Bitcoin stable as Credit Suisse, Deutsche Bank rumored to be on the brink of collapse

Bitcoin is holding steady amid rumors of a bank collapse, trading between $18,900 and $20,200 over the past three days.

Investor Miles Deutscher drew parallels between the woes at Credit Suisse and Deutsche Bank and the collapse of Lehman Brothers during the 2007-2008 financial crisis.

Could the collapse of Credit Suisse and Deutsche Bank be the Lehman Brothers moment of 2022?

— Miles Deutscher (@milesdeutscher) 3 October 2022

Lehman Brothers was the fourth largest US investment bank at the time, but it filed for Chapter 11 bankruptcy after a drastic devaluation of its assets and a sharp drop in its share price. The primary driver for this was the firm’s exposure to subprime loans.

Fast forward to the present, and several recent events, including the Bank of England (BoE) being forced to intervene with a £65 billion bailout of the bond market, suggest that the old financial system is on the brink of failure.

Investors turn to Bitcoin

Meanwhile, the price of Bitcoin has been trading in a relatively stable pattern as stocks continue to fall amid the macro chaos.

During this period, analyst Dylan LeClair pointed to a divergence between BTC and the S&P 500 around mid-September.

Recently, with Bitcoin closely mirroring risk-to-price movements, the safe-haven narrative has unraveled. However, it has reasserted itself in recent weeks.

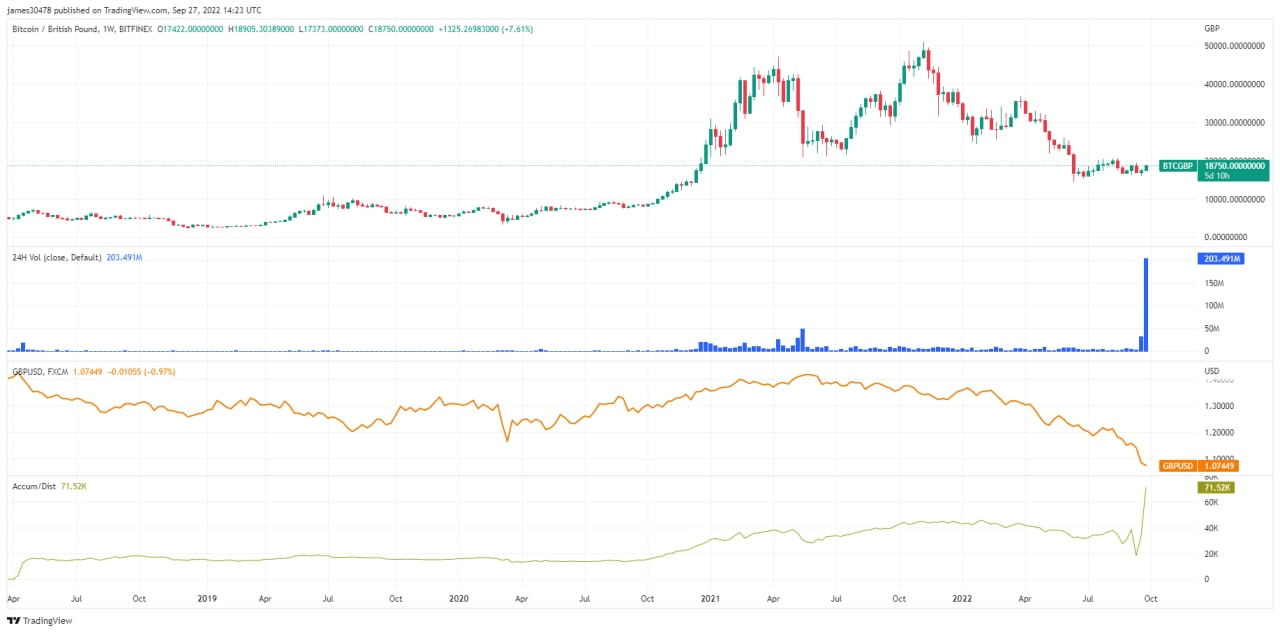

On the day the BoE intervened in the UK bond market, the BTC/GBP trading pair saw a massive increase in trading volume, suggesting Brits bought Bitcoin as the central bank held off on cutting its balance sheet.

Proponents argue that Bitcoin, with its fixed supply of 21 million tokens, cannot be debased or inflated to zero.

Bank collapse

At the center of Credit Suisse’s problems are Credit Default Swaps (CDS). These refer to a financial derivative product that enables investors to exchange or offset their credit risk with another investor.

Analysis according to the latest weekly MacroSlate report compared the current CDS market to events during the 2008 subprime crash.

“CDS is a good indicator of potential defaults; when the price of CDS rises, the insurance becomes more expensive (higher chance of default).

Currently default insurance at Credit Suisse is approaching the same levels seen during the collapse of Lehman Brothers.

However, the founder of Lyn Alden Investment Strategy, Lyn Aldenstated that while European banks are struggling, bonds, currencies and energy are the biggest flashpoints in 2022.

Seeing a lot of chatter on social media about bank contagion, so I’m retweeting this here.

The bigger economic and financial issues here in 2022 are centered in government bonds, currencies and energy. They are not primarily centered in banks like 2008, except in some areas. https://t.co/xxIoTHfZLK

— Lyn Alden (@LynAldenContact) 2 October 2022

@knowerofmarkets Kim also downplayed the seriousness of the Credit Suisse situation, saying the fact that it’s being widely discussed suggests it’s not as “bad as people make it out to be.”

With the US payrolls data due for release on October 7th, this week will be critical for Bitcoin and its tentatively restored safe haven narrative.