Bitcoin set to end week ~8% lower on renewed macro fears, Kraken strike update

Just_Super/iStock via Getty Images

Bitcoin (BTC-USD) is set to end the week 7.7% lower as sentiment was hit by renewed macroeconomic concerns as well as regulatory scrutiny after the US SEC shut down cryptocurrency exchange Kraken’s betting service.

Broader financial markets was weighed down by increasingly hawkish comments from Federal Reserve speakers, in response to recent data that signaled a stubbornly resilient labor market.

Meanwhile, Kraken ended its staking-as-a-service program for crypto assets and will pay $30 million to settle the SEC’s costs. The regulator alleged that Kraken failed to register its staking program, exposing investors to risk with minimal protection.

“As the SEC has so far not even approved a Bitcoin spot ETF, it seems unlikely that it would have approved a slightly more obscure product like staking,” said Markus Thielsen, head of research, Matrixport. “Although the SEC enforcement is negative for the industry, it excluded US crypto users from being part of the innovation. The winners are likely to be stake providers in Asia.”

Coinbase (COIN) CEO Brian Armstrong warned that the SEC may be wise to get rid of retail crypto stakes.

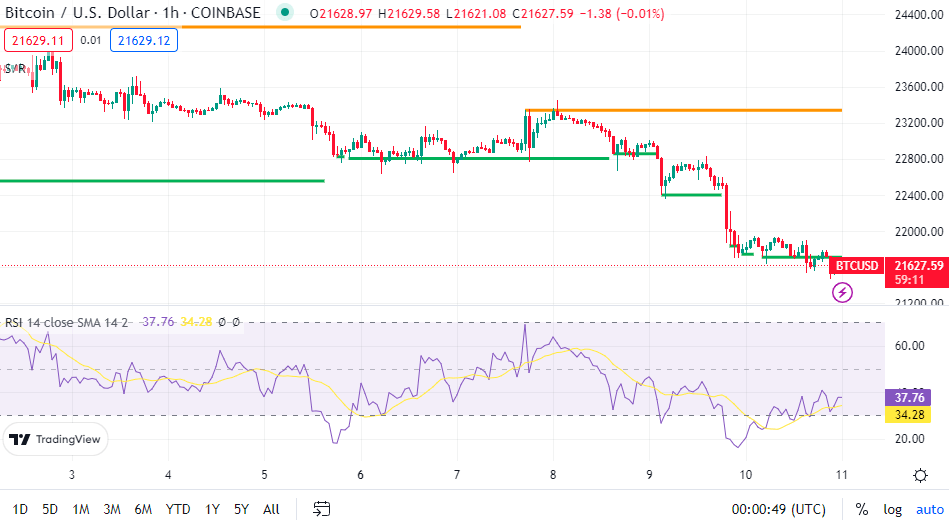

Bitcoin (BTC-USD) stayed within $21.55K-$23.68K this week, halting its gains this year. The global crypto market cap currently stands at $1.01T, down 0.7% over Thursday, according to CoinMarketCap.

Regulatory Updates

- Fed Board Governor Christopher Waller called crypto a “speculative asset, like a baseball card.” He also warned that if the price of cryptos falls to zero, “don’t expect the taxpayers to socialize your losses.”

- But Philadelphia Fed President Patrick Harker said cryptos are likely to remain in demand despite the recent bear market.

- Meanwhile, the SEC warned investors that crypto investments in some self-directed IRAs may be unregistered securities.

Contagion continues

- Crypto exchange LocalBitcoins is shutting down after operating for over 10 years as a result of the “very cold crypto winter”.

- Crypto ATM operator Coin Cloud filed for Chapter 11 bankruptcy protection, with estimated liabilities of up to $500 million. The company owes over $100 million to insolvent crypto lender Genesis, its largest creditor.

- Digital Currency Group began offloading shares in trusts run by unit Grayscale Investments at a deep discount as it seeks to raise funds to repay creditors of unit Genesis.

- Ishan Wahi, a former Coinbase (COIN) executive, pleaded guilty to two counts of conspiracy to commit wire fraud, in the first-ever crypto insider trading scheme.

Remarkable news

- Hut 8 Mining (HUT) will merge with US Bitcoin in a merger of equal shares that is expected to give the combined company a market capitalization of ~$990 million. The news sent crypto mining stocks lower as more consolidation is expected in the sector.

- Deutsche Bank’s asset management unit, DWS Group, is reportedly considering taking minority stakes in two crypto firms as a means of stimulating growth.

- PayPal has halted its stablecoin work as New York regulators reportedly investigate its key partner in the project.

Bitcoin price

- Bitcoin (BTC-USD) fell 0.7% to $21.64K at 7pm ET and ether (ETH-USD) fell 2.1% to $1.51K.

- SA contributor Ryan Wilday said bitcoin’s (BTC-USD) rally over the past month is promising, but bulls have more work to do to confirm that the bearish trend that began in 2021 is over.

Crypto-related Stocks Ending Lower on Friday: CleanSpark (CLSK) -8.8%Hut 8 Mining (HUT) -8.2%Bitfarms (BITF) -6.6%. Coinbase (COIN) -4.3%Riot Platforms (RIOT) -2.5%.