin triumphs in rebellion against the US dollar

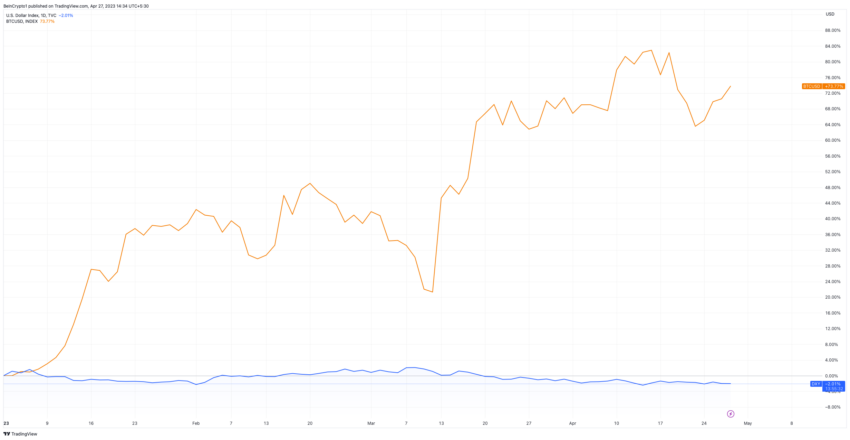

Political turmoil and the growing popularity of cryptocurrencies have shaken the US dollar’s dominance in the global financial system. The recent debt ceiling crisis exposed the fragility of the US economy, prompting a search for alternatives to the dollar. This has led to increased interest in Bitcoin as a potential store of value and medium of exchange.

During the crisis, investors flocked to Bitcoin, attracted by its decentralized nature and limited supply. It proved a safe haven, with prices rising as the dollar’s value faltered. The incident sparked a larger conversation about the dollar’s role in the global economy. Many experts question its long-term viability as the world’s primary reserve currency.

Central banks exploring digital currencies

The decline of the US dollar has led to the rise of Bitcoin as more investors consider it a viable alternative. With a limited supply of 21 million coins, Bitcoin’s scarcity makes it an attractive store of value.

As the US dollar continues to weaken, Bitcoin may continue to gain momentum in the global financial market.

In response to Bitcoin’s growing popularity, central banks around the world have begun to explore the development of their own digital currencies. These are known as central bank digital currencies (CBDCs), and aim to provide a more efficient and secure method of payment while maintaining control over monetary policy.

China’s digital yuan, for example, is already in advanced stages of development and testing. The European Central Bank is also considering the launch of a digital euro. Meanwhile, the US Federal Reserve has launched research into a potential digital dollar.

The rise of CBDCs could further challenge the US dollar’s dominance. Countries may look to reduce dependence on the dollar.

The development of CBDCs also provides an opportunity for Bitcoin to strengthen its position in the global financial landscape.

As central banks work to create digital currencies, demand for decentralized alternatives like Bitcoin is likely to increase. This could further drive its adoption and strengthen its role in the global economy.

Cryptocurrencies and the shift in global reserve currencies

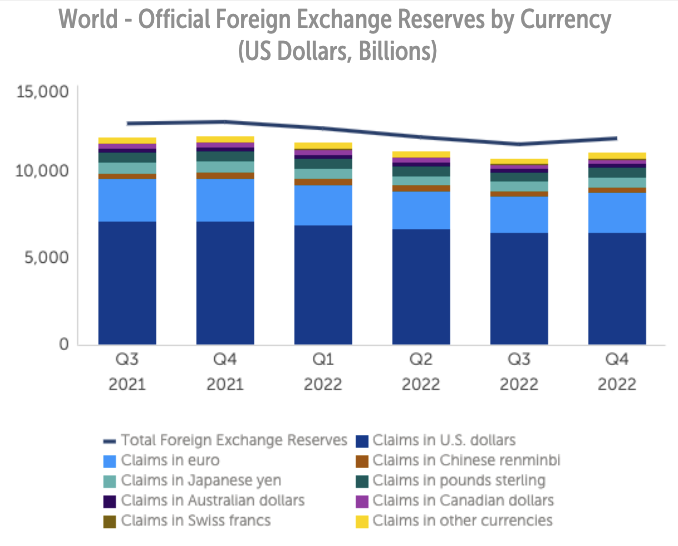

The growing interest in digital assets has triggered a shift in the global reserve currency landscape. As countries explore the adoption of CBDCs and the use of Bitcoin, the US dollar’s role as the world’s primary reserve currency is increasingly under threat.

This is a potential result of this shift is the emergence of a multipolar reserve currency system. Several major currencies, including the digital yuan, the euro and Bitcoin, share the role previously held exclusively by the US dollar. A long-time currency analyst at Deutsche Bank said:

“The money printing, with its blatant currency extraction and inflationary reactions, has only further encouraged those in the developing world who want to establish a multipolar currency system more in line with their growing share of global GDP.”

This scenario will have significant implications for the global financial system. It could reduce the impact of US monetary policy on other economies and increase the importance of digital assets in international trade and finance.

Bitcoin’s growing influence in the global economy cannot be ignored. The US dollar faces challenges from rival nations and cryptocurrencies.

The world may be witnessing the beginning of a new era in global finance – one in which Bitcoin plays a central role.

Bitcoin’s role in international trade

As the world moves towards a more digitized financial system, Bitcoin is well positioned to play an important role. Its decentralized nature, borderless transactions and ability to bypass traditional banking systems make it an attractive option for global commerce.

Countries with unstable local currencies, such as Argentina and Venezuela, have already started adopting Bitcoin for cross-border transactions. This adoption allows them to circumvent the limitations imposed by their domestic currencies while avoiding the volatility associated with the US dollar.

“Every night I ask myself why all countries have to base their trade on dollars,” said Brazilian President Lula da Silva in a speech at the New Development Bank in Shanghai.

“Why can’t we trade based on our own currencies?” President Lula added.

As more nations embrace digital currencies, Bitcoin could become an important component of international trade.

Furthermore, Bitcoin’s underlying technology, blockchain, offers unparalleled transparency and security. This can streamline the trading process and reduce the risk of fraud.

The distributed ledger technology enables all parties involved in a transaction to have access to a shared, immutable ledger, promoting trust and efficiency.

Implications for the US dollar and the global economy

The rise of Bitcoin and other digital currencies poses significant challenges for the US dollar and the global financial system. As countries explore alternatives to the dollar-based system, the dollar’s dominance as the world’s primary reserve currency may decline.

This potential shift in the global financial landscape could lead to a more balanced distribution of power and influence among major economies. The United States may no longer have a monopoly on global monetary policy, and nations may have greater autonomy in managing their economic affairs.

In the long term, the rise of Bitcoin and other digital currencies could promote a more inclusive and resilient global economy. As more people gain access to financial services through digital assets, economic growth and development can become more widespread and sustainable.

Bitcoin’s growing prominence as an alternative to the US dollar signifies a potential tipping point in the global financial landscape. As the dollar faces increasing challenges from rival currencies, political unrest and the rise of digital assets, Bitcoin could play a crucial role in shaping the future of global finance.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.