Bitcoin: Stay away from it in 2023

Vertigo3d

Bitcoin (BTC-USD) has no intrinsic value, in my view. That’s the main point why I wouldn’t recommend buying it as a long-term investment. Although it is an interesting speculative instrument, I believe that its real value is zero and that is therefore not worth buying for conservative investors. It can go up ten times, but then fall down to earth. If you’re considering buying BTC at a discount thanks to a massive correction, I wouldn’t personally recommend it. But let me explain my task in more detail.

Bitcoin as an investment – difference from other asset classes

In fact, you could argue that Bitcoin is no different from other asset classes. After all, everyone buys BTC, even conservative pension funds do. All the worse for them since they are risking their customers’ money.

But at the end of the day, there is a risk involved in any investment, and it is sometimes impossible to predict exactly what return a particular investment will generate. Let me consider other asset classes. Take the housing market. You are going to buy an apartment and you don’t quite know where the housing market will go next year. You take out a loan to finance at least part of your apartment purchase. But you can use that apartment to live in, or you can buy it to rent. In the first case, it will serve you or your family. In the second case, you will end up with a fixed income. An apartment is also tangible. In other words, you see what you are buying, which is not the case with Bitcoin. Also, the housing market can collapse, and occasionally there are bubbles. Just think of the collapse of 2008-2009. But unless there is a war or natural disaster, the apartment’s value will not drop to zero, no matter how bad the crisis. The value of Bitcoin, on the other hand, can drop to zero.

Last month, for example, the second largest crypto exchange FTX (FTT-USD) filed for bankruptcy last month. Many cryptocurrencies fall to zero. For example, Luna’s (LUNC-USD) value dropped to zero and was therefore removed from Binance (BNB-USD). You might argue that it won’t happen with Bitcoin since it is a highly liquid cryptocurrency. Of course, that can’t happen. But there are enough risks that BTC could fail like some of its fellow cryptocurrencies did.

An investment should also have intrinsic value. There is a market value for any asset, in other words the price the buyer is willing to pay and the seller is willing to sell the asset for. But in addition to that, an asset also has a true value really value. Let’s also take a construction company. It generates net cash flows and has some net assets (assets – liabilities) on the balance sheet. You can determine the company’s net worth by estimating its NPV (net present value of future net cash flows) or simply taking its net assets or book value. The company also runs a business, and has a reputation and a future. Admittedly, there is a possibility that the financial reports may turn out to be inaccurate. Remember the Enron case. Something can also go wrong, for example a recession can happen. But normally you know what you’re paying for. Bitcoin, on the other hand, has no economy at all. It owns no assets. When you buy it, you buy unaudited and unverifiable electronic records. Not to mention that, unlike bonds and stocks, cryptocurrencies do not generate any passive income whatsoever.

You may also like to compare Bitcoin to gold, at least many media people do. But in my opinion this is wrong. I agree with the thesis that fiat money continues to lose value at a fast enough pace. Most of this actually happened because of central banks’ attempts to support their economies during the COVID-19 shutdowns. But gold has existed for thousands of years as both a store of value and a medium of exchange. Crypto technologies are in turn very new. Gold can also be used as a commodity. It is still used in the production of appliances, but most importantly jewellery. Central banks also hold physical gold bars as their strategic reserves. Holding Bitcoins instead would have been easier and less expensive, but they don’t do this. Instead, they have recently bought more gold. So gold and cryptocurrencies are different stories.

Now let’s consider the future of Bitcoin as money.

BTC and functions of money

Many analysts say that Bitcoin can effectively be used as money.

But here are the functions of money:

- It is a medium of exchange – in other words, it must be accepted in exchange for goods and services.

- It is a value store – we save it for later use.

- Account unit – we use it to measure value in financial transactions.

Very good. But which of these functions does Bitcoin or any other cryptocurrency perform?

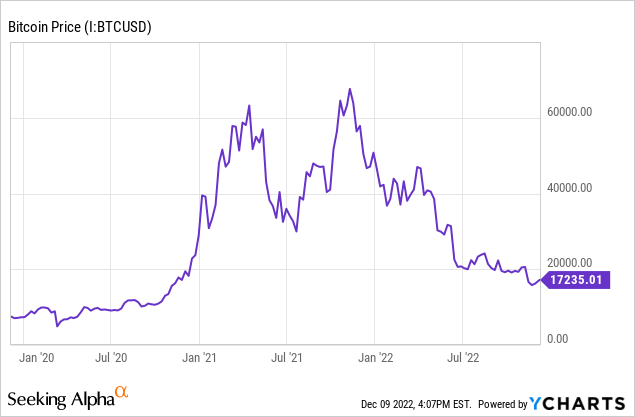

To begin with, we cannot use Bitcoin as a proper store of value. Why? Because the price is very volatile. Let’s take a look at the chart below. That shows BTC’s three-year price history.

In the spring of this year, Bitcoin’s price hovered around $45,000. Now it’s slightly more than $15,000. It took about 6 months for this cryptocurrency to lose two-thirds of its value. So it is very unreliable to keep your savings in BTC to later buy, say a car or a house. For this reason, I believe that BTC cannot be used as a unit of account. It is very difficult to put a price tag of 3 BTC on your car, for example. It is of course possible, but in that case your car would be worth $45,000 ($15,000 per BTC) today but $15,000 or say $150,000 tomorrow since Bitcoin is quite volatile unlike fiat money. It can actually be used as a medium of exchange, but not everyone will accept BTC as payment for goods or services due to Bitcoin’s very high volatility. In some countries, there are also rigid rules and regulations aimed at controlling cryptocurrencies. That’s because cryptocurrencies are sometimes used in shady transactions. Bank transfers are very easy to monitor unlike crypto payments. But I will touch on this topic later.

Risks

You might be thinking that I am absolutely certain that BTC would collapse in value in 2023. I actually accept the possibility that it may not happen. One of the possible reasons for Bitcoin’s COVID-19 price spike was the endless money printing by the Fed and many other central banks. Many financial institutions and private individuals were therefore left with plenty of free cash they wanted to invest. Some of them decided to buy cryptocurrencies to “protect” money against inflation. So if the Fed eases monetary policy, BTC could rise again.

There is one feature of BTC that is somewhat in its favor: namely its limited supply. Technically, only 21 million Bitcoins can be mined. In my view, this in itself does not make BTC a worthwhile investment with high intrinsic value.

Another factor that could make BTC appreciate is its legalization. For example, there were earlier rumors that a new cryptocurrency would be created in Ecuador and backed by gold to facilitate transactions across the country. However, the idea was not realized. But there is a possibility that some countries may issue more lenient laws regulating Bitcoin. Some developing countries, especially those struggling with hyperinflation, may even legalize BTC as an alternative currency. If that happens, Bitcoin will be here to win. However, this is highly uncertain and even improbable. After all, many governments are concerned about the anonymity characteristic of BTC transactions. So, in fact, it is likely that many new stricter regulations will be adopted in the field.

Valuation

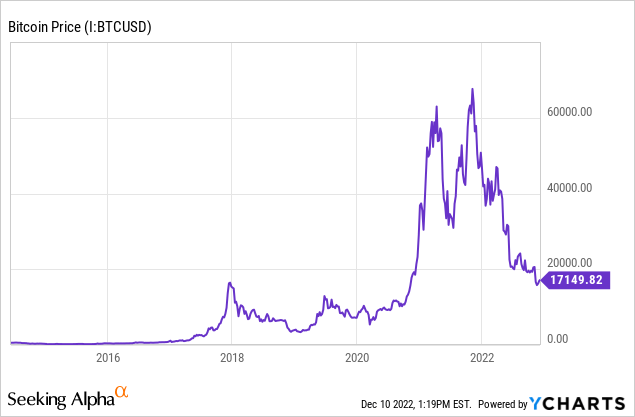

As I have mentioned before, I believe that Bitcoin has no intrinsic value. So it’s hard to estimate its fair value the way we can for stocks and even ETFs. However, we can take a closer look at this cryptocurrency’s price history.

Here is Bitcoin’s 10-year price history above. It is actually very volatile. It increased enormously in 2020, but is now trading down significantly.

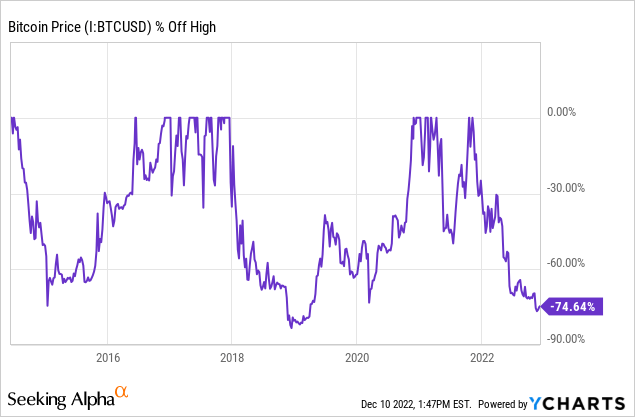

As the chart above suggests, Bitcoin is down 75% from its all-time highs.

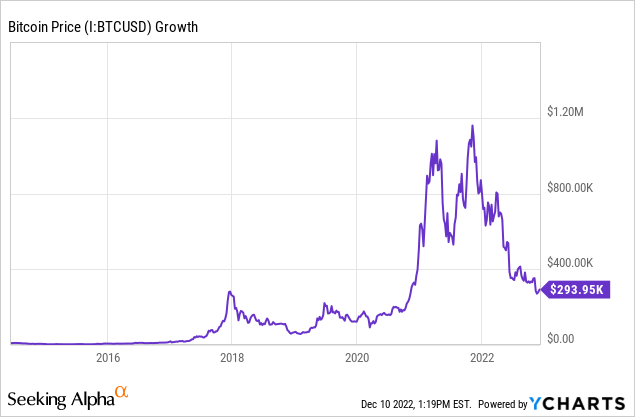

At the same time, if you had invested $10,000 10 years ago, you would have ended up with almost $294,000 now. I know how attractive this sounds. But the bubble may well be bursting right now.

In 2020, I wrote an article about investing in Bitcoin when the price of that cryptocurrency rose and said it was not a good idea. But we can actually compare “cryptomania” to other historical asset bubbles. I’m sure everyone has heard of the tulip mania that happened in the Netherlands in the 17th century, the South Seas bubble and of course the Dot.com bubble in the 2000s. There are many more examples of this. But they all show that a “trendy” asset class is only worth what the market is willing to pay for it. Trendy assets are normally not worth much at all, but due to the enthusiasm of many investors, prices continued to rise. Asset bubbles end pretty badly. A similar situation seems to be happening now.

Conclusion

Don’t get me wrong. I appreciate that crypto technologies have a future. But I don’t like the idea of buying any cryptocurrency, including Bitcoin. There is a possibility that it will rise to all-time highs. But eventually, in my view, it should reach its eigenvalue, zero. There is too much volatility and too much uncertainty. But it’s an interesting speculative asset, by all means. If you have Bitcoins and they have lost some of their value, you may be lucky next year if they rise. This could happen if the Fed becomes more dovish. But I don’t recommend buying BTC for conservative investors just because it’s peaking.

Editor’s note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick contest, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!