Bitcoin Stock-to-Flow Model Maker PlanB Promotes ‘Quantum Investing’ Via ByBit to ‘100x’ HODL Strategy

PlanB, the infamous creator of the stock-to-flow (S2F) model for Bitcoin, has apparently abandoned the HODL strategy in favor of “quantum investing” through ByBit.

In a tweet Friday, he announced a “copy my trade” partnership with ByBit that “outperforms buy and hold 100 times.” An article describing the strategy was published on Monday via PlanB’s website.

The article on quant investment is almost ready. It includes a trading rule that outperforms buy and hold by 100x. You can copy my trade here (registration + deposit): pic.twitter.com/jgW8AmCjlc

— PlanB (@100trillionUSD) 5 August 2022

PlanB and the Stock-to-Flow model

The S2F creator has gathered a large following online after he created the methodology by which many investors speculate on the future price of Bitcoin.

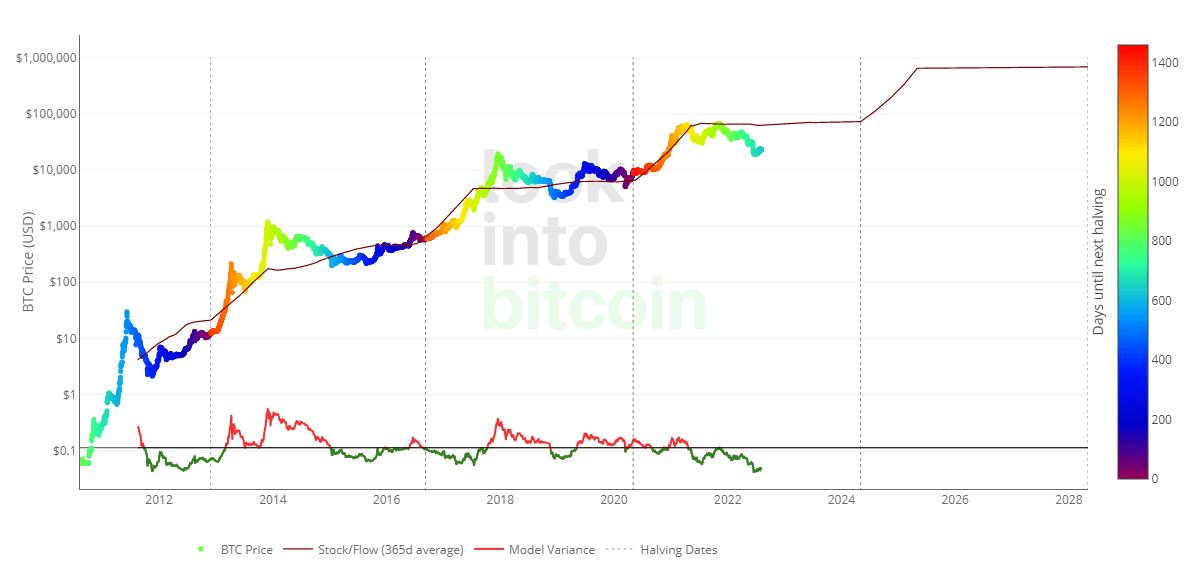

The model is based on the fixed supply of Bitcoin and its predefined release schedule linked to Bitcoin halvings. According to the stock-to-flow model, the price of Bitcoin will reach close to $1 million by 2026.

Historically, the S2F model has been surprisingly accurate; But over the course of the recent bull run, there has been an increased number of crypto-natives renouncing the theory’s legitimacy.

As far back as June 2021, Ethereum founder Vitalik Buterin described those who believe in the model as deserving “all the scorn they get.”

Stock-to-flow is really not looking good now.

I know it’s rude to enjoy yourself and all that, but I think economic models that give people a false sense of security and predestination that numbers-will-go-up are harmful and deserve all the scorn they get. pic.twitter.com/glMKQDfSbU

— vitalik.eth (@VitalikButerin) 21 June 2022

The methodology confirms that buying and holding Bitcoin is the safest method of investing in Bitcoin due to the assumption that it will continue to follow the projected price for a given time frame. The price may deviate from the model over a period of time, but it will eventually return to the stock-to-flow line due to the fixed supply and distribution of coins.

Criticism of S2F has grown during the bear market as the price of Bitcoin is now well below the model’s prediction and has been since December 2021.

Volume trading and 100x returns

PlanB appears to have taken the opportunity to deviate from the “buy and hold” philosophy to promote a new trading system in conjunction with ByBit. His strategy will reportedly beat a HODL approach by “100x” and is available to copy via ByBit now that his new article on “quantum investing” is out.

He claims that he receives “the same reactions as when I published the S2F article in March 2019”. Nevertheless, most of the criticism comes from those who question the move away from HODLing and towards copy trading, where PlanB will actually face a backlash from ByBit. The copy trading page of ByBit’s website states that master traders can receive “up to 30% commission and 500 USDT in bonuses.”

Funny to see the same reactions as when I published an S2F article in March 2019 when BTC<$4K and I was calling for $55K. "fraud" "demand is not in the model" "$55K impossible".

Now people can’t imagine 100x B&H outperformance in 10 years and hate exchange. Let’s wait for the article. https://t.co/tjDpqnA2Nx— PlanB (@100trillionUSD) 6 August 2022

The quant trading strategy is outlined in full in PlanB’s article titled Quant Investing 101.” The core philosophy appears to be based on trading the RSI levels of Bitcoin tested over the past ten years.

The trading rule PlanB uses for the strategy is described below.

“IF (RSI was above 90% last six months AND falls below 65%) THEN sell,

IF (RSI was below 50% last six months AND jumps +2% from low) THEN buy, ELSE hold.”

For further details on how ITM options are used to optimize returns, see the full article on PlanB’s website.

Responsible strategies for “influencers”.

Hodlonaut, the author of the Bitcoin Zine, Citadel21, tweeted his dismay at the concept of PlanB partnering with what they call a “leverage shitcoin casino” and forgoing “buy and hold”.

Wait, am I understanding this correctly? PlanB asks people to sign up with a shitcoin casino with influence so they can copy his trades and get 100x more btc than if they just buy and hold?

I must be misunderstanding something, right?

Right?

— hodlonaut 🌮⚡🔑 🐝 (@hodlonaut) 7 August 2022

Cory Kilppsten of Swan Bitcoin, one of the first to identify problems at Celsius, went so far as to call PlanB a “scam”.

Plan Brandolini @100 trillion usd is such a charlatan piece of shit. What an absolute joke. pic.twitter.com/9sbMgakoQ1

— Cory Klippsten (@coryklippsten) 6 August 2022

Crypto trader Eric Wall extended the sentiment that PlanB is no longer relevant in the industry, claiming “Bitcoin maxis did not defend this charlatan.”

Fortunately Bitcoin maxis didn’t defend this charlatan… Saifedean, Adam Back, Caitlin Long, Vijay Boyapati, Pierre Rochard, Bitstein, Preston Pysh and a bunch of other Swan advisors, plus almost all Bitcoin podcasts were an irrelevant minority in the large group. the arrangement of things

— Eric Wall (@ercwl) 7 August 2022

Furthermore, PlanB’s article on quant investing raises an interesting issue as it says so

“nothing in this article is financial advice. All content is for informational and educational purposes only.”

However, the article has been identified as a precursor to its copy trading strategy on ByBit. So while PlanB may say he doesn’t give investment advice, he encourages users to follow this strategy by copying his “quant investment” trades.

PlanB claims to offer the information about its trades for free on Twitter, allowing for a “DIY” option. Furthermore, he confirms that he only trades 10% of his portfolio “mainly due to credit risk”.