Bitcoin rises as 4.9% CPI suggests Fed policy is working

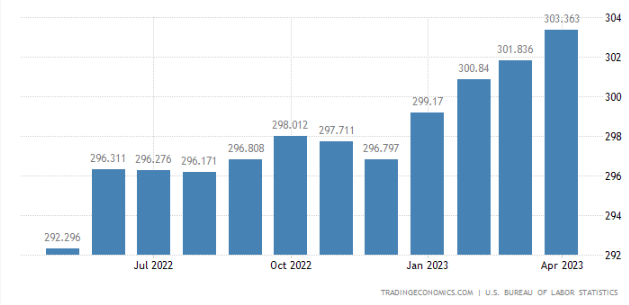

Bitcoin (BTC) is incurring little upside volatility as the US Consumer Price Index (CPI) for April misses estimates, which could strengthen the case for a Federal Reserve (Fed) rate hike pause later this year.

The asset typically shows volatility from about six hours before the US CPI announcement. However, like the S&P 500 and Dow Jones, it traded fairly flat in premarket trading.

Cryptos Trade Flat, But Analysts Are Cautious

The current price is around $27,981, bolstered 1.2% by lower-than-expected 4.9% headline inflation, Ethereum (ETH) is also subdued to $1,840, according to Coingecko. Lower cap cryptos such as Cardano and Dogecoin were down 0.2% and 0.5%.

Analysts estimated April’s annual US headline CPI to be steady at 5%, with core inflation, excluding volatile food and energy prices, rising to 5.5%.

Despite combining with lower, headline inflation remains well short of the Fed’s 2% target. Core inflation was in line with expectations, coming in at 5.5% annually and rising 0.4% monthly.

Following the news, Bitcoin, whose 30-day correlation with the Nasdaq has reached 0.5, tracked US futures higher. Treasury yields fell.

According to the MSCI World Index, which fell 0.1% this morning, most stocks have traded sideways over the past month, pending news from the Federal Reserve.

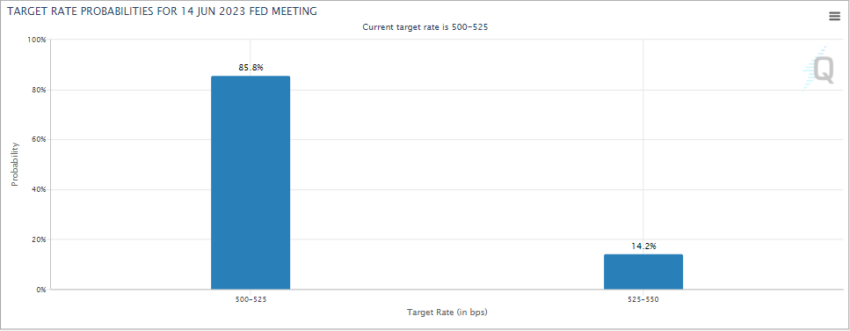

The Fed said on May 4 that future rate hikes will depend on upcoming data. It has increased interest rates by around 500 basis points over the past 14 months. Last month’s nonfarm payrolls report revealed hourly wage increases that could encourage more increases.

At press time, the markets still expect a break in interest rates at the Fed’s next meeting.

The New York Fed does not foresee an interest rate cut

New York Fed President John Williams said yesterday that he does not expect inflation to reach 2% for the next two years.

Furthermore, his basic forecasts do not predict any interest rate cuts this year.

“Because of the lag between policy actions and their effects, it will take time [Federal Open Market Committee’s] actions to rebalance the economy and return inflation to our 2% target.”

Asian shares fell this morning as investors eased risk positions ahead of the CPI news. Tech stocks began their slide as an index tracking Chinese state-owned enterprises fell more than 1%. Shares in Tencent Holdings recorded their third straight day of decline.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.