Bitcoin to Sub-$20,000 Next? Here’s what the options markets are saying about the BTC price outlook

Cryptocurrency markets fell on Tuesday in line with US stocks as US interest rates and the US dollar rose in the wake of hawkish comments from US Federal Reserve Chairman Jerome Powell on the first day of his semi-annual testimony to the US Congress on Tuesday.

Powell warned that the Fed could raise interest rates higher and at a faster pace than previously signaled. Analysts interpreted Powell’s comments as an opening for a possible 50 bps rate hike at this month’s policy meeting.

Bitcoin last traded just above $22,000 after its first drop below that level since mid-February earlier in the session and was last down approx. 1.5% on the day. Technicians pointed out that Tuesday’s drop means Bitcoin has now broken below an uptrend that had been in play since mid-January, opening the door to a potential retest of February’s lows in the $23,000s and perhaps even the 18th.th January lows in the $20,300s.

Certainly, the 14-day relative strength index (RSI) suggests that there is plenty of room for further downside before Bitcoin reaches a point of being oversold. Bitcoin’s RSI was last around 40, with a score below 30 seen as a sign that market conditions have turned overly bearish.

Some bears believe that a retest of Bitcoin’s 200-day moving average and realized price (the average price that each Bitcoin last moved on the blockchain) in the $19,700-800 region is a possibility. Crypto futures traders certainly appear to have become more bearish, with futures margin funding rates turning negative in recent days to a degree not seen since early January.

US interest rates rising higher and at a faster pace than previously signaled, which Powell warned was a possibility, depends on how hot upcoming US economic data is. Crypto traders will now be nervously monitoring this week’s US jobs data, hoping the data doesn’t reveal too strong a labor market. The current stronger-than-expected US labor market is seen as a challenge for the Fed, which is trying to get inflation under control.

If the jobs data comes out on the stronger side, this could trigger further downside in crypto as traders increase their bets on a 50 bps Fed rate hike later this month. That is likely to worsen sentiment in the crypto market.

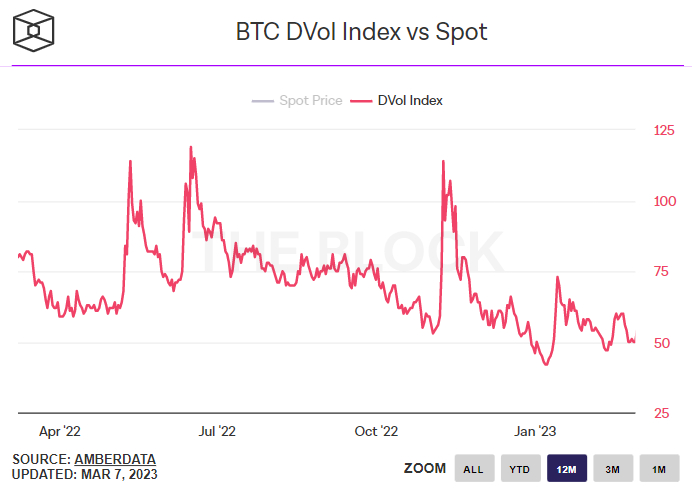

The options markets are still uncertain about volatility risk

Despite concerns that a further hawkish repricing of the Fed’s tightening expectations could provoke fresh volatility in the cryptocurrency market, Bitcoin options markets continue to signal that price risk remains contained. For example, Deribit’s Bitcoin Volatility Index (DVOL) remained unchanged at 51 on Tuesday, still not that far above January’s record lows of 42, according to data presented by The Block. Deribit is the dominant cryptocurrency derivatives exchange.

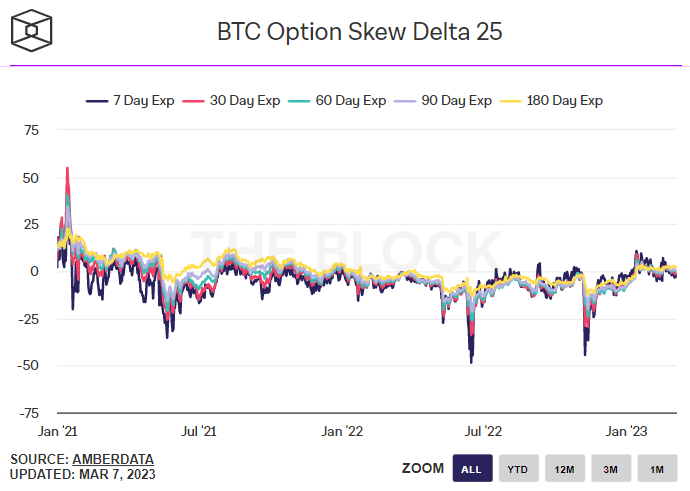

Meanwhile, the 25% delta bias on Bitcoin options expiring in 7, 30, 60, 90 and 180 days also continues to move sideways, within the latter ranges, and mostly still quite close to zero, indicating a fairly neutral market positioning bias. In fairness, the 25% delta bias for shorter expirations such as the 7 and 30-day is slightly negative at around -1.5, while the 180-day is around 2.4, suggesting that the market is slightly more bullish in the medium to long term Bitcoin price outlook than short term.

The 25% delta option bias is a popularly watched proxy for the extent to which trading desks are over or underpricing for upside or downside protection via the put and call options they sell to investors. Put options give an investor the right, but not the obligation, to sell an asset at a predetermined price, while a call option gives an investor the right, but not the obligation, to buy an asset at a predetermined price.

A bias of 25% delta options above 0 suggests that desks charge more for equivalent call options versus puts. This implies that there is stronger demand for calls versus puts, which can be interpreted as a bullish sign as investors are more eager to secure protection against (or bet on) a rise in prices.

The options markets are sending a message that a major price collapse is unlikely in the short term. This could indicate that Bitcoin will find strong buying interest if/when it retests key support areas such as around $21,400, in the $20,300s or in the $19,700-800 range.