Bitcoin to $1M, Big Brother and India

Crypto News: We give you an overview of what has happened in crypto this week. And we’re leading with the most outrageous forecast we’ve seen in years. Balaji Srinsavan, the former CTO of Coinbase, predicts that Bitcoin (BTC) will be worth $1 million in 90 days.

Knocking on a collapse

He is so sure that he bet social democrat James Medlock $2 million in USDC that the US banking system would collapse, hence his forecast. While the prospect of a $1 million Bitcoin would be reason to cheer, BeInCrypto’s global news editor, Ali Martinez, sounded a warning. “This simplified calculation does not take into account factors such as market liquidity, order book depth, weakening US dollar values and other market dynamics,” he said.

The valuation will see a market value of Bitcoin of $18.7 trillion. Which is $5 trillion more than gold. Which is probably unlikely in 90 days.

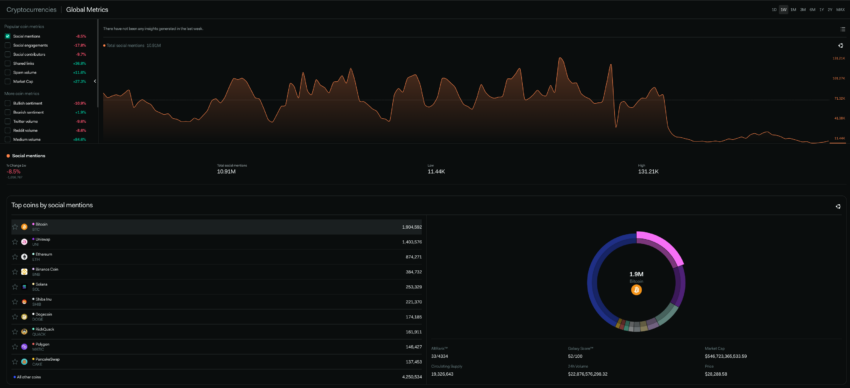

Crypto News – Socially

Crisis? What crisis?

The fallout from the banking crisis continues. The Federal Reserve has printed $300 billion to bail out the banks – or almost half the amount lent during the 2008 financial crisis.

According to Fortune, the Fed allocated $143 billion to holding companies for failed banks such as Signature Bank and Silicon Valley Bank. The holding companies will use the money to make the depositors whole. They then borrowed $148 billion through a program called the “discount window.” Finally, the Fed inaugurated the Bank Term Funding Program (BTFP) and lent $11.9 billion. This program helps the bank raise funds to meet the needs of all depositors.

Cash register go brrr, anyone?

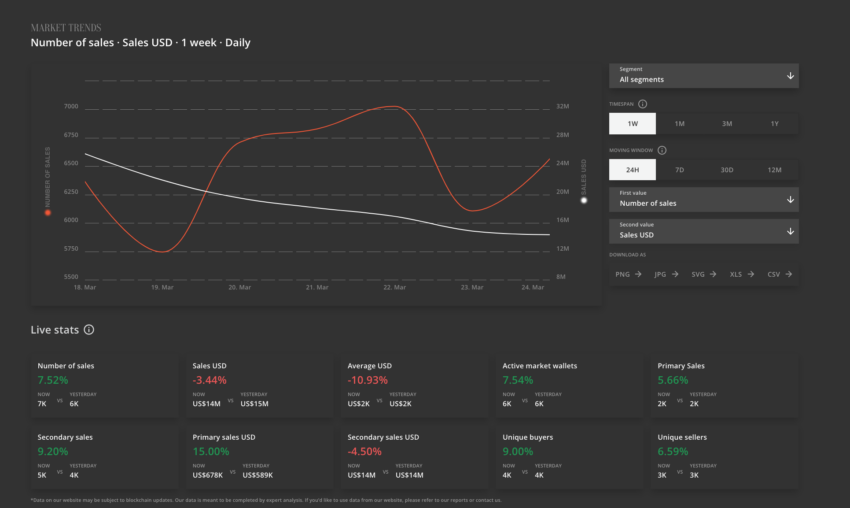

This week in NFT Sales

India in March

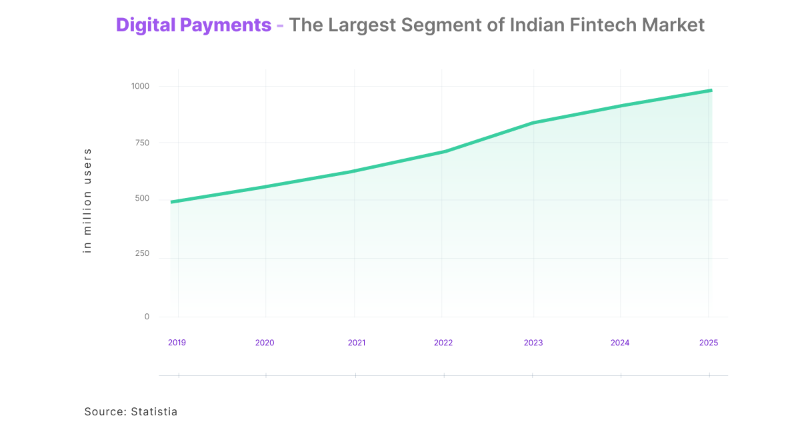

India could account for more than 50% of global cryptocurrency users this year, claims a report.

“With 156 million people using digital coins by 2023, India will have three times more crypto users than the US, Japan, UK and Russia combined,” said the team at BitcoinCasinos.com.

The COVID-19 pandemic was a major turning point for the region. The country’s cryptocurrency market took a hit during the pandemic, mostly due to poor financial infrastructure. The number of crypto users skyrocketed by 760% between 2017 and 2022 to 134 million.

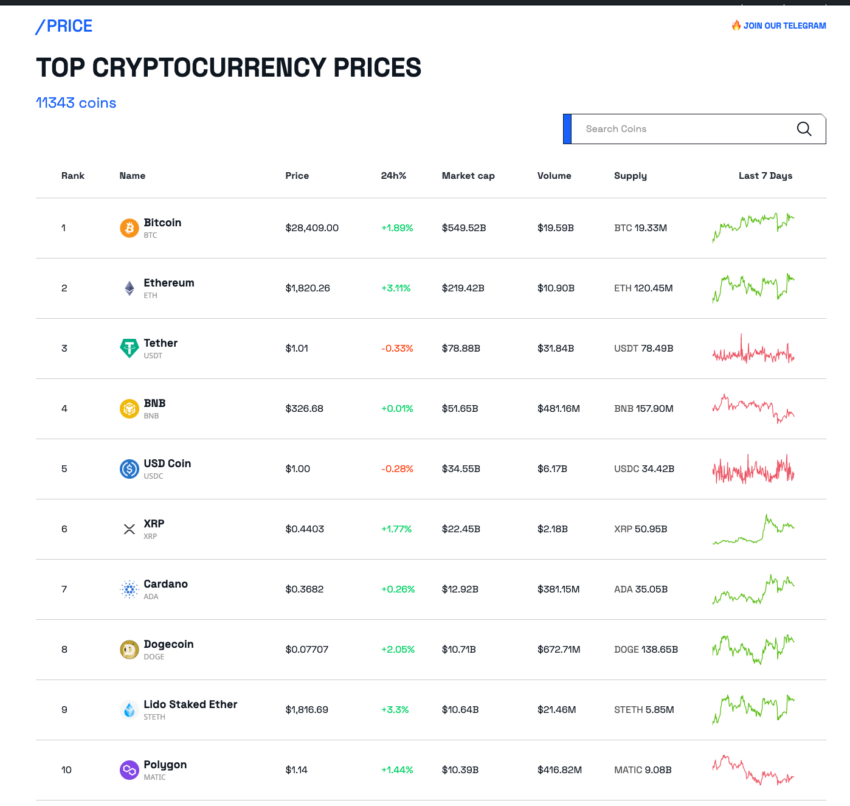

News about crypto coins

Mask Network (MASK) took the trophy for the biggest gainer this week, with a 45% increase. It was followed by XDC Network (XDC) and Ripple XRP, both up 17%.

The biggest losers were Kava (KAVA), down 16%, Immutable (IMX), down 15%, and Huobi Token (HT), down 14%.

Is Big Brother Really Watching You?

Florida Governor Ron DeSantis raised eyebrows earlier this week with his proposal to ban central bank digital currencies (CBDCs) citing privacy concerns. Actually, that’s an understatement. He called them “Big Brother’s Digital Dollar”

CBDCs are similar to stablecoins in that they are pegged to the price of a sovereign currency such as the US dollar. But because they are issued by nation states or central banks rather than minted by private companies. “What [a] central bank digital currency is about monitoring Americans and controlling Americans, he said. “You open up a big can of worms, and you give a central bank enormous, enormous amounts of power, and they will use that power.”

Quant (QNT) Price on the brink of something big?

This week, senior analyst Valdrin Tahiri turns his charts to Quant (QNT), which shows strong signals that a breakout is likely.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.