Bitcoin Short Bets Build – Here’s What It Means for BTC Price

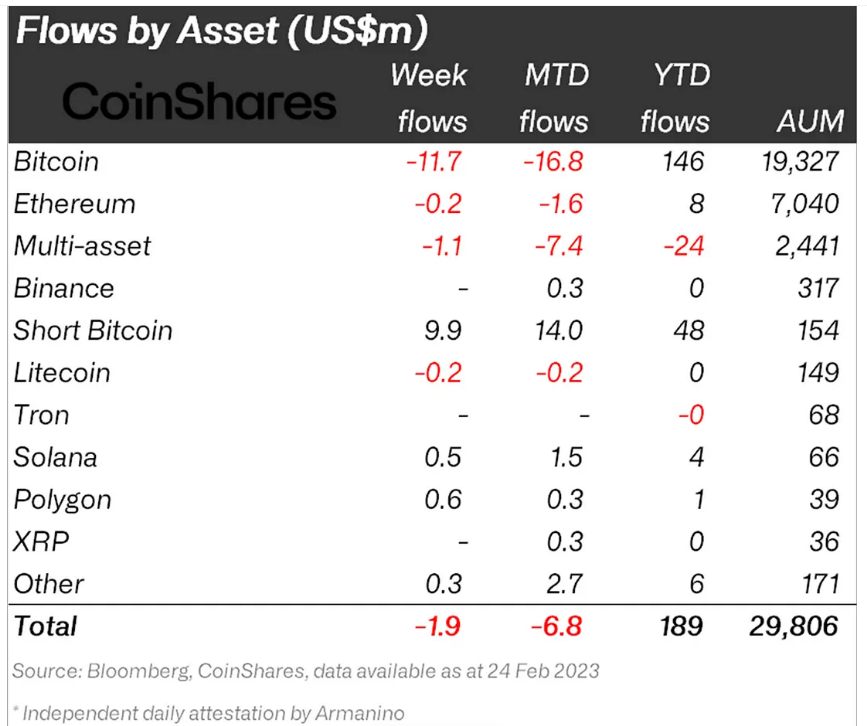

Short Bitcoin investment products saw an inflow of nearly $10 million last week, according to CoinShare’s latest Digital Asset Fund Flows Weekly Report. It took monthly streams to $14 million. Meanwhile, during the same time period, long Bitcoin investment products saw outflows of close to $12 million, taking monthly outflows of $16.8 million.

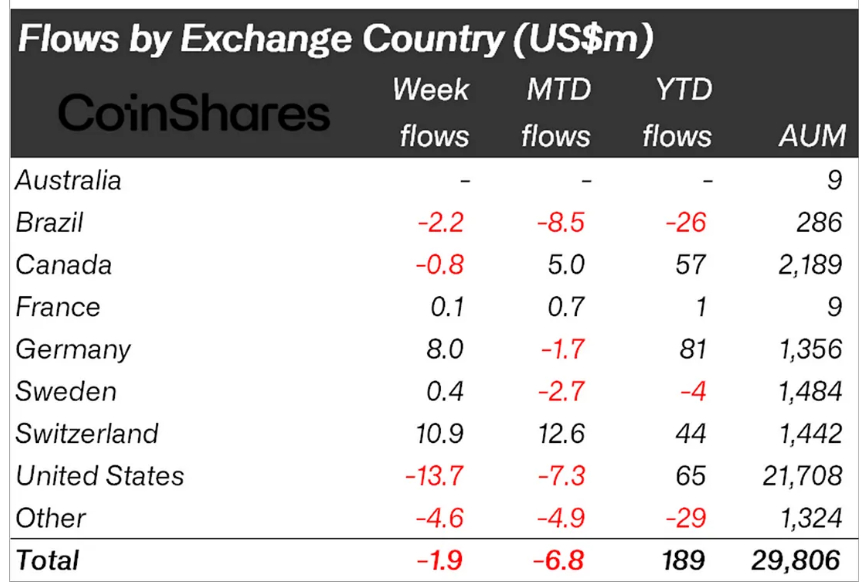

Ethereum, Litecoin, Solana, Polygon, Multi-asset and other cryptocurrencies saw their related investment products have net flows of close to zero, highlighting how recent pessimism has been largely concentrated on Bitcoin. In terms of flows by region, the United States saw outflows of almost $14 million. “We believe this reaction reflects nervousness among US investors following the recent stronger-than-expected macro data, but also highlights its sensitivity to the regulatory crackdown in the US.”

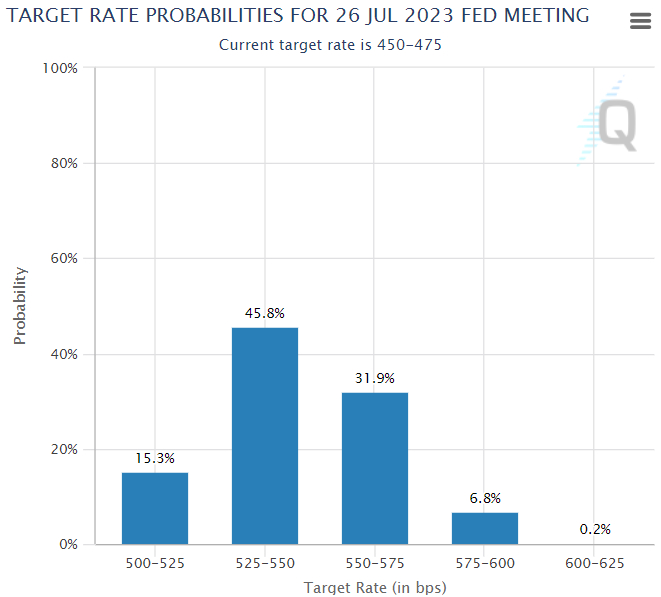

A series of much stronger-than-expected US data releases this month, including the likes of January jobs and ISM reports, as well as January CPI and Core PCE inflation reports, have markets betting on significantly more Fed tightening this year than this time last month. According to money market data presented by CME, the market’s new base case is that interest rates reach almost 5.5% before the end of H1 this year. A month ago, markets had expected rates to top out in the 5.0% range.

Retail investors are not panicking yet, funding rates suggest

Larger-scale investors, who tend to use crypto investment products more heavily than retail investors, have clearly become more pessimistic, especially in the US amid growing macro headwinds. But Bitcoin’s ongoing resilience is impressive, with the world’s largest cryptocurrency last changing hands in the low $23,000s, still up over 40% for the year and still slightly in the green on the month.

That can be partly explained by the fact that retail investors don’t seem to be turning bearish, according to Bitcoin futures funding rate data presented by crypto derivatives analysis website coinglass.com. According to coinglass.com, Bitcoin funding rates remain largely positive, suggesting that traders looking to go long Bitcoin futures are paying a premium compared to those looking to go short.

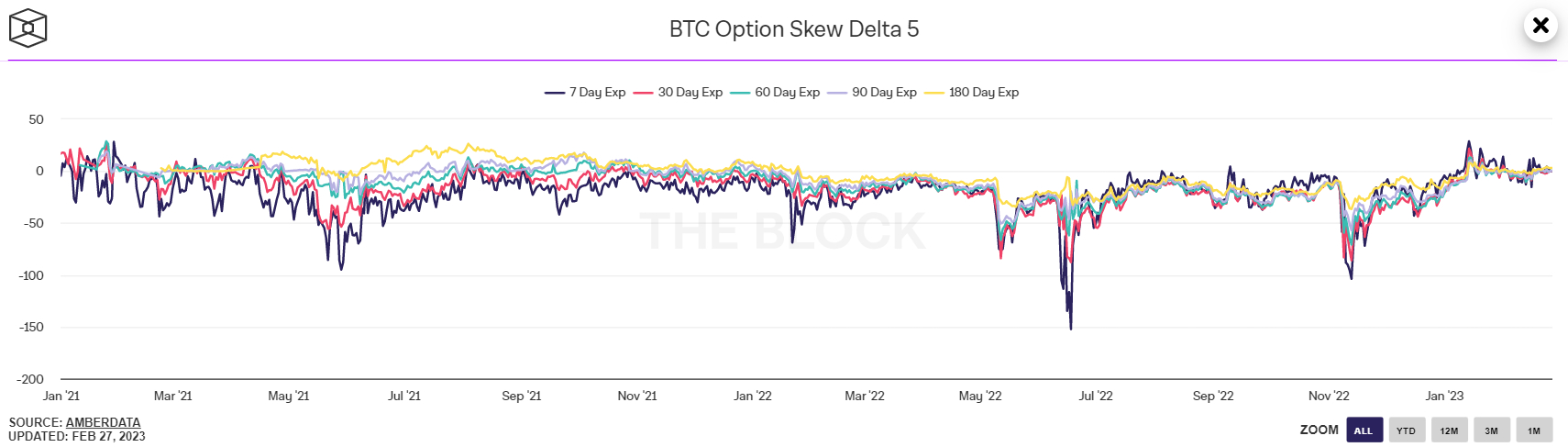

Similarly, Bitcoin options markets are also sending a signal that broader pessimism towards the world’s largest cryptocurrency has not seen a notable jump this month. The 25% Delta Skew of Bitcoin options expiring in 7, 30, 60, 90 and 180 days all remained slightly above zero on Friday, indicating that options investors have a net neutral view of the market.

The 25% delta option bias is a popularly watched proxy for the extent to which trading desks are over or underpricing for upside or downside protection via the put and call options they sell to investors. Put options give an investor the right, but not the obligation, to sell an asset at a predetermined price, while a call option gives an investor the right, but not the obligation, to buy an asset at a predetermined price.

A bias of 25% delta options above 0 suggests that desks charge more for equivalent call options versus puts. This implies that there is higher demand for calls versus puts, which can be interpreted as a bullish sign as investors are more eager to secure protection against (or bet on) a rise in prices.

What next for the BTC price?

The jump in investment in short Bitcoin investment products, according to CoinShares, may not seem to weigh on broader market sentiment too much, but could provide fodder for a further squeeze on shorts in the weeks and months ahead. Bitcoin’s resilience against the latest macro headwinds has been impressive and may be due to the fact that, according to several on-chain and technical indicators, the cryptocurrency was way oversold at the end of 2022.

Bitcoin’s snap back in 2023 may, more than anything, just be a return to the levels where it probably should have been trading all along (ie in the $20Ks, not the mid-$10Ks). As for the cryptocurrency’s short-term outlook, things still look relatively positive in the wake of January’s decisive break above the 200-day moving average and “golden cross”, with Bitcoin still seemingly moving higher within the framework of an ascending trend channel.

As long as upcoming US data releases in early March, such as this week’s ISM reports and next week’s official jobs data release, do not deliver any fresh hawkish shocks, BTC may continue to grind higher amid optimism that the 2022 bear market is over. A break above $25,000 could open the door to a push higher towards $28,000.