Bitcoin smashes 1,000,000,000 address milestone as tap on ‘Diamond Hand’ crypto holders attaches: Glassnode

Bitcoin has officially surpassed a massive network milestone.

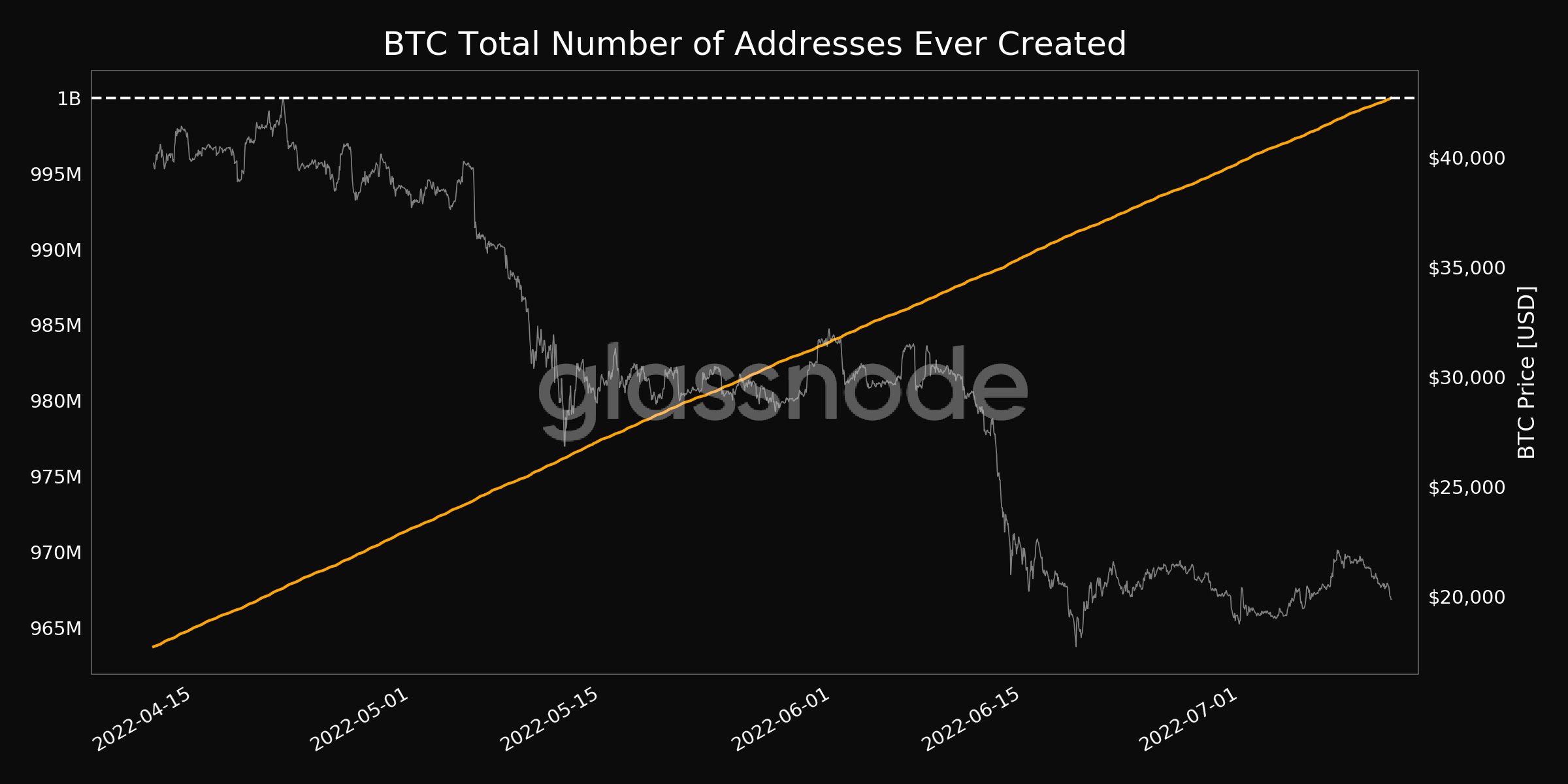

Users have now created more than 1 billion Bitcoin addresses, according to cryptanalysis firm Glassnode.

Each unique address is essentially a series of letters and numbers that represent a virtual location to which BTC can be sent.

“Bitcoin (BTC) total number of addresses ever created went just over 1,000,000,000. Present value: 1,000,002,559.”

The milestone comes when long-term and highly convicted crypto holders with “diamond hands” face pressure to hold on and avoid capitulation.

According to Glassnode, the share of BTC held by long-term holders (LTH) compared to short-term holders (STH) indicates that Bitcoin has not yet reached a bottom.

“In the depths of previous bear markets, the share of supply held by LTHs, and at a loss, reached over 34%. Meanwhile, the share of STHs fell to only 3% to 4% of supply.

At present, STHs still have 16.2% of the supply in losses, which indicates that newly redistributed coins now have to go through the maturation process in the hands of holders of higher judgment. This indicates that while many bottom formation signals are in place, the market still requires an element of duration and time pain to establish a resilient bottom. Bitcoin investors are not out of the woods yet. “

Glassnode also points to the risk that an increasing number of Bitcoin miners operating the network in the coming months will have to sell their BTC to stay afloat.

“The duration of the mining capitulation in the bear market 2018-2019 was around 4 months, and the current cycle only started 1 month ago. Miners currently have about 66.9,000 BTC collected in their treasuries, and thus the next quarter is likely to remain in jeopardy. for further distribution unless coin prices recover meaningfully.

The big picture, according to the company, is that Bitcoin seems to be entering the final phase of a bear market, with both long-term and short-term owners facing increasing pressure to sell.

Glassnode analysts describe a large number of crypto investors who mainly live in a pressure cooker.

They say that further downside moves may be needed to test the true beliefs of crypto holders and ultimately form a final market bottom.

Don’t miss a beat – Subscribe to have crypto email alerts delivered directly to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed by The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment adviser. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock / 3000ad