Nobel laureate Paul Krugman complained on Twitter on Wednesday that he had problems with the centralized payment processor Venmo. His tweet was followed by a barrage of bitcoin supporters who insisted that Krugman now realized the importance of censorship-resistant payment systems.

Krugman’s experience highlights the growing interest in censorship-resistant payment systems

Nobel laureate and author Paul Krugman, who famously wrote in 1998 that “by 2005 or so it will be clear that the Internet’s impact on the economy has been no greater than that of the fax machine,” had problems with a third-party payment provider. On Wednesday, Krugman announced on Twitter that he was busy but needed to explain the situation.

“Too busy to tweet. But not to vent,” Krugman so. “I’ve used Venmo for years, but now it won’t allow me to make payments. I spent a long time chatting with representatives and they told me they can’t explain why – or fix it. The software has taken control.”

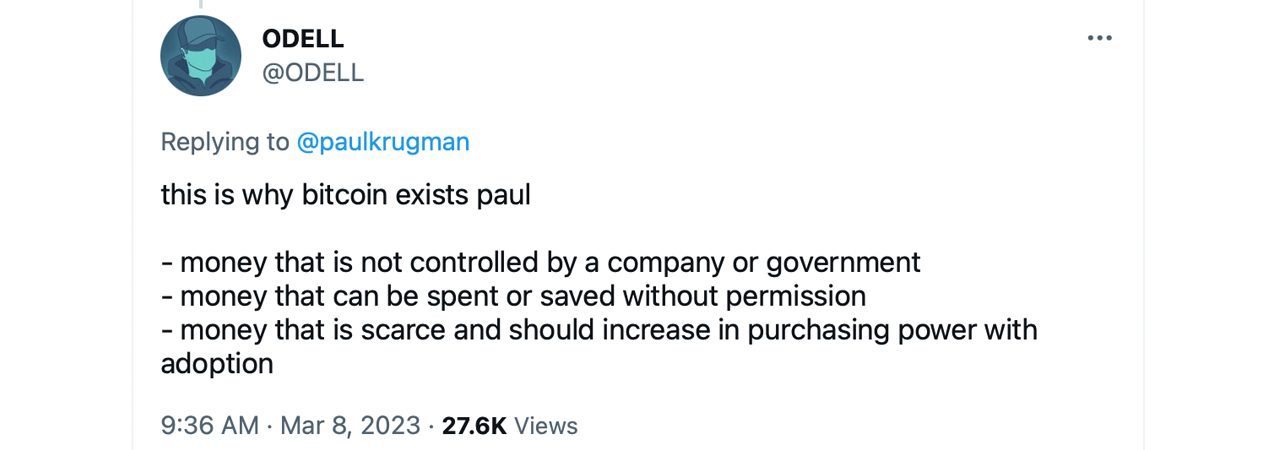

Paul Krugman follows the school of Keynesian economics and has long been a skeptic of bitcoin. He was quickly criticized by several bitcoin supporters, including Microstrategy’s Michael Saylor, who insisted that “Bitcoin fixes this.”

A Twitter user even cited Krugman, asks “Exactly what is [bitcoin] shall we do what we are not already doing for the most part?” In the past, the economist has compared the cryptocurrency market to the subprime mortgage crash and is known for his skepticism about bitcoin.

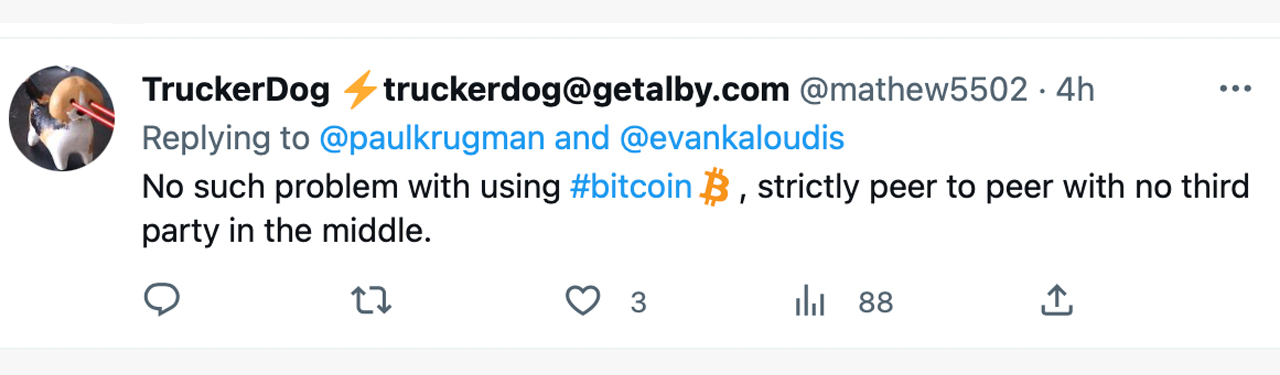

Krugman expressed his frustration with Venmo on Twitter, and the thread quickly filled with comments about bitcoin. Despite many statements, the economist did not respond to the crypto fans. One individual cited from the bitcoin white paper, saying “Try a pure peer-to-peer version of electronic cash that will allow online payments to be sent directly from one party to another without going through a financial institution.”

Shortly after Krugman’s first tweet, the economist explained that his tweet helped solve his problem with Venmo. “And tweeting paid off. A representative called and we seem to be back up,” Krugman says told his 4.5 million followers on social media. Krugman’s experience with Venmo is not unique, as billionaire Mark Mobius recently described his own difficulties getting funds out of HSBC China. Mobius’ problems were also criticized by bitcoin enthusiasts, who pointed out that he should understand the importance of censorship-resistant money like bitcoin.

Tags in this story

billionaire, Bitcoin, censorship resistant, centralized, chat support, cryptocurrency, decentralized, digital assets, digital currency, economic impact, electronic cash, financial institution, financial technology, HSBC China, keynesian economics, mark mobius, michael saylor, micro strategy, monetary policy, nobel laureate , Online Payments , Paul Krugman , payment processors , payment systems , peer-to-peer , social media , software , subprime mortgage crash , third party , Twitter , Venmo

What are your thoughts on Paul Krugman’s Venmo question and the criticism he received from bitcoin supporters over his views on cryptocurrency? Share your thoughts on this topic in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.