Bitcoin soars, then retreats. What’s behind this week’s rollercoaster? What’s ahead?

Join the most important conversation in crypto and web3! Secure your place today

It’s been a wild week for bitcoin with the biggest cryptocurrency by market capitalization hitting multiple six-month highs before pulling back suddenly late on Thursday, only to rally again.

Bitcoin (BTC) recently traded above $24,557, up nearly 3.1% in the past 24 hours and off a weekly high early Thursday when BTC passed $25,000 for the first time since August.

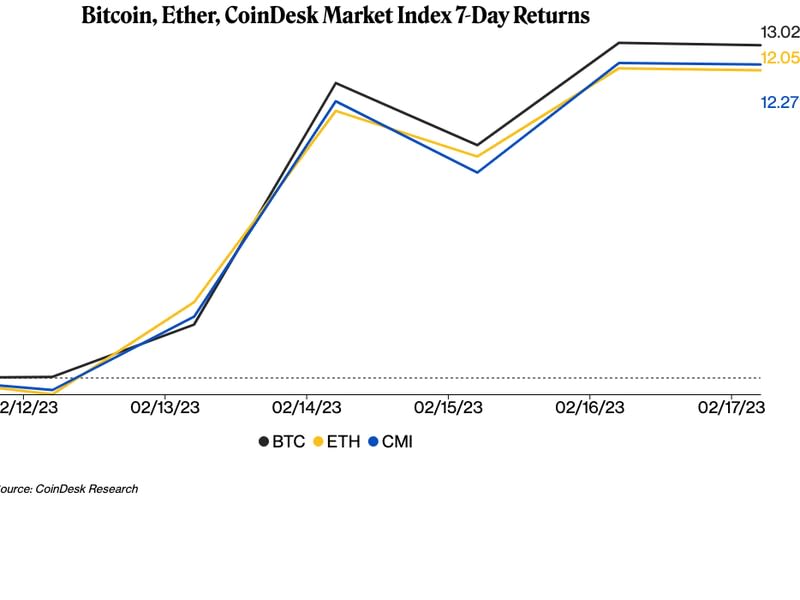

Despite Thursday’s drop, bitcoin is still changing hands 13% higher than it was seven days ago. The reasons for the decline from previous support around $22,000, subsequent decline and then rally have varied. They underscore crypto’s ongoing sensitivity to macroeconomic conditions and industry-specific events, even if BTC sometimes behaved counterintuitively.

Late on Tuesday, investor optimism trumped concerns about a stablecoin slump and the tepid consumer price index (CPI) to send bitcoin, ether and most other cryptocurrencies soaring. In an interview with CoinDesk, Riyad Carey, research analyst at crypto data firm Kaiko, said bitcoin’s rise was “a bit of a euphoric rally that regulatory issues have temporarily cooled.”

Earlier this week, Darius Tabatabai, co-founder of Vertex Protocol, a London-based decentralized exchange, said “we may have the foundations for a new bull market.”

A day later, markets were caught off guard and bitcoin fell more than $1,000 in a few hours amid hawkish remarks from Federal Reserve officials, the announcement of a US Securities and Exchange Commission (SEC) lawsuit against disgraced Terraform Labs co-founder Do Kwon, and a disappointing wholesale prices report suggesting inflation remained stubbornly resilient.

BTC’s “medium-term overbought conditions provide headwinds with key resistance near $25,200, increasing the likelihood of a near-term pullback. Support is near the 200-day MA $20,000,” wrote Katie Stockton, founder of technical analysis research firm Fairlead Strategies , to CoinDesk in an email.

Edward Moya, senior market analyst for forex market maker Oanda, noted in an email Friday that “after Bitcoin tested the $25,000 level and failed to extend, many active traders locked in profits. Appetite for riskier assets may struggle in the short term, which could support a Bitcoin consolidation as long as a regulatory crackdown doesn’t take down a key stablecoin or crypto company.”

By Friday afternoon, investors appeared to have shaken off the latest discouraging news to push bitcoin back just a few dollars below $25,000. And cryptos continued to outperform the stock markets with which they correlated for much of 2022. Ether (ETH), the second largest crypto by market capitalization, has risen more than 12% in the past week.

Oandas Moya believes that the larger outcome of the new US crypto-regulatory pressure will not be visible for some time, allowing the markets to sort themselves out and the industry itself to remain flush with interesting projects. “There’s always a period when regulators and lawmakers want to hear from the market that they’re going to make an impact,” Moya told CoinDesk in an interview. “But I haven’t seen anything that takes away from this market from continuing to grow, to see investment and to get projects done that can hopefully drive the use case argument for it,” he added, although he added that a lot of money maybe leave stablecoins for other types of crypto investments.

To be sure, some observers believe that regulatory overreach could drive away investment and spook markets. “Based on their unwillingness to come to the table, it’s clear that the SEC’s motivations lately have been driven by a desire to protect the incumbent financial operators — that is, Wall Street,” Al Morris, founder of the decentralized publishing protocol Koii Network, CoinDesk told in an email, adding that overly strict US rules could benefit other crypto hubs in Europe and Dubai.

Optimism

But investors remained largely optimistic about crypto markets. They see the Fed approving a second straight 25 basis point rate hike at its next Federal Open Market Committee (FOMC) meeting in March rather than returning to the more aggressive hikes in 2022. And they hope that any economic slowdown will be soft – so-called safe landing that central bankers seek.

“While forecasts of higher prices weigh on the values of future cash flows, increasing global liquidity is helping to lift asset prices,” Lucas Outumuro, head of research at blockchain research firm IntoTheBlock, wrote in a Friday newsletter.

Meanwhile, Moya noted on Thursday that “bitcoin resilience” has been “impressive” given bond market volatility and a steady flow of regulatory headlines.

But he cautiously added in a follow-up interview with CoinDesk: “I think we have to live week by week, and right now it seems like the main goal is to put consumer protections in place. That will ultimately be where things get fixed on these potential investigations . I think part of the market is also getting used to that kind of expectation.”